Key Attractions

KTAM China A Shares Equity Fund (Class A)

Allianz Global Investors

Open-end Equity Fund,

Feeder Fund

Market Insights

1. China’s evolving economic importance

- China, the second largest economy today, is forecasted to overtake the United States as the world’s largest economy by 2030i. The China A-Shares market is the most direct way to access economic opportunities.

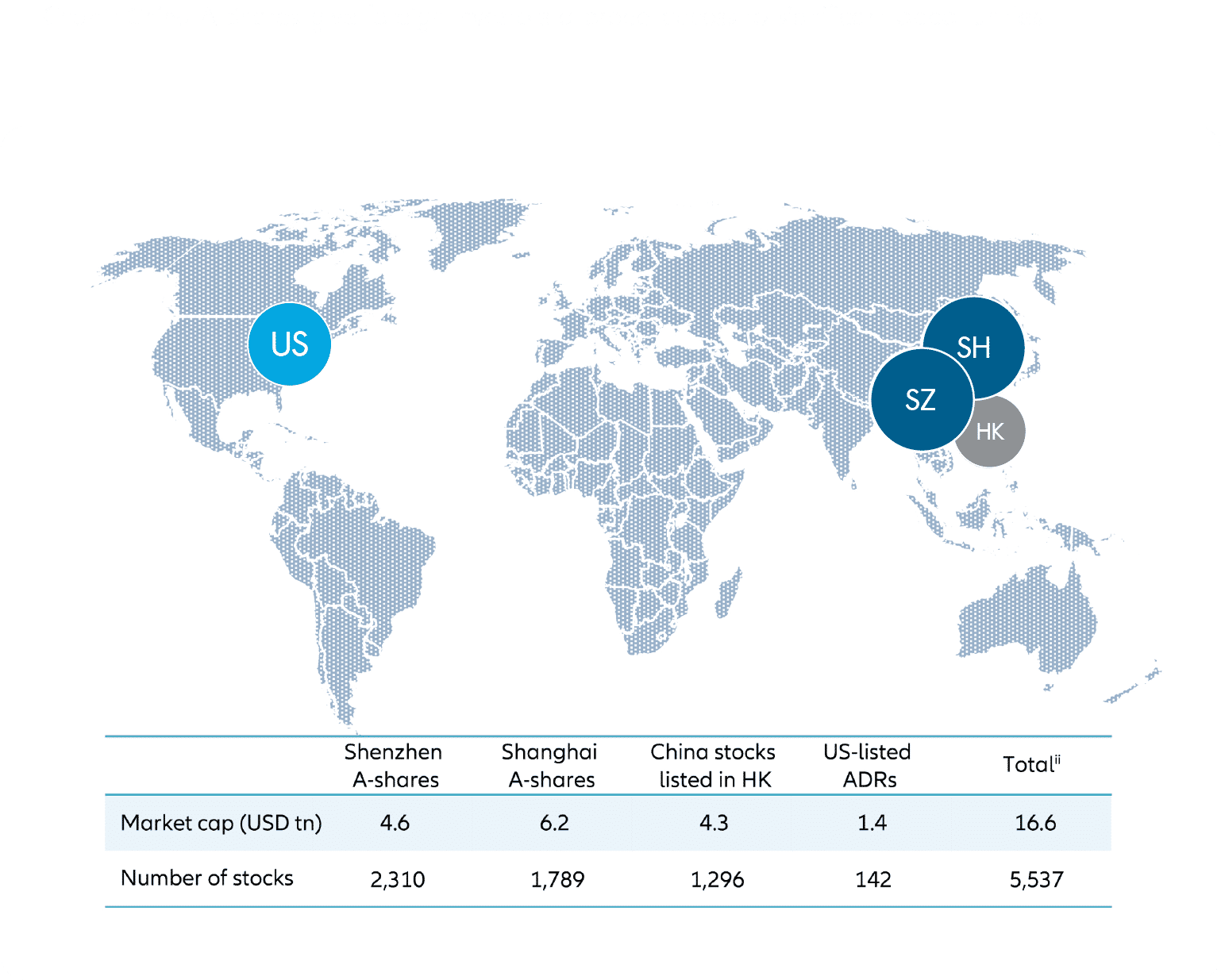

- The China A-Shares alone encompasses more than 4,000 listed companies worth nearly USD10.8 trillion (Chart 1) across the entire market capitalisation spectrum, and accounts for approximately 65% of China’s total equity market capitalisation.

