Fund’s Attractiveness

KTAM Asia Growth

J.P. Morgan Funds –

Asia Growth Fund

Master Fund

Asia Ex-Japan Market

...which is more than focusing solely on securities with structural growth.

Image source: Shutterstock. Data source: J.P. Morgan Asset Management. JPM Asla Growth Strategy is an Investment style Implemented by actively managed Investment vehicles based in several countries (such as, funds. portfolios, unit trusts, or separately managed accounts). The representative portfolio characteristics are subject to change at the discretion of the investment manager without notice. Provided for Information and reporting purposes, not to be construed as Investment advice or recommendation relating to any securities or sectors listed here.

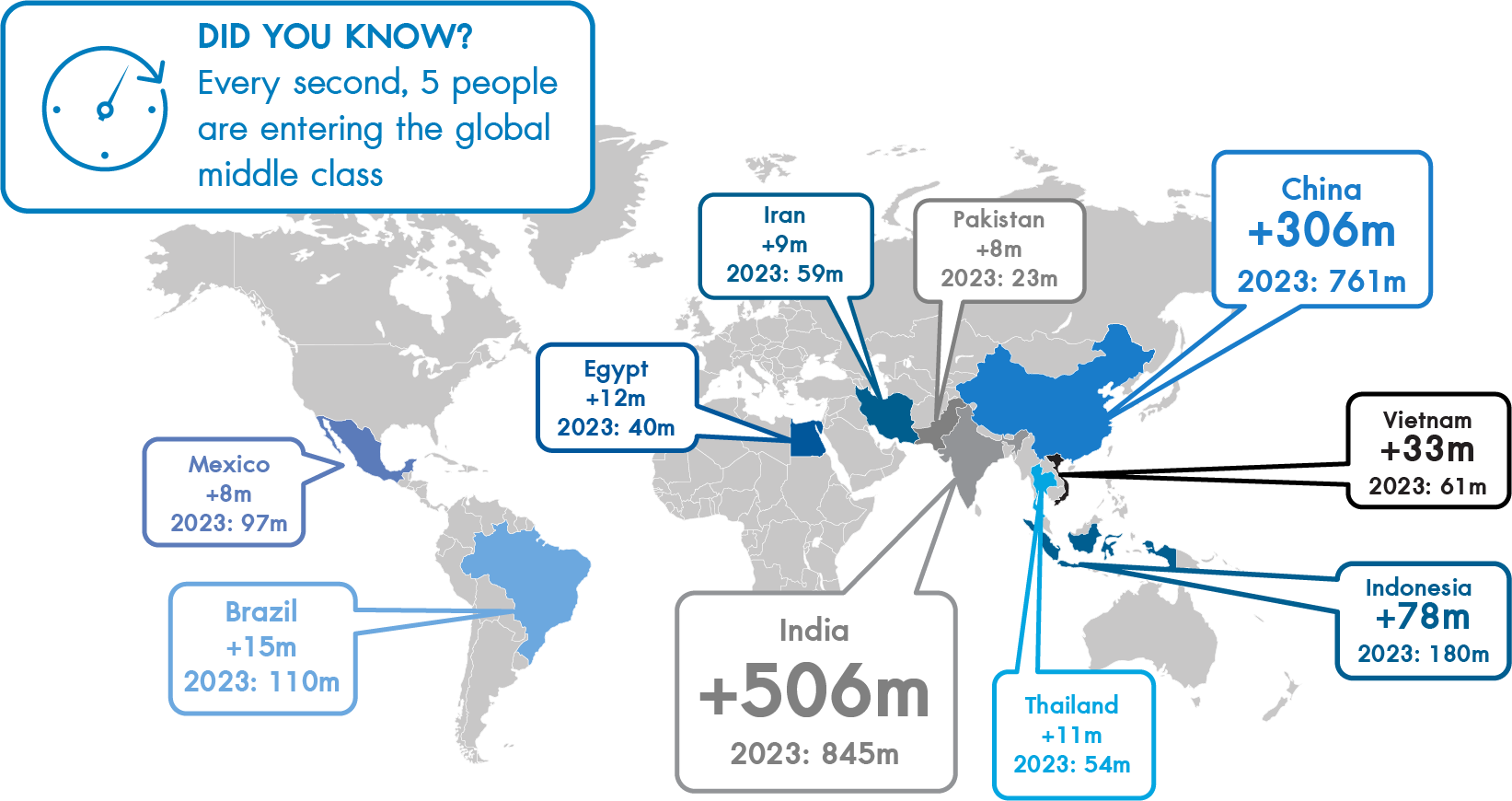

Increasing Continuously

- By 2020, almost 400 million people in China will have household disposable incomes of between $16,000 and $34,000 per year

