Fund’s Attractiveness

KTAM China

BGF China Fund

Master Fund

Stocks of Chinese

Companies Registered

both Inside and

Outside China

Reasons to Invest

Highlights of KT-CHINA

Master fund manager has been experienced in

analyzing and investing in Chinese stocks.

|

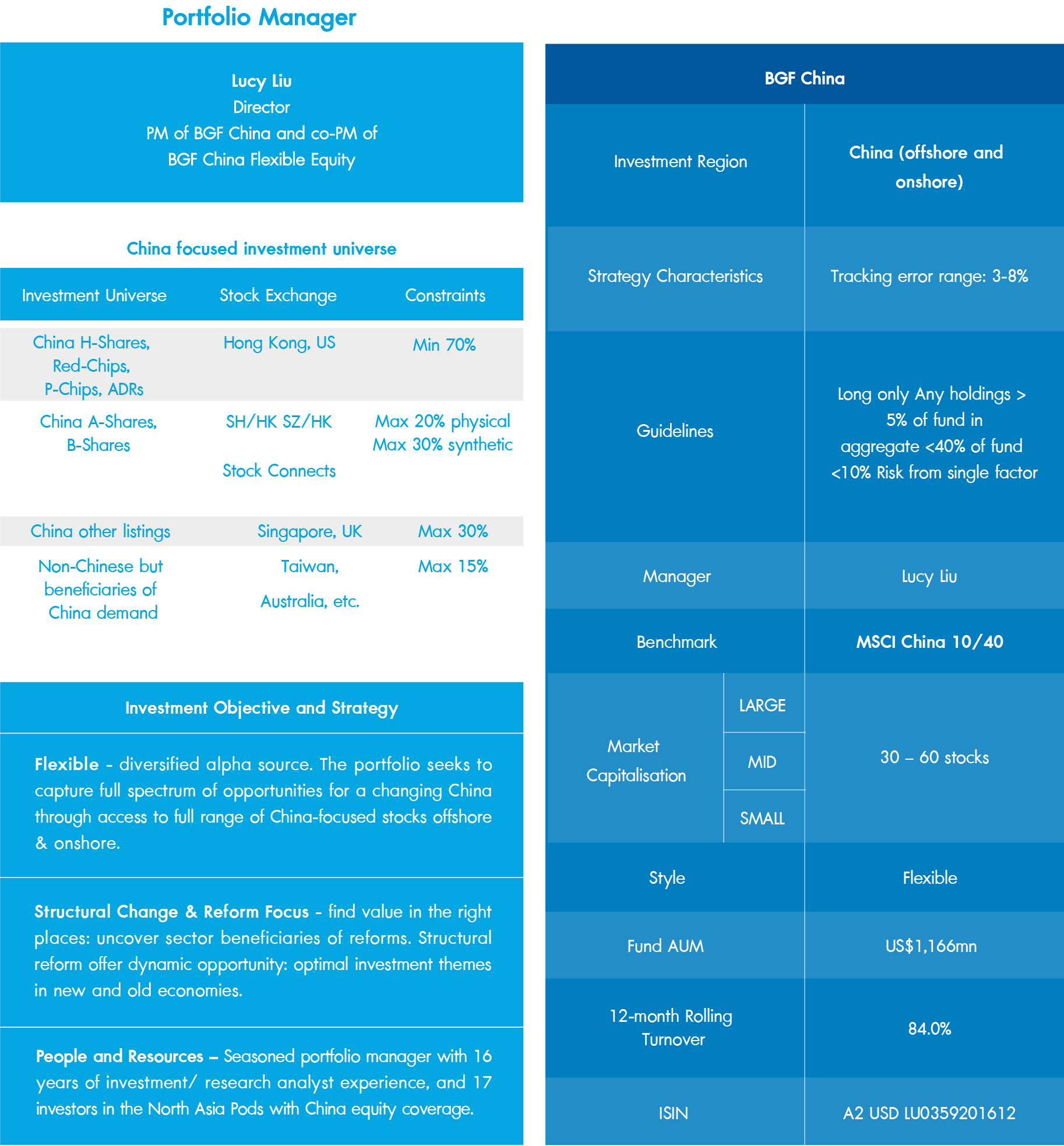

Lucy Liu Director

|

Lucy Liu is the fund manager and analyst in the Global Emerging Markets Equities team, which is part of the Fundamental Active Equity division of BlackRock's Active Equity Group.