- As MSCI adds China A-Shares into emerging-market indices, China’s growing importance will increasingly be reflected in global equity indices. In our view, the exposure of foreign investors to A-shares should increase noticeably.

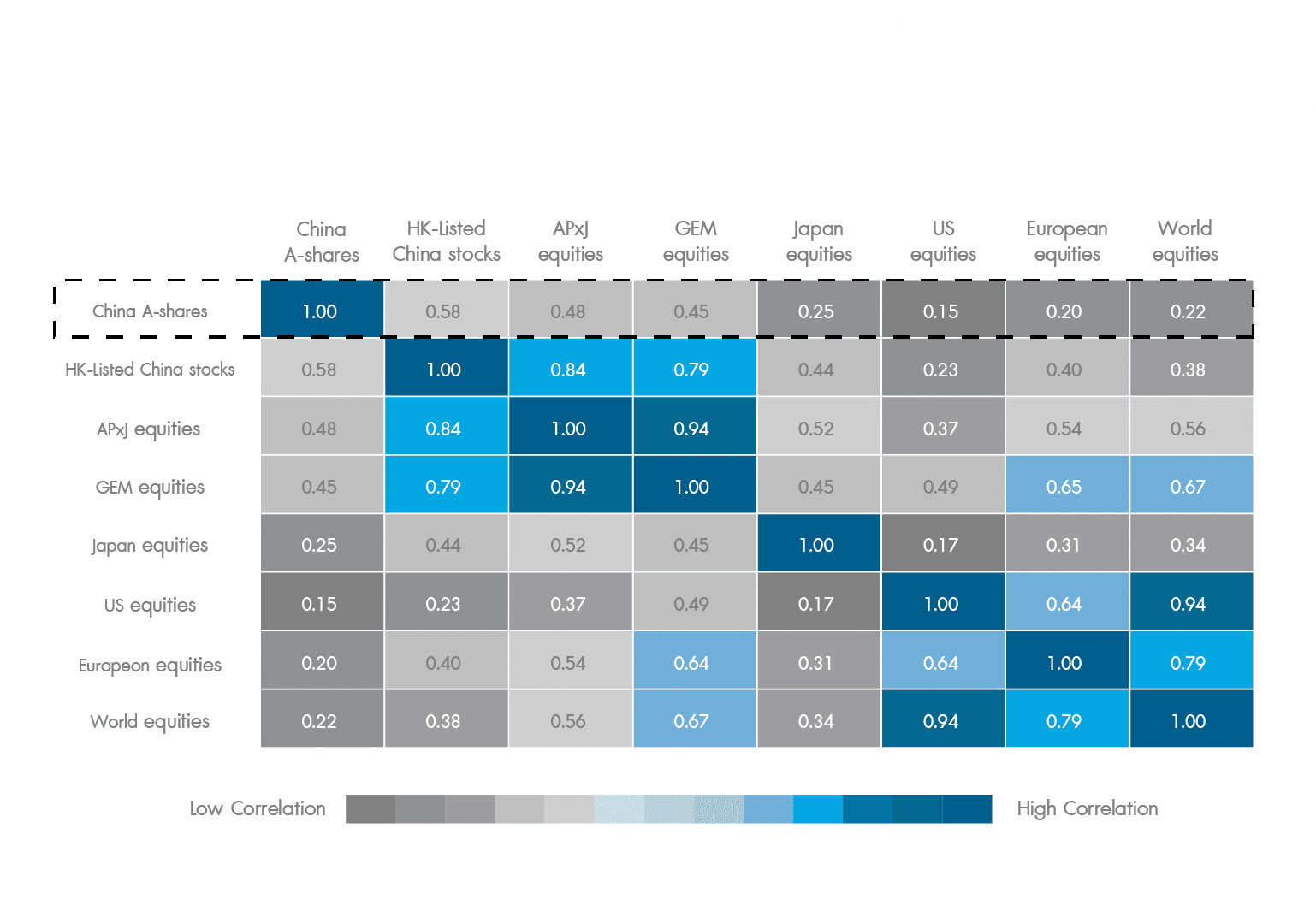

2. Low correlations with potential diversification benefits to other asset classes

- China’s domestic market exhibits low correlation with other widely held asset classes, because it is influenced by unique economic, political and monetary policy considerations.

- In addition, since these companies generate the vast majority of their revenues locally, the effects of ongoing trade tensions with the US are less pronounced than may be commonly perceived.

- China A-Shares add meaningful portfolio diversification, and can help investors access a broader investment universe reflecting the faster-growing sectors of China’s “new economy".