- By 2025, annual consumption in emerging markets will reach $30tn, roughly equivalent to developed markets

First row numbers = estimated increment by 2023

Second row numbers = estimated middle class population in 2023

Source: Brookings Institute, HSBC estimate as of 2018

Most Powerful Growth Factors

The bottom-up stock selection reflects a number of long term structural growth opportunities

The Fund is an actively managed portfolio, holdings, sector weights, allocations and leverage, as applicable are subject to change at the discretion of the Investment Manager without notice. For illustrative purposes only. The mentioning of the securities / companies in the above should not be interpreted as a recommendation to buy or sell. J.P. Morgan Asset Management may or may not hold positions on behalf of its clients in any or all of the aforementioned securities. The use of the above company logos is in no way an endorsement for JPMAM investment management services.

างใด\

Reasons to Invest

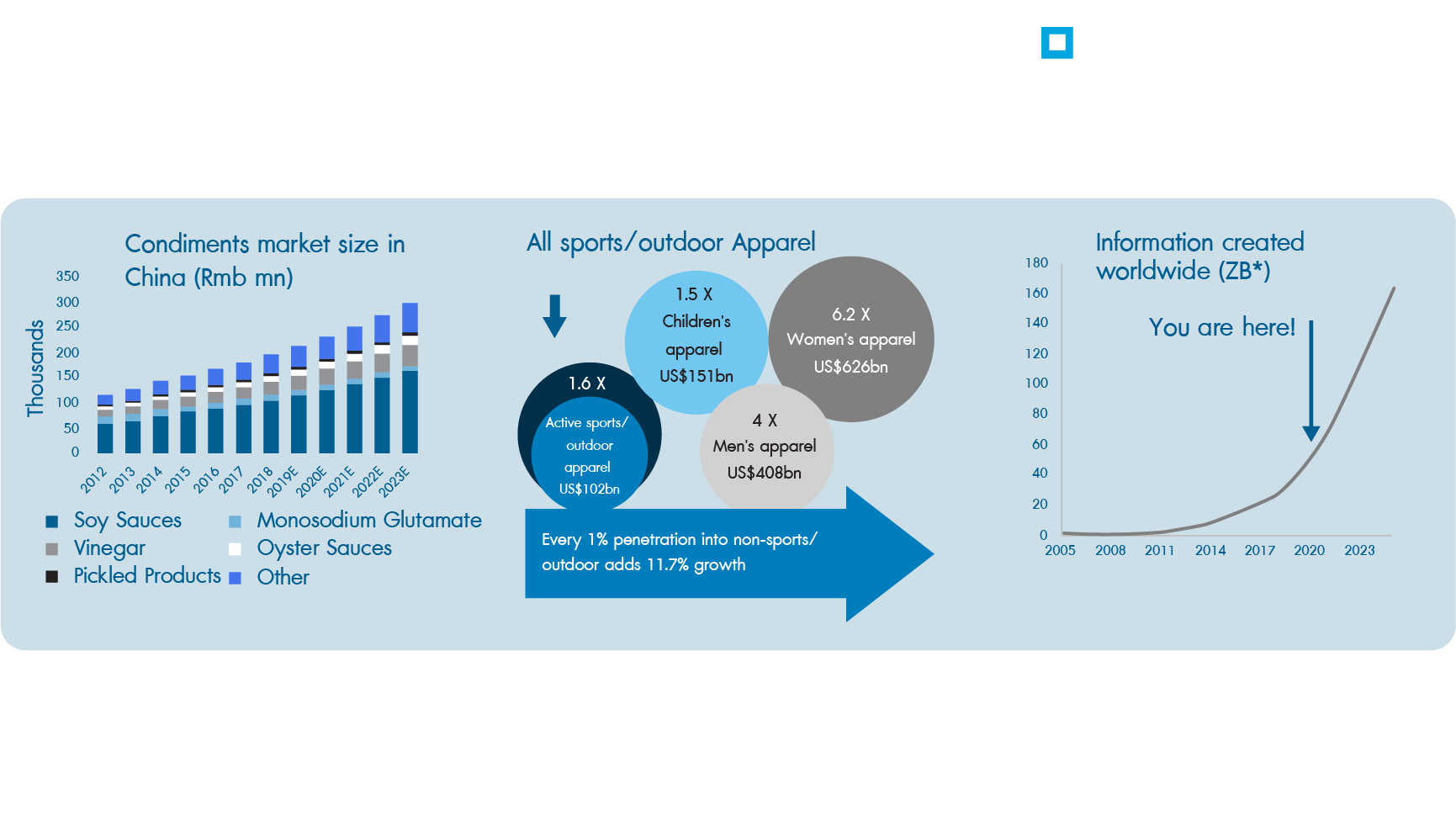

Higher Standard of Living

*ZB = zeta byte. 1 zeta byte = 1million petabytes. 1 petabyte = 1million gigabytes, thus 1 zeta byte also equals 1 trillion gigabytes

Source: World Bank, HSBC, Gartner, DRAM Exchange, Bernstein analysis. Company data. J.P. Morgan Asset Management. Data as of end May 2019. The companies/securities above are shown for illustrative purposes only. Their inclusion should not be interpreted as a recommendation to buy or sell. J.P. Morgan Asset Management may or may not hold positions on behalf of its clients in any or all of the aforementioned securities