She leads the research team for North Asia Consumers and Communication Services.

In addition, she manages strategic portfolios in China and co-manages China Unconstrained and China A-Share strategic portfolios.

|

Before joining Blackrock in 2014, she had over 10 years of experience as a sell-side analyst at Goldman Sachs and JPMorgan in Hong Kong, specializing as a researcher in mainland China.

She holds a Bachelor’s Degree with honors in Finance at Shanghai Jiao Tong University in China and a Master’s Degree in Economics at the Chinese University of Hong Kong.

About BlackRock

As an asset manager focused on the long-term, we will continue to ask bigger questions at the intersection of investing and society. About how to push forward without leaving people behind. About building bridges between society and shareholders, the planet and profits, in service of the biggest question of them all.

As a global investment manager and fiduciary to our clients, our purpose at BlackRock is to help everyone experience financial well-being. Since 1999, we've been a leading provider of financial technology, and our clients turn to us for the solutions they need when planning for their most important goals.

Master Fund Investment Information : BGF China

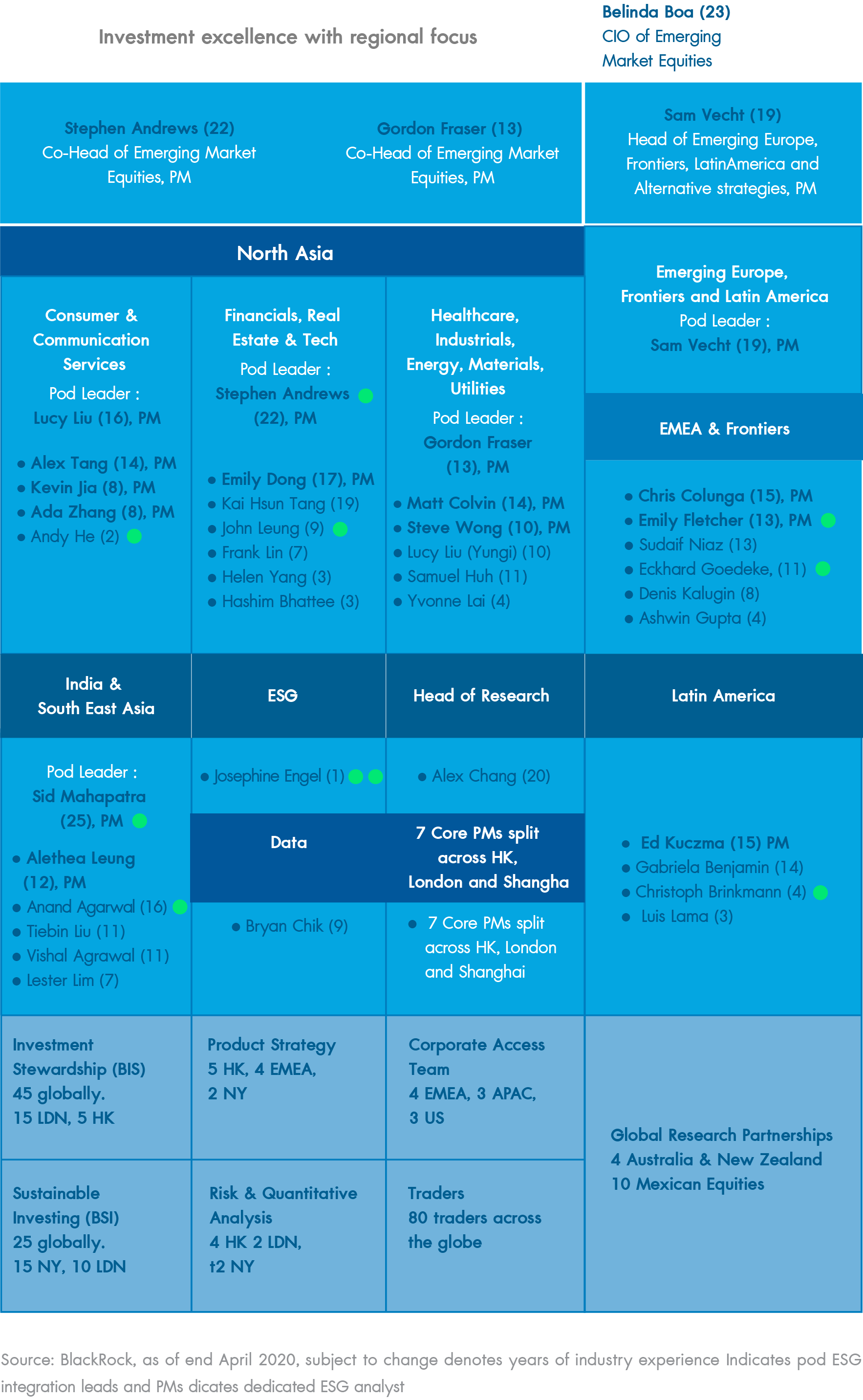

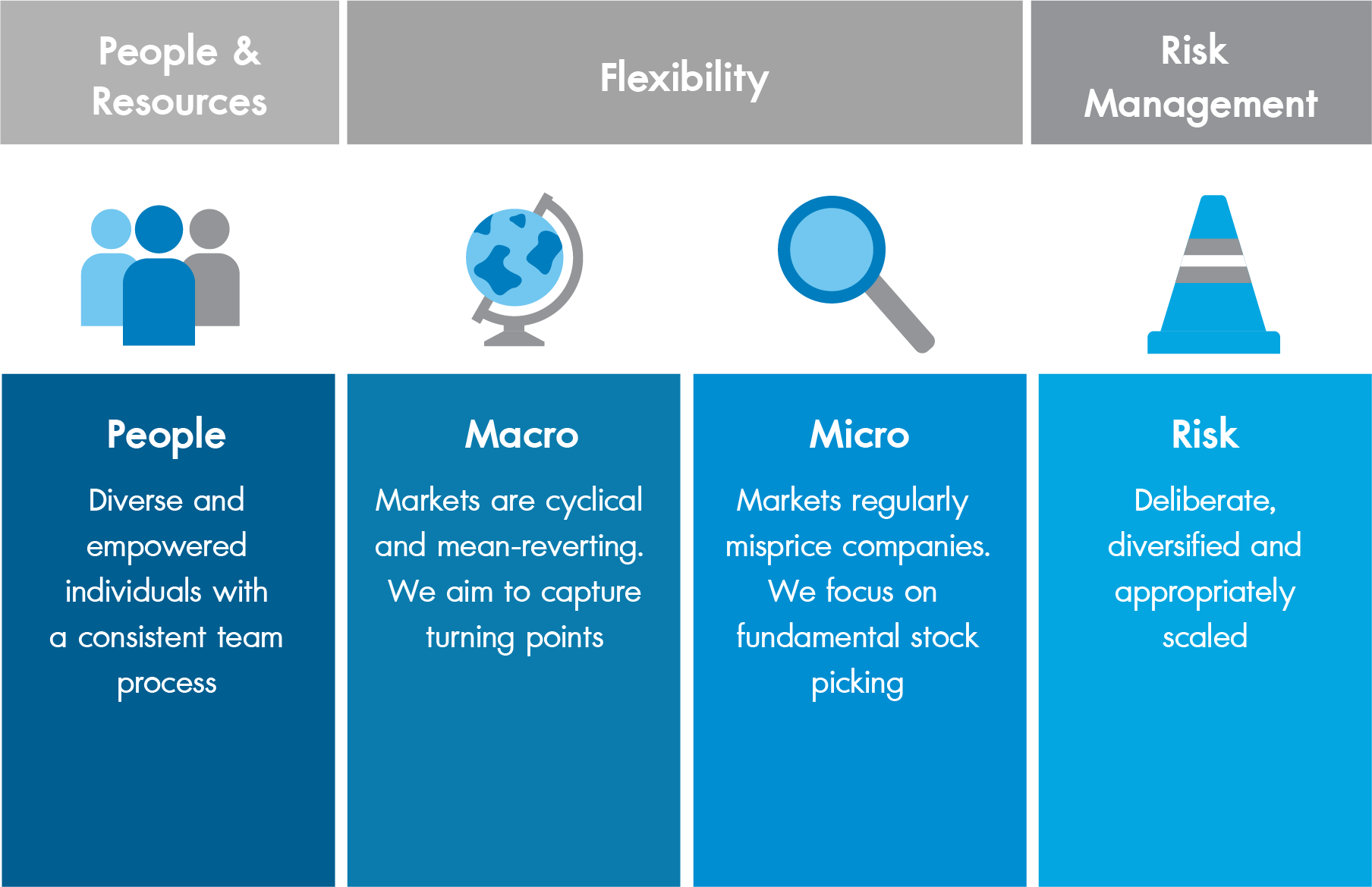

BlackRock Global Emerging Markets Team

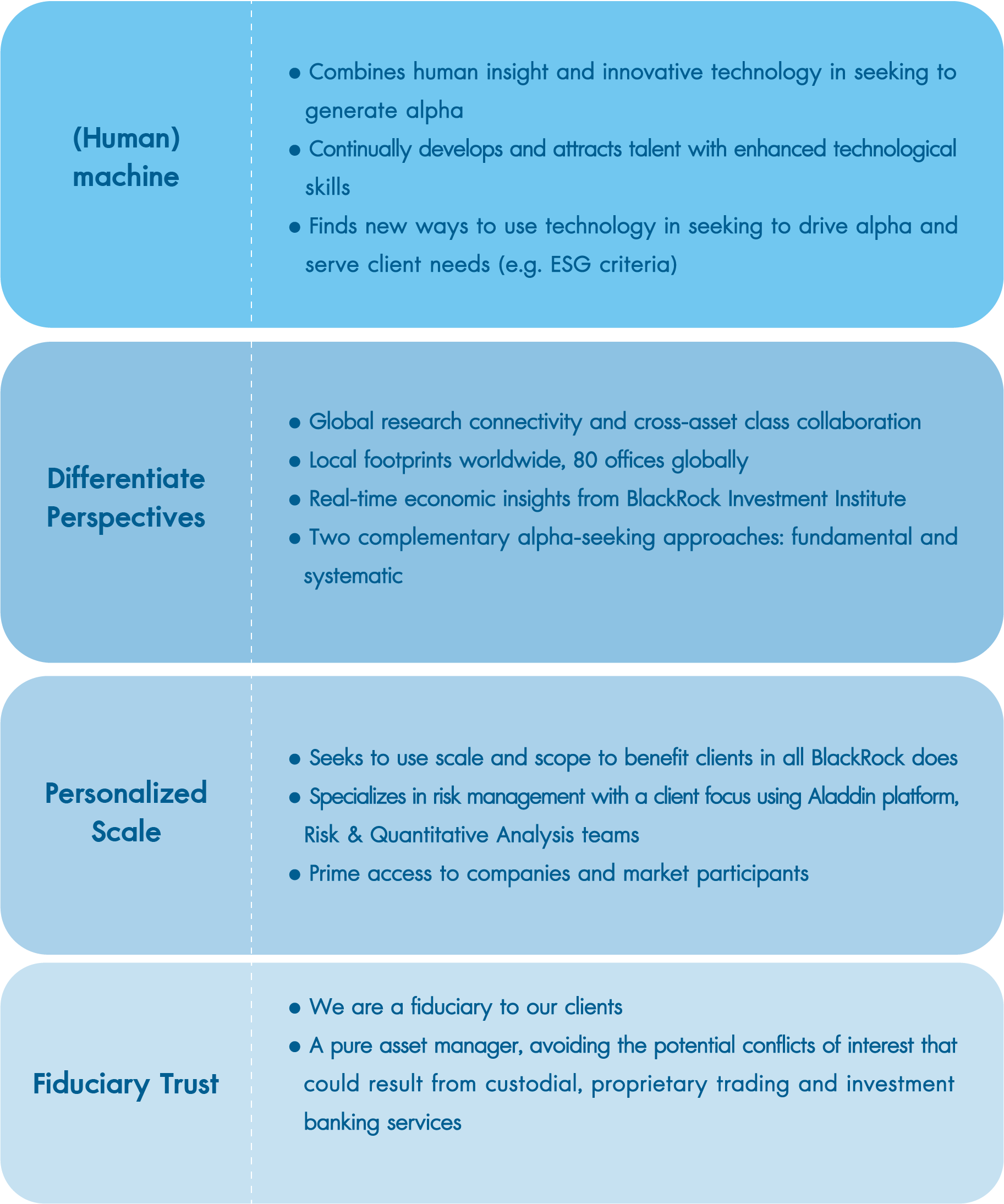

Why BlackRock for Actively Managed Funds?

