Key Attractions

KTAM Asian Fixed Income

INVESCO Asian Bond Fixed

Maturity Fund 2022-III

Asian ex Japan

Invesco 2021 Outlook

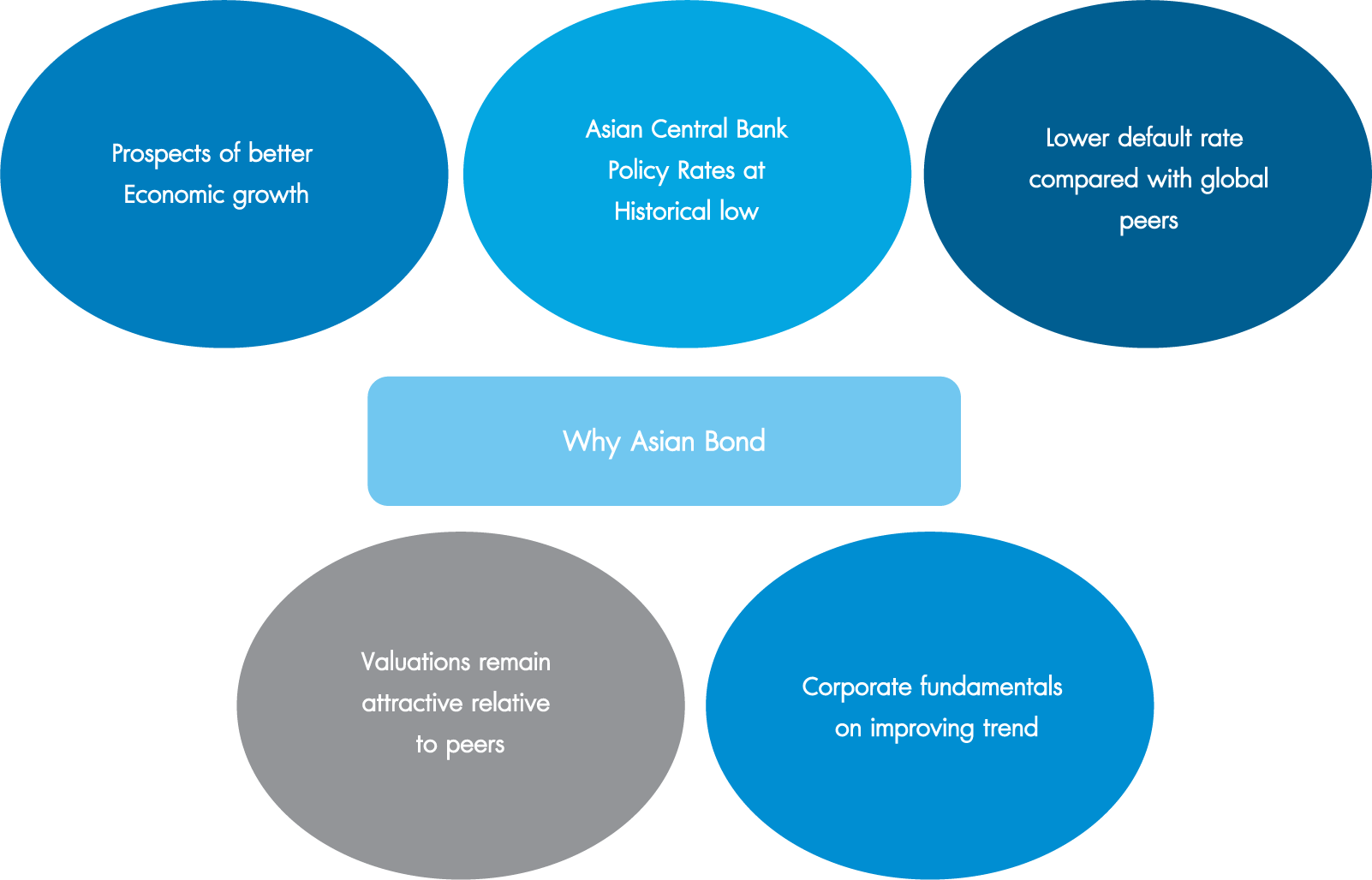

Asia : Prospects of better economic growth

Asia has unquestionably performed better in suppressing the virus.