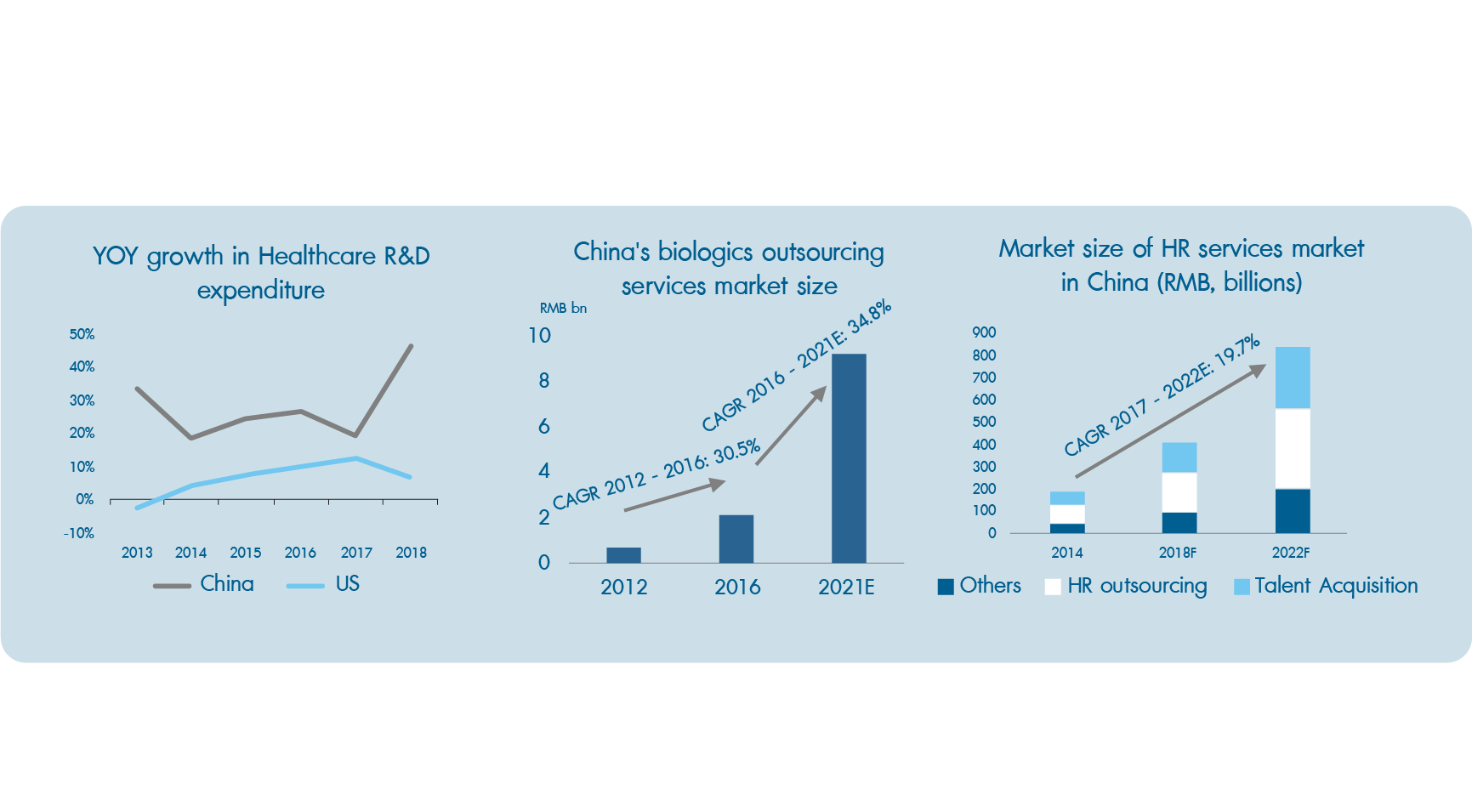

Demographic Changes

YOY = Year on Year, R&D = Research & Development, CMO = Contract Manufacturing Organisation; CRO = Contract Research Organisation; CAGR = Compounded annualised growth rate.

Source: PWC, Frost & Sullivan. CIC. Company data. J.P. Morgan Asset Management Data as of end May 2019. The companies/securities above are shown for illustrative purposes only. Their inclusion should not be interpreted as a recommendation to buy or sell. J.P. Morgan Asset Management may or may not hold positions on behalf of its clients in any or all of the aforementioned securities