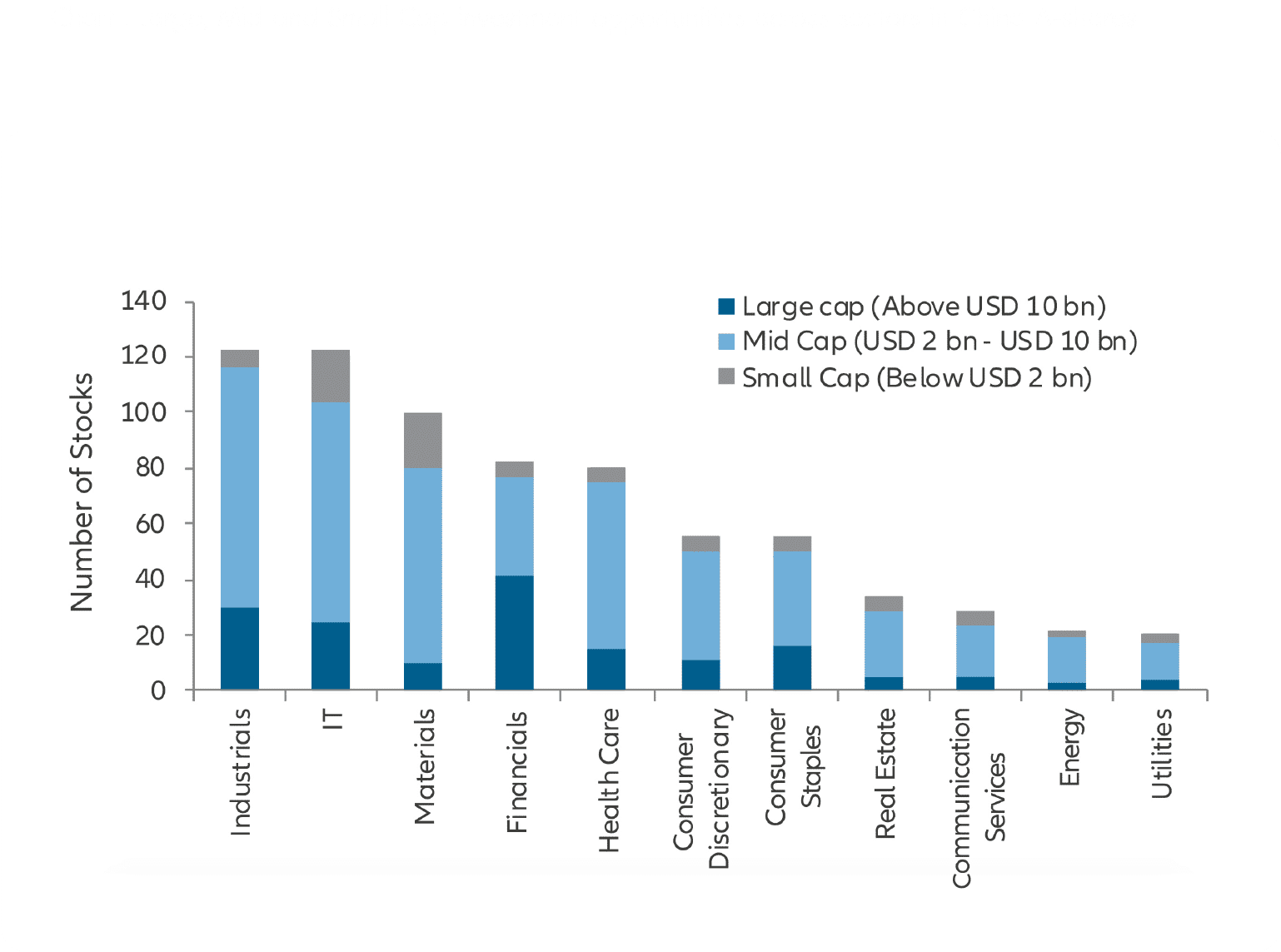

3. Gain access to potential growth across a wide range of sectors

- China is currently shifting from an export-driven economy to the “new economy,” characterised by an increased role of domestic consumption and higher value-added sectors, such as tourism, entertainment, healthcare equipment, industrial automation, new energy vehicles, biotech, software and new materials.

- Investing in China A-shares gives investors greater access to the small-and mid-cap companies set to be the future growth drivers of China’s economy - technology, innovation and the rapidly expanding Chinese middle class.