There is no guarantee that a positive investment outcome will be achieved.

Source: BlackRock, as of end Dec, 2019. While proprietary technology platforms may help manage risk, risk cannot be eliminated.

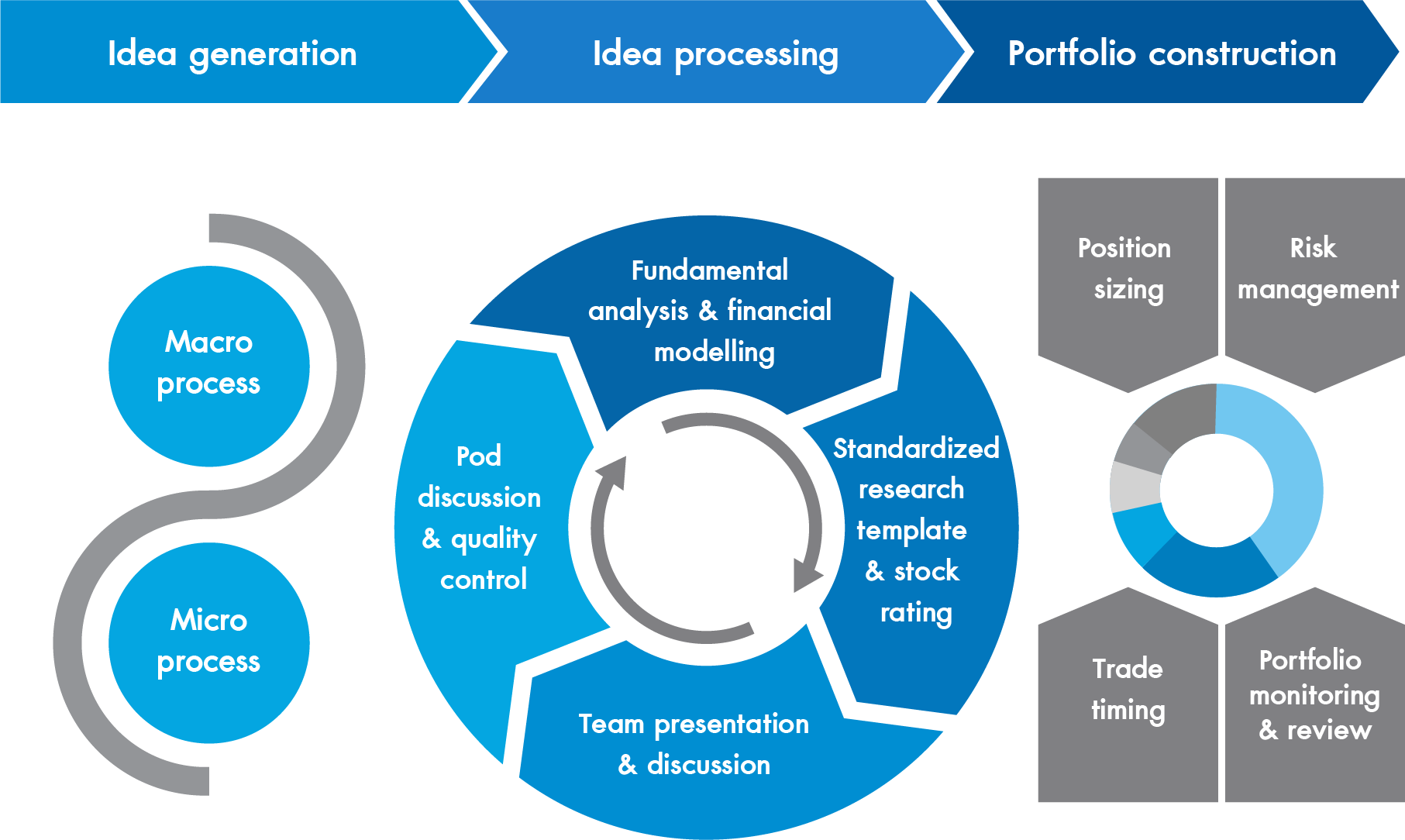

Investment Philosophy and Process

Investment Process

Risk-aware portfolios built from a structured research framework

Investment philosophy and process subject to change and provided here for illustrative purposes only. There is no guarantee that a positive investment outcome will be achieved. Source: BlackRock, as of end December 2019.