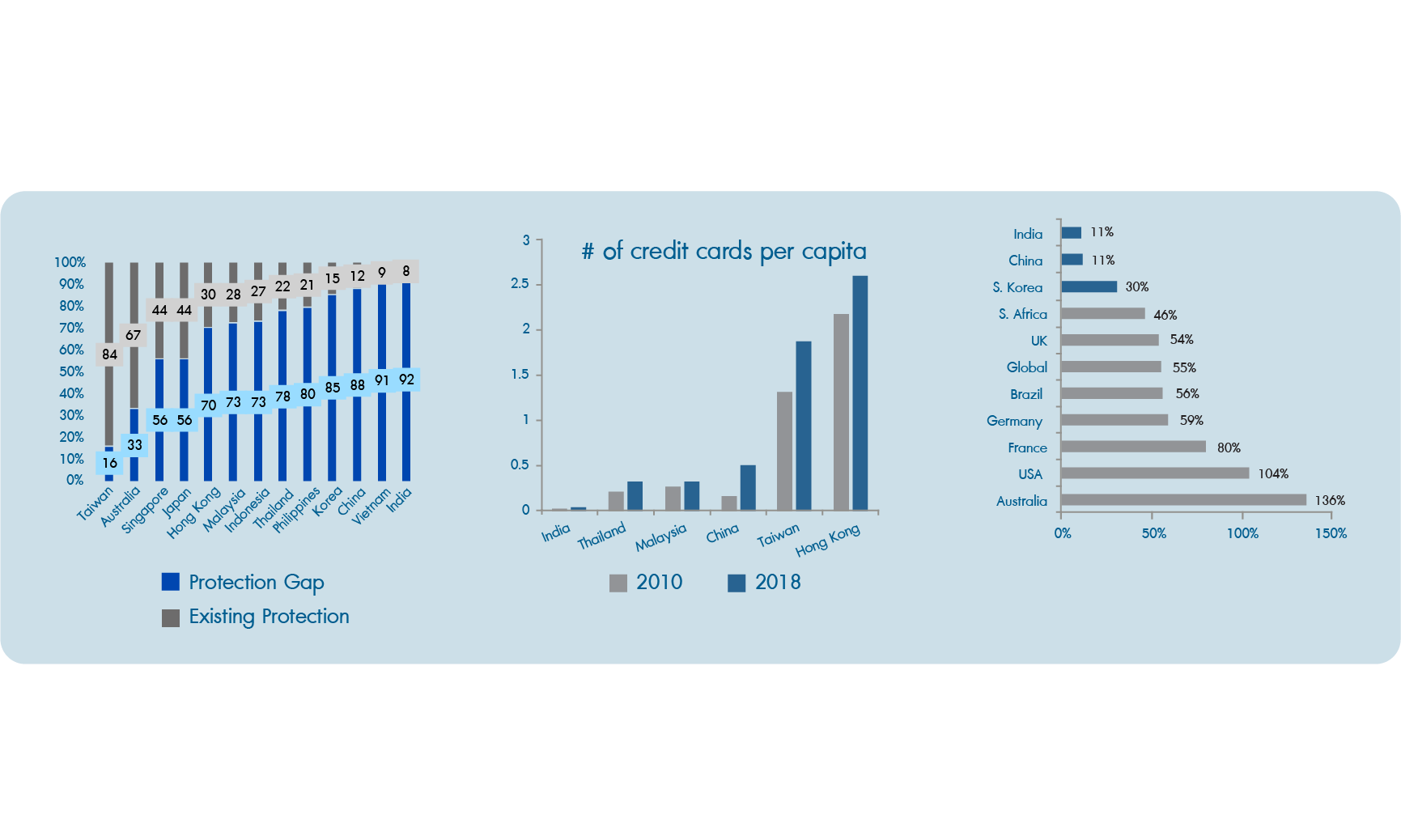

Financial Deepening

Source: (left) Swiss Re Mortality Protection Gap: Asia Pacific 2015. (Middle) Asian Banker Research, as of end Sep 2018. (Right) CLSA Company data. J.P. Morgan Asset Management Data as of end Dec 2018.The companies/securities above are shown for illustrative purposes only. Their inclusion should not be inte recommendation to buy or sell. J.P. Morgan Asset Management may or may not hold positions on behalf of its clients in any or all of the aforementioned securities

About J.P. Morgan

J.P. Morgan is a global leader in financial services, offering solutions to the world's most important corporations, governments and institutions in more than 100 countries. As announced in early 2018, JPMorgan Chase will deploy $1.75 billion in philanthropic capital around the world by 2023. We also lead volunteer service activities for employees in local communities by utilizing our many resources, including those that stem from access to capital, economies of scale, global reach and expertise.

Our presence in Thailand dates back to 1964, and we are now a leader among international investment banks in the Kingdom. Local operations are linked to the world’s major financial hubs by a global distribution network that provides in-depth, industry-specific expertise and regional market acumen.

We have operated in Asia Pacific since 1872, and today are present across 17 markets in the region. Clients rely on our global strength, local expertise and leadership across our lines of business.

In Asia Pacific, we are committed to helping promote economic growth and economic inclusion through our key philanthropic initiatives in the areas of workforce readiness, small business development and financial capability. Our investments aim to increase the number of quality jobs created for the underserved individuals and communities, helping small businesses become more sustainable, as well as assisting marginalized people in gaining access to affordable financial products so that they can become more financially secure. This shared commitment to the community drives our Foundation’s giving and employee engagement and volunteering activities across the region.

Fund Information

KTAM Asia Growth

Equity Fund

J.P. Morgan Funds –

Asia Growth Fund

Master Fund

Asia Ex-Japan Market

|

Investment Policy |

|

|---|---|

|

KT-ASIAG |