Reason to invest

Fund Features

1. All cap approach without market timing

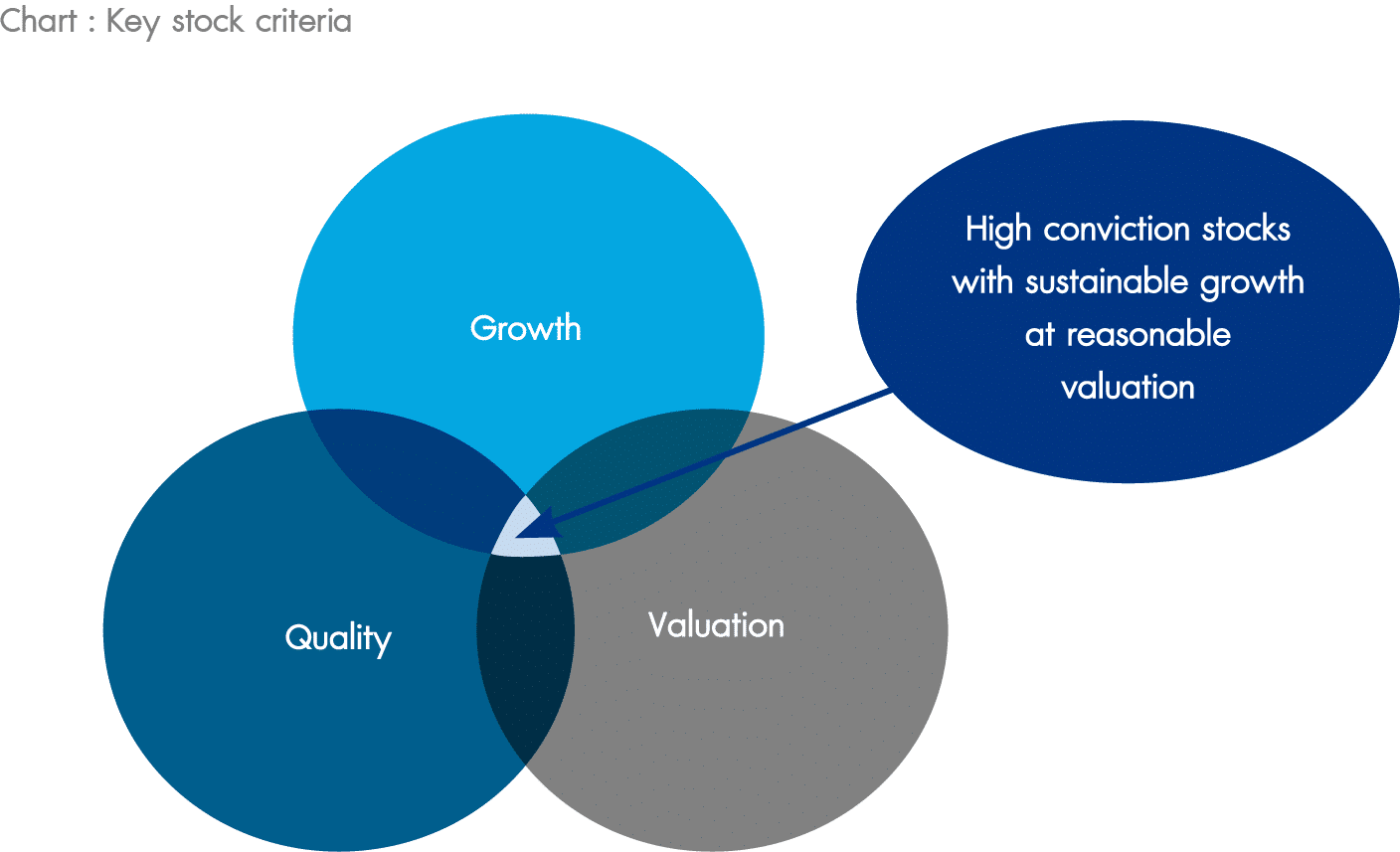

- By applying three key criteria – growth, quality and valuation, the Fund aims to build a focused portfolio of high conviction stocks that offer exposure to China’s long-term economic growth potential across various sectors.

- The Fund is fully invested in pure A-shares, adopting all cap approach without market timing.

2. Diversified access to the China growth story

- The Fund aims to provide access to growth opportunities across different sectors, providing well diversified sources of alpha from various industries.

- We continue to favour companies that can benefit from policies to advance national competitiveness or support economic growth.

- Consumption upgrade is another multi-year trend. We capture this opportunity through companies with the ability to upgrade their product offerings to premium segment.

- Domestic companies can substitute foreign brands through continuous product upgrade and better localization.

3. Fund performance

- The Fund is managed by an experienced Hong Kong based team with several years of relevant management experience and that fully understands the China A-Shares market trends, and strives for a consistent fund performance.