|

|

Asia high yield bonds’ default rate is relatively low global wise

Asian Central Bank Policy Rates at historical low

Asia : Valuation remain attractive relative to peers

Yields of Asian, Us and Euro bonds

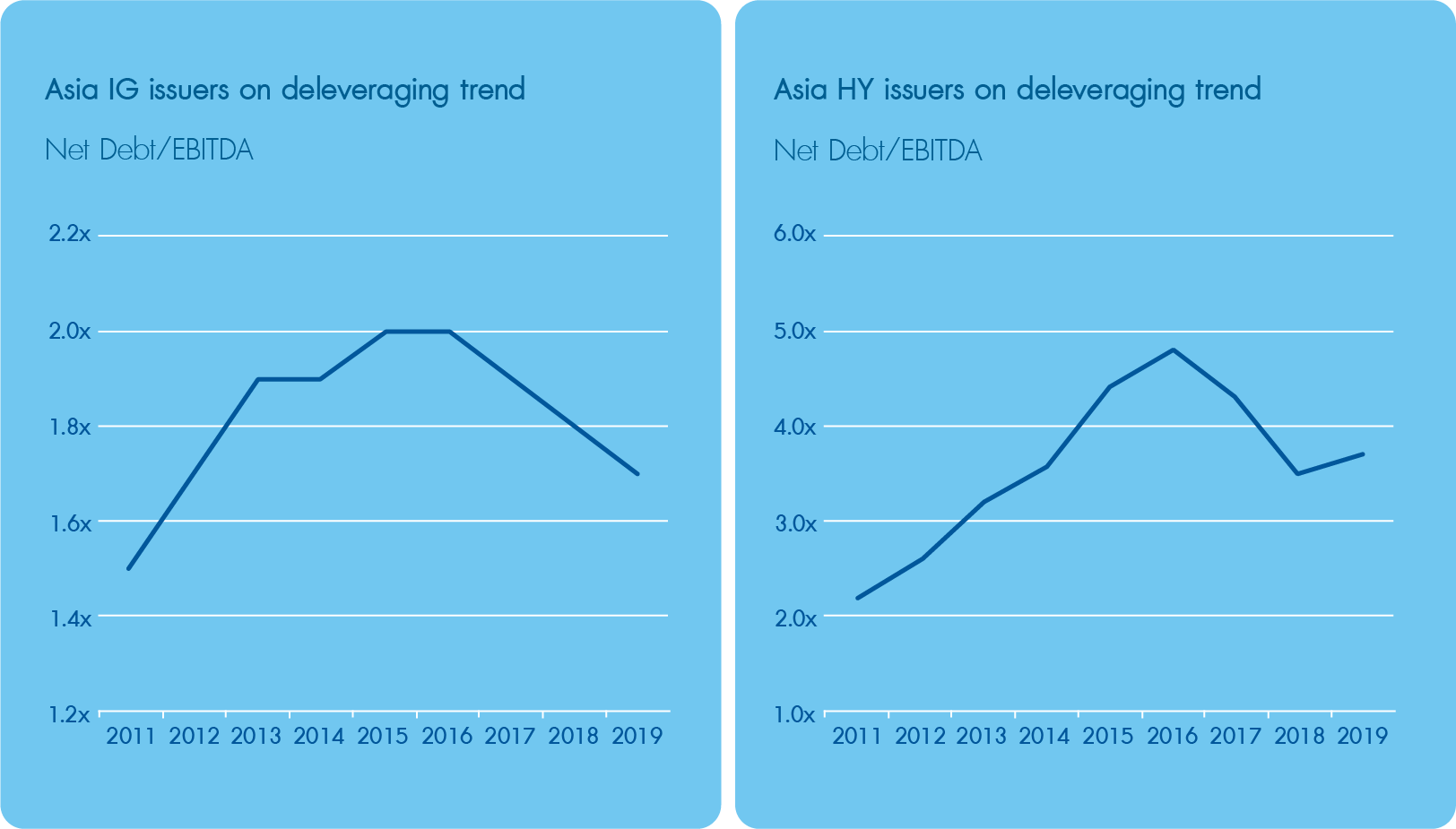

Asia : Corporate fundamentals on improving trend

Update on China credit market - Recent Onshore Default

Events

- The recent defaults of two local SOEs (a coal mining company and an automotive manufacturer) and a Chinese semiconductor manufacture triggered panic selloff in the market