The fund aims to solely invest in the units of the master fund, a retail fund, amounting to an average of no less than 80% of the net asset value during the financial year. |

|

Master Fund |

The fund's investment objective is to provide investors with long term capital appreciation by investing at least 67% of the net asset value in equity securities of companies with businesses that benefit from, or are associated with, the growth of the Asian economy (excluding Japan) and including emerging market countries. The fund will invest in approximately 40-60 equity securities and may invest in small-cap stocks. The fund may be concentrated in certain industries or countries. The fund can invest in China A-Shares through the China-Hong Kong Stock Connect Programs. |

|

Fund name |

KTAM Asia Growth Equity Fund |

|

Fund type |

Equity Fund, Feeder Fund |

|

Fund risk level |

6 |

|

Master fund |

JPMorgan Funds – Asia Growth Fund |

|

ISIN (Master Fund) |

LU0943624824 |

|

Currency |

USD |

|

Exchange rate hedging |

at the discretion of the fund manager |

|

Minimum purchase |

1,000 baht |

For more information, click

Risks of KTAM Asia Growth Equity Fund

- Market risk

- Credit Risk

- Exchange rate risk

- Counter Party Risk

- Country Risk

- Liquidity Risk

- Repatriation Risk

- Investment switching risk

Warnings

-

Investing in this fund can be highly risky and is suitable only for investors who are ready to take risks. Past returns are not a guarantee of future returns. The value of the fund's investment units may fluctuate and can be greatly reduced within a short period of time. In addition, there is a chance that investors will receive an ending balance that is less than their initial investment.

-

Investors are exposed to exchange rate risk. Fluctuations in the exchange rate between the currency of the master fund and the Thai baht may cause investors to receive an ending balance that is less than their initial investment upon redemption. Please read the fund prospectus for more information.

Who is suitable for this fund?

- Investors who can accept the risks and price volatility of securities held by the fund which may increase or drop below investment costs, thereby resulting in a loss.

- Investors with a medium to long term investment horizon, settings sights on achieving better financial

- Investors who can accept foreign currency risk.