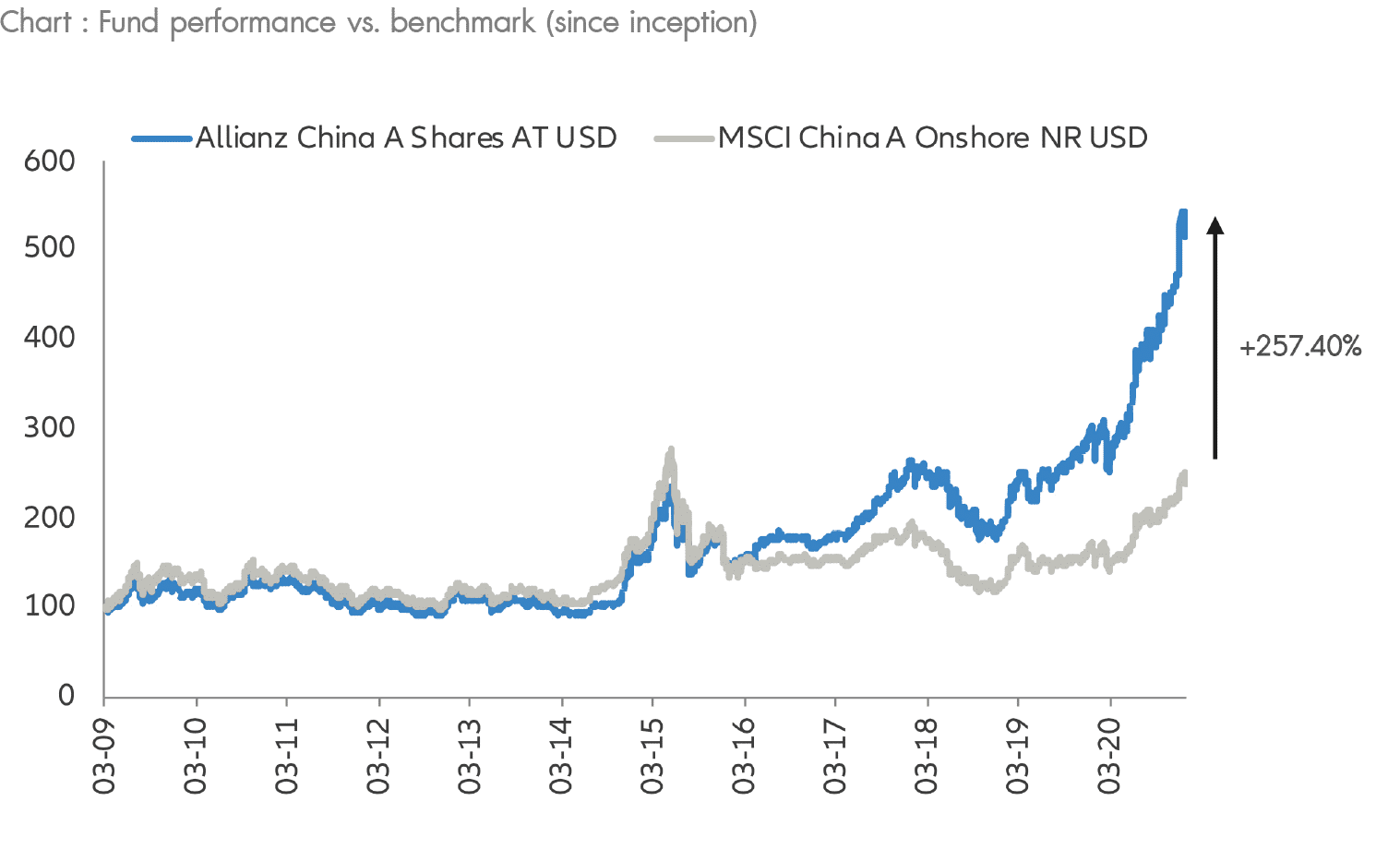

- As at 28 February 2021, the Fund (Class AT (USD) Accumulation) has achieved a return of 394.18% since inception, outperforming its benchmark by 257.40%. (For full details of fund performance, please refer to the next page.)

China – the investment opportunity

Significant potential for investors

Already the world's second-largest economy, China is set to become the biggest global economy by 2030. Reforms are shifting its focus to high-value sectors such as robotics, biotech and tourism.

The world is "underweight" China

Given the scale of the opportunity, we think investors' current allocations to China underrepresent the potential rewards - and we expect investors to increase their exposure steadily.

To pre-empt the opportunity, invest actively

As more investors look to China, "buying the index" may not provide the right kind of access, since China is widely underrepresented in benchmark indices. An active, selective approach may provide better exposure.

Lean on the right expertise

China's markets have been volatile, though their institutionalisation and transparency are improving. Yet it's still an unfamiliar market, emphasising the need to invest with conviction and the right partner.

China A-shares: 7 key facts investors need to know

Once largely out of reach to foreign investors, China's stockmarkets have opened up, attracting USD 146 billion of investor capital in the last six years through the Stock Connect programme alone. China A-shares have grown increasingly accessible, and they give investors more direct access to China's compelling growth story. |  |

Allianz Global

Investors

Allianz Global Investors

Allianz Global Investors works for many clients around the world. From pension funds, large and small, to blue-chip multinationals, from charitable foundations to families, individuals and their advisers. We have created a business that enables us to meet the demands of our clients on a local basis and that empowers our investment managers to focus on achieving strong and consistent investment results.

25 Locations worldwide

€582 bn Aessets under management

760+ Investment professionals

630+ Relationship managers

Our investment thinking is rooted in our purpose: to help our clients achieve their investment goals.