- More than 50 publicly issued bonds were cancelled or postponed in order to reduce the risk of issuance. Most of the companies were local state-owned enterprises

Common characteristics

- Commercialized industries, with more from the commodity sector

- Debt-heavy provinces, except for Henan

- Both university-backed names defaulted

- Weak corporate governance or complex organizational structure

Our View

- Government support to local SOEs is becoming more selective

- Still minimal LGFV defaults

Update on China’s IG market

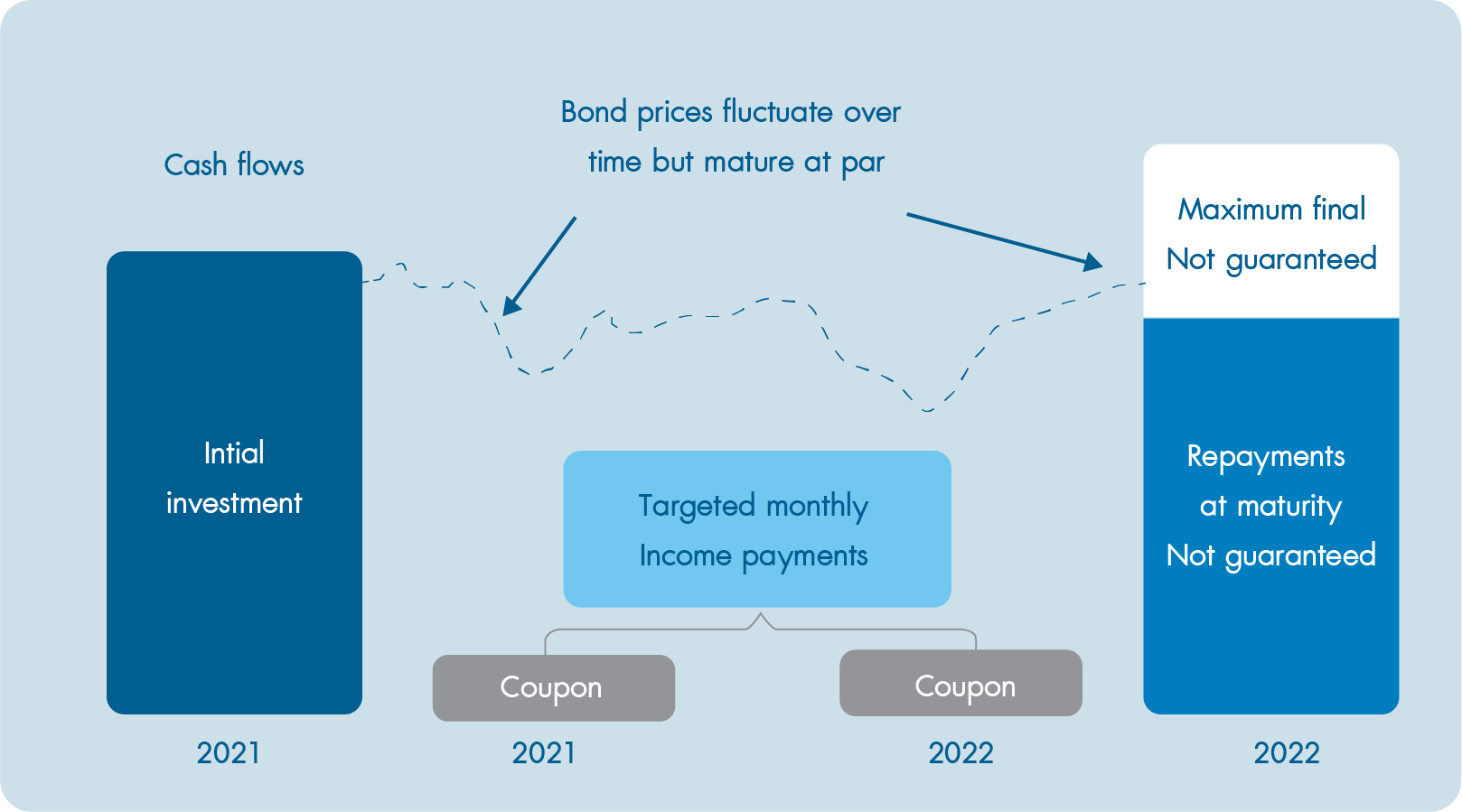

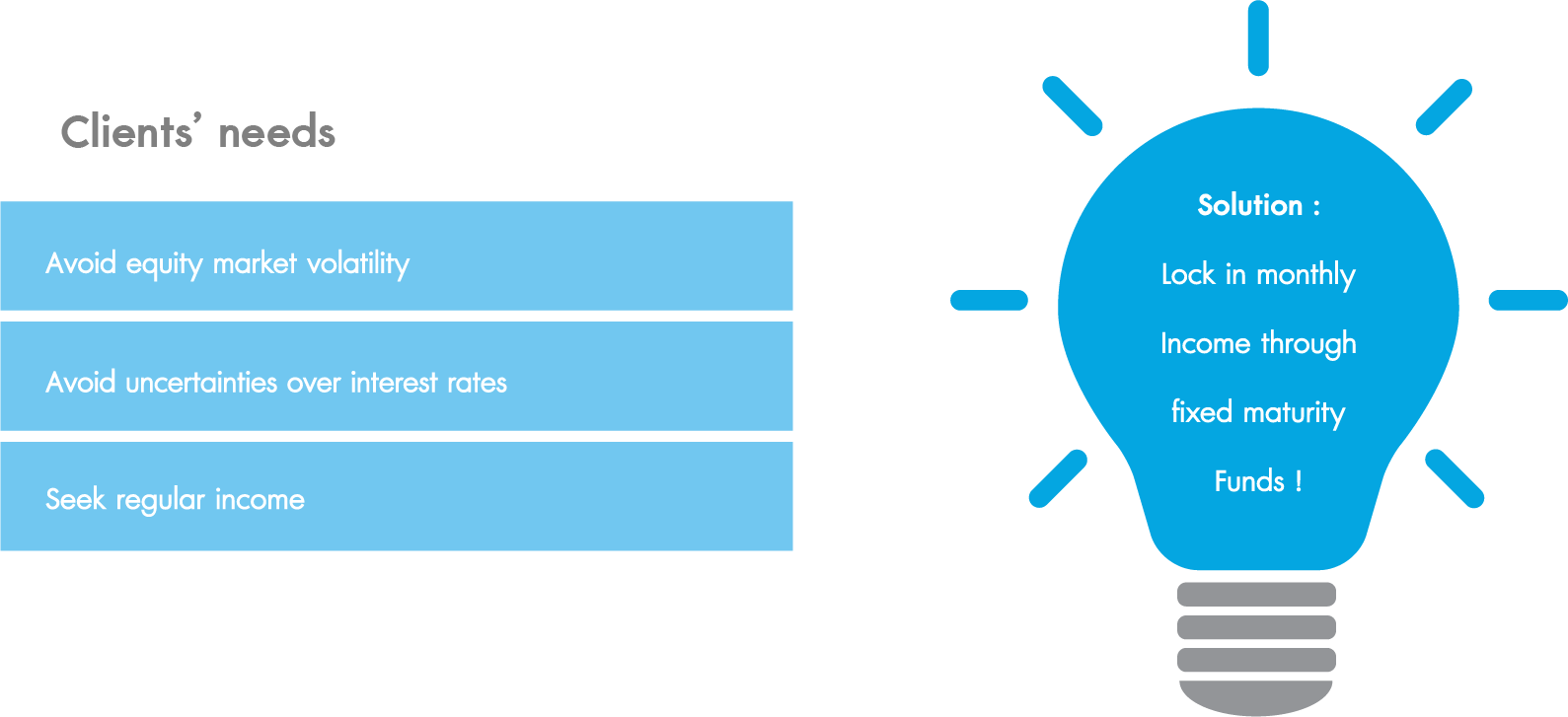

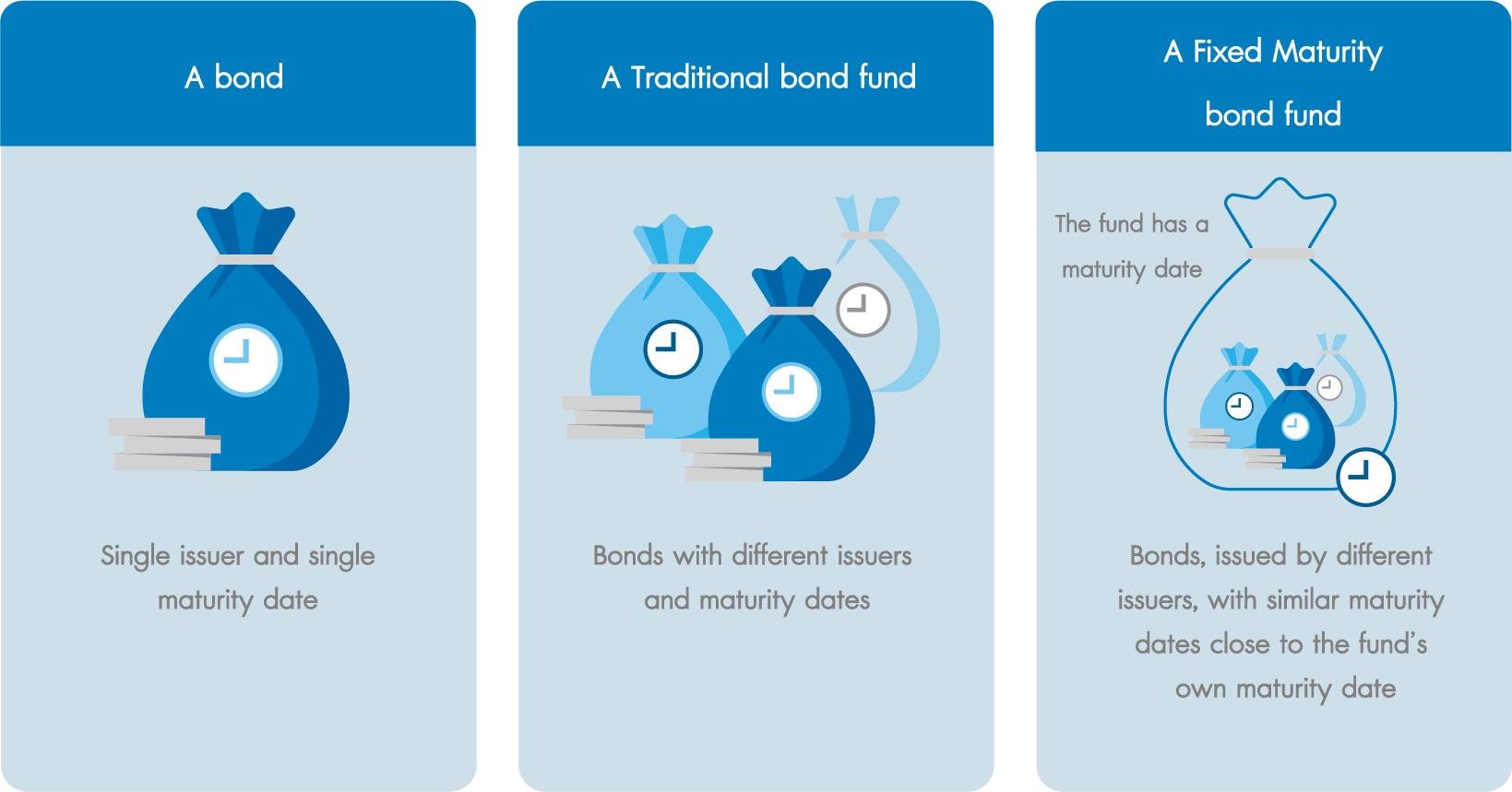

How does a fixed maturity bond fund work?

Visibility of income throughout the investment period

- An Asian fixed maturity bond fund consists of predominantly a basket of Asian bonds.

- From an income perspective, investors of an Asian fixed maturity bond fund are expected to receive regular distribution.

- From the price perspective, as the holdings of an Asian fixed maturity bond fund approach their maturity dates, their price fluctuations tend to diminish and move to their par value.

Risk for FMPs

Fixed Maturity Fund - Things to be considered?

Reason To Invest

|

|

- A fixed maturity bond fund combines the benefits of a traditional bond fund with a fixed maturity date.