Across all our investment strategies, there is a common belief that insightfulness and understanding will give us an advantage. We address the challenges our clients face with forward-thinking strategies and customized solutions.

Why invest in Allianz Income and Growth ("the Fund”)?

- The US risk assets extended gains in Q3, supported by better-than-feared corporate earnings, accommodative monetary policy and progress with a COVID-19 vaccine and treatment.

- Economic reports surprised to the upside. Q3 growth estimates were revised higher, unemployment numbers declined, most housing-related statistics exceeded expectations and consumer confidence topped projections.^ Against this backdrop, US election

uncertainty, the lack of a new fiscal package and rising European virus cases could trigger market volatility.

- The Fund adopts a "three-sleeves” approach, with the core holdings invested primarily in a portfolio consisting of 1/3 US high-yield bonds, 1/3 US convertible bonds and 1/3 US equities/equity securities. It aims to capture multiple sources of potential income

and includes participation in the upside potential of equities at a potentially lower level of volatility than pure-equity investment.

Structure of the KTAM China

A Shares Equity Fund (Class A)

(KT-Ashares-A)

KTAM China A Shares Equity Fund

(Class A) (KT-Ashares-A)

Allianz Global Investors

Open-end Equity Fund, Feeder Fund

Fund Infomation | |

|---|---|

KT-Ashares | The fund’s policy is mainly to invest solely in USD-denominated PT share lass of the Allianz Global Investors Fund - Allianz China A-Shares Fund (master fund), averaging at least 80% of NAV during the financial year, or at the weighting prescribed by the Securities and Exchange Commission. The KTAM China A Shares Equity Fund may consider investing or holding derivatives to hedge against FX risk, in compliance with SEC regulations or SEC Office notifications. The use of derivatives is subjected to the discretion of fund managers according to the prevailing investment climate. |

Master fund | - Sub-Fund assets may be invested in Emerging Markets - Max. 69% of Sub-Fund assets may be invested via RQFII - Max. 20% of Sub-Fund asset may be invested in Equities of PRC markets other than China A-Shares market (e.g. China B-Shares and China H-Shares) - Max. 10% of Sub-Fund assets may be invested in Equities outside PRC - Sub-Fund assets may not be invested in convertible debt securities including contingent convertible bonds - Max. 10% of Sub-Fund assets may be held directly in deposits and/or invested in Money-Market Instruments and/or in Debt Securities and/or in money market funds for liquidity management |

Fund Type | Open-end Equity Fund, Feeder Fund |

Risk Level | 6 |

Master Fund | Allianz Global Investors Fund - Allianz China A-Shares (Class PT) |

ISIN (Master Fund) | LU1997246811 |

Asset Management | Allianz Global Investors GmbH |

Currency (Master Fund) | USD |

For more information Click

- The Fund aims at long-term capital growth by investing in the China A-Shares markets of the PRC.

- The Fund is exposed to significant risks of investment/general market, country and region, emerging market, company-specific and currency (in particular RMB).

The Fund invests in China A-Shares via the RQFIl regime and the Stock Connect and thus is also exposed to the associated risks including quota limitation, change in rule and regulations, repatriation of the Fund's monies, trade restrictions, volatility and stability of China markets, potential clearing and/or settlement difficulties, change in economic, social and political policy in PRC and Mainland China tax risks.

- The Fund may invest in financial derivative instruments ("FDI") which may expose to higher leverage, counterparty, liquidity, valuation, volatility, market and over the counter transaction risks. The Fund's net derivative exposure may be up to 50% of the Fund's net asset value.

- Investment involves risks that could result in loss of part or entire amount of investors' investment.

- In making investment decisions, investors should not rely solely on this material.

<

Who is this fund suitable for?

- Investors who can accept the risks and price volatility of securities held by the fund which may increase or drop below investment costs, thereby resulting in a loss.

- Investors with a medium to long term investment horizon, settings sights on achieving better financial returns than general fixed income investments.

- Investors who can accept foreign currency risk.