- An Asian fixed maturity bond fund invests in predominantly a diversified portfolio of Asian bonds whose maturities are roughly the same as the end date of the fund itself.

- When the fund matures, there will be repayments at maturity.

- Investors of fixed maturity bond funds have the advantage of locking in monthly income until maturity.

- Additional benefits from investing in fixed maturity bond fund!

- Maximize the portfolio transparency

- “Buy & Maintain” strategy increases the cost-effectiveness of the portfolio

- Better control of volatility compared to traditional bond funds.

Why FMP

Why Invesco Asian Bond Fixed Maturity Fund 2022 - IV?

Diverified Asian bond portfolio with more than 70% of Net Asset Value in Investment Grade bonds

Help investors lock in potential income

Short Tenor (An investment period of approximately 1 year)

Managed by a team strong expertise in Fixed maturity funds

Why FMP

- To seek investments with shorter tenor.

- To lock in potential income amid low interest rate environment globally.

- To diversify amid heightened market volatility.

- To seek a seasoned investment team with strong expertise in fixed maturity funds.

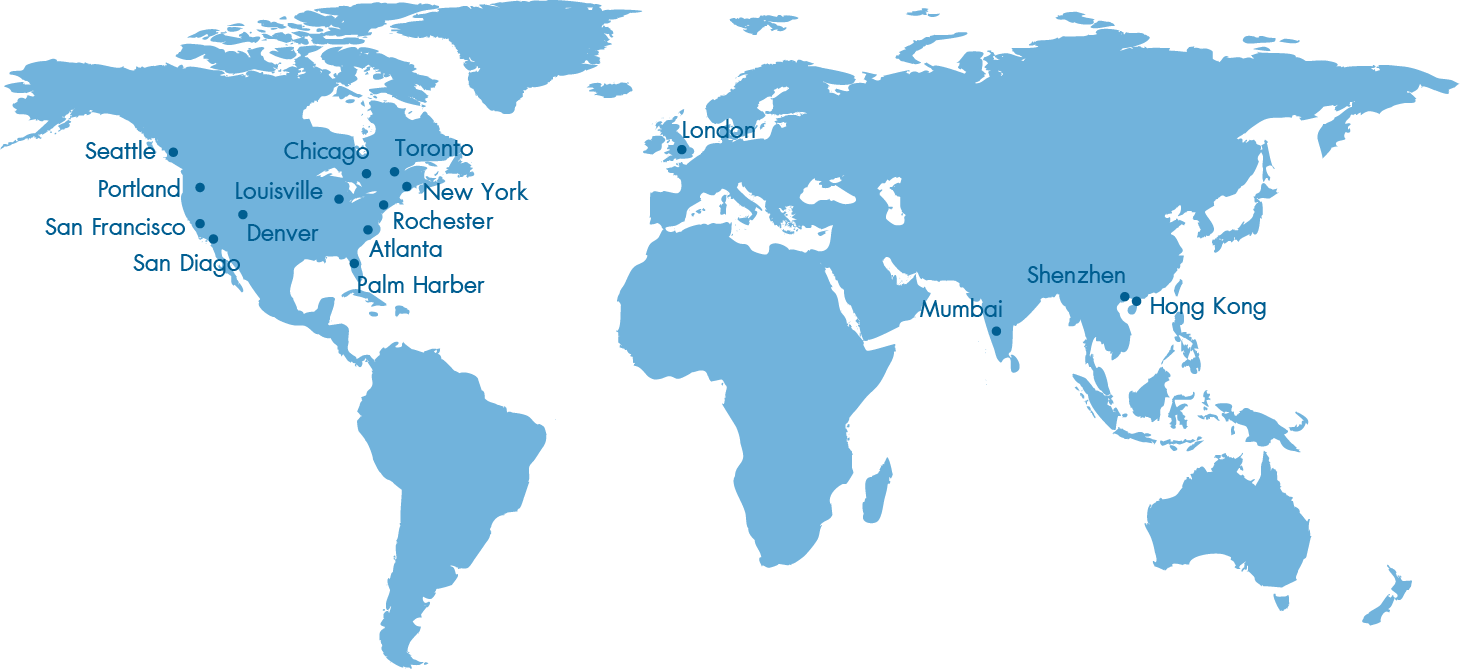

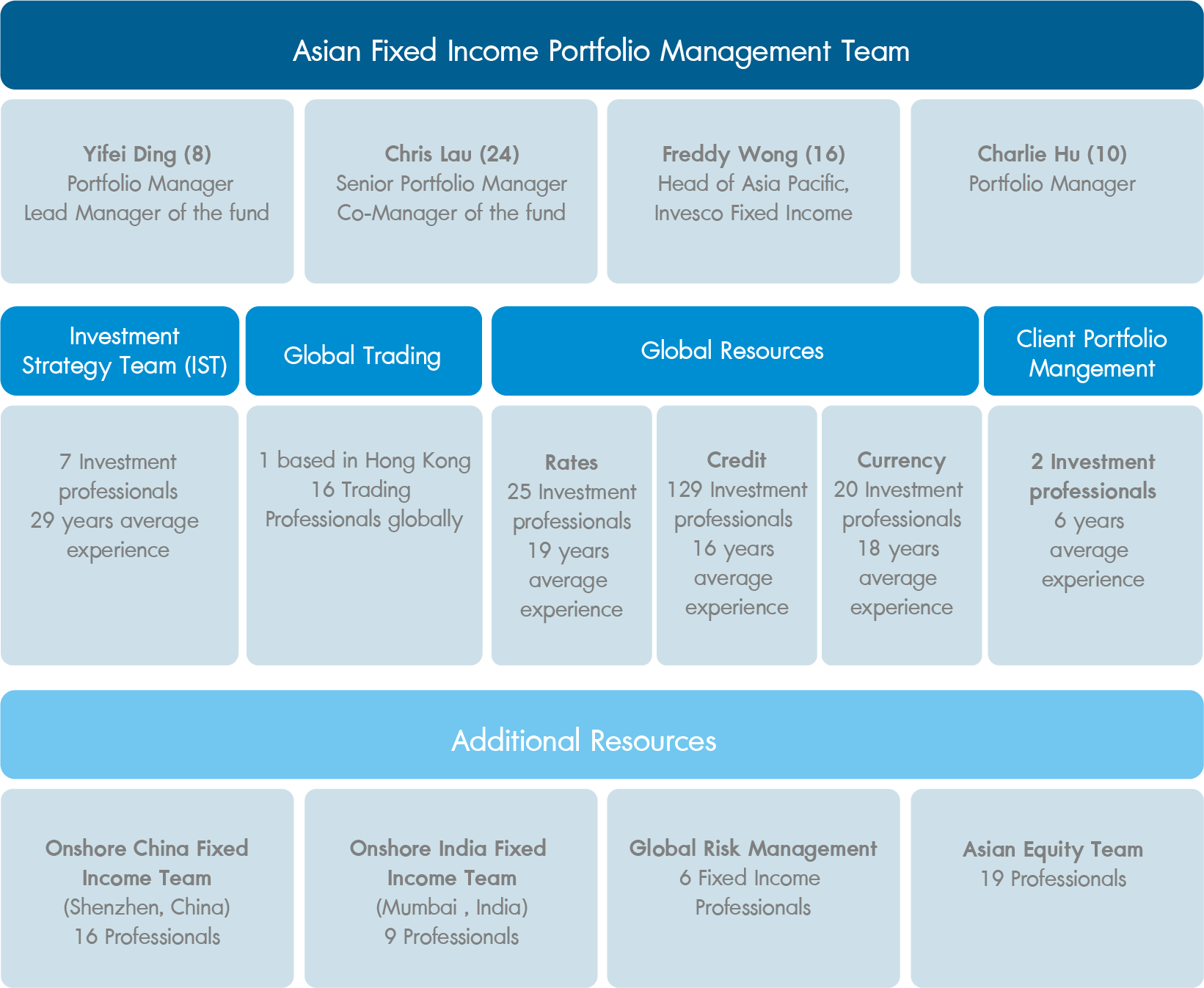

Invesco Fixed Income (IFI) - A global fixed income team

Scope of fixed income platform :

US$360 billion AUM

Depth of resources :

177 investment professionals

228 professionals

Global footprint :

12 locations in key markets

Asia Asset Management 2019 : BEST OF THE BEST

- Best One Belt, One Road Initiative

Benchmark Fund of the Year Awards 2017 : BEST-IN-CLASS

- Asia Fixed Income

Asian Fixed Income Team Leverage global & local resources

Invesco

Invesco was established in 1935 and today operates in more than 25 countries. The firm is currently listed on the New York Stock Exchange under the symbol IVZ. Having been in the region since 1962, Invesco is one of the most experienced investment firms in Asia Pacific. 13+ offices across 8 markets in Asia Pacific

Key highlights of our Asia Pacific business include :

- 50 years of experience investing in Asia Pacific, with 165 investment professionals.

- A pioneer investor in Chinese Equities, with around 25 years of experience in managing offshore Chinese Equities and over 10 years in managing onshore Chinese equities (under the QFII scheme).

- An early mover, started in Hong Kong in the 70’s and the first Sino-America fund management company in 2003 in China.

- One of the first few global asset managers that established a wholly-foreign owned enterprise in China to conduct investment management business.

- Two important joint ventures, partnering with China Huaneng Group, in China :

- Invesco Great Wall – formed to target domestic mutual funds market in China

- Huaneng Invesco WLR – targeting private equity market

- Significant presence in Japan since 1983.

- Expanding presence and capabilities in India with Invesco Asset Management (India) Private Limited^, one of the top 16# asset management companies in India, with an AUM of US$5.40 billion.

- Prominent presence in Australia, Singapore and South Korea.

Our goal is to deliver an investment experience

that helps people get more out of life.

We manage US$ 1.3 trillion* of assets globally with an on-the-ground

presence in more than 25 markets.

Invesco, data as of 31 Dec, 2020

A unique blend of people, capabilities and scale

Invesco offers a multi-style, multi-product approach, allowing our clients to choose what they need and to diversify their investments. Investment strategies are tailored to the markets in which we operate, and our investment teams follow systematic, proven investment processes with a strong emphasis on risk control.

WORLDWIDE NETWORK

Access to a worldwide network of investment

professionals.

DIVERSIFICATION

Diversified offering of capabilities in virtually every asset

class and investment style.

COMMITMENT TO EXCELLENCE

An independent firm with an investment-centric,

client-focused culture

Why should you invest with us?

Having been in the region since 1962, Invesco is one of the most experienced investment firms in Asia Pacific. We have comprehensive geographical coverage with offices in Australia, China, Hong Kong, India, Japan, Singapore, South Korea, and Taiwan. In addition, Invesco has a presence in China via a joint-venture, Invesco Great Wall.

Structure of the KTAM

Asian Fixed Income 30M1/30M2

KTAM Asian Fixed Income

30M1/30M2

(KTAF30M1/30M2)

INVESCO Asian Bond Fixed

Maturity Fund 2022-III

Asian ex Japan

|

Fund Information |

|

|---|---|

|

KT-AF30M1/30M2 |

The fund’s emphasis is to invest solely in the units of the Invesco Asian Bond Fixed Maturity Fund 2022 – III (Class C (USD) - MD1) (master fund), averaging at least 80% of fund NAV during the financial year. |

|

Master Fund |

The Fund will invest primarily (i.e. at least 70% of its Net Asset Value) in a portfolio of Asian fixed income instruments denominated in USD issued by issuers selected by the Manager at its discretion (such as Governments, Government Agencies, Supranational Entities, Corporations, Financial Institutions and Banks), which may include issuers located in emerging as well as developed markets in Asia. For the purposes of the Fund, Asian countries include all countries in Asia excluding Japan but including Australia and New Zealand. |

|

Fund Type |

Fixed Income Fund, Feeder Fund |

|

Risk Level |

5 |

|

Master Fund |

Invesco Asian Bond Fixed Maturity Fund 2022 – III (Class C (USD) - MD1) |

|

Management |

Invesco Hong Kong Limited |

|

Currency (Master Fund) |

USD |

For more information Click

Who is this fund suitable for?

Investors who can accept the risk of investing in a foreign fund that holds fixed income securities and contain exposure to fx risk. The investor should also be able to hold the units until maturity (approximately 2 years and 6 months), while fully understanding the potential price volatility, in exchange for the prospects of earning a higher financial return by investing in such foreign fund.