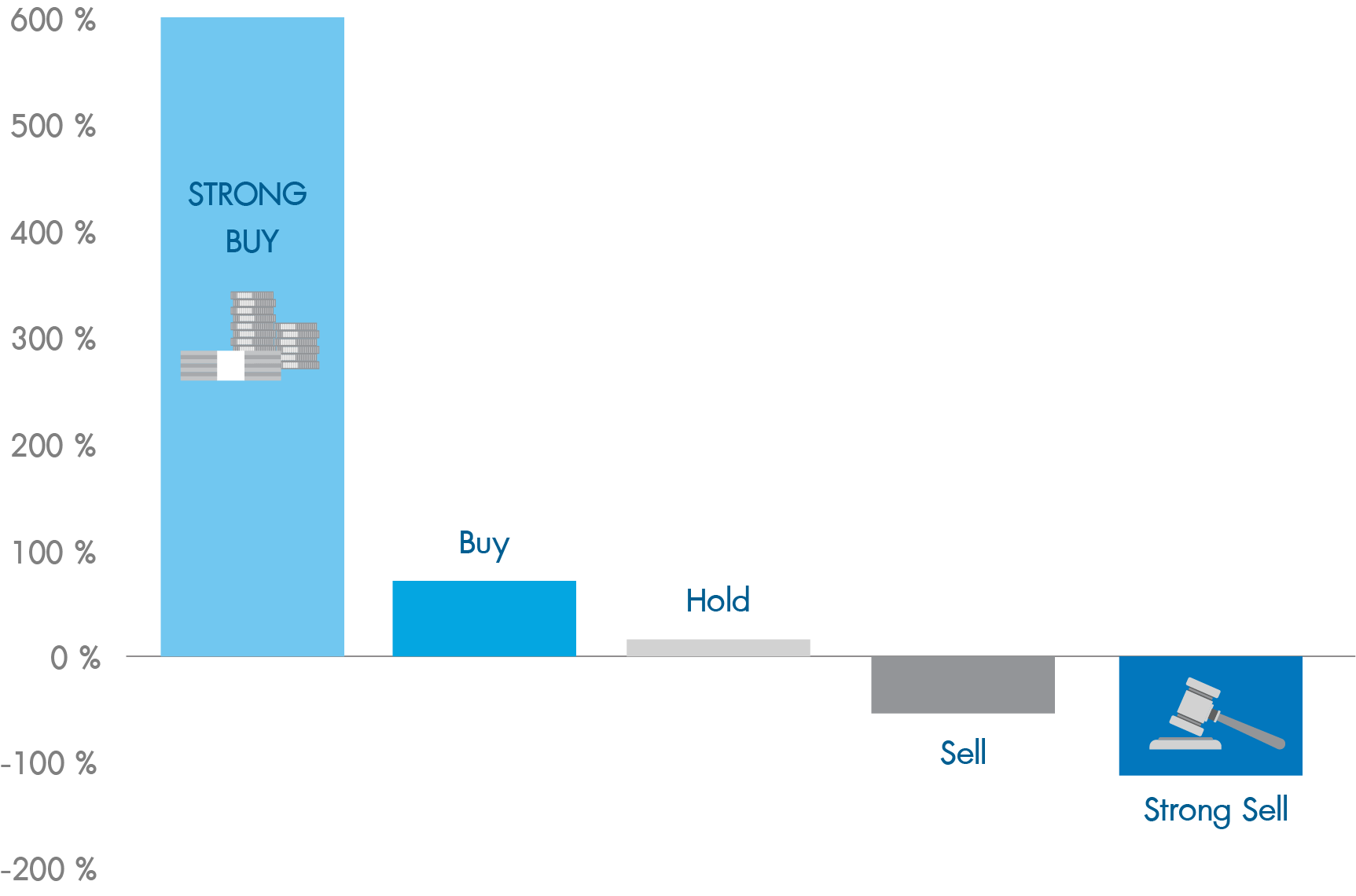

“Selection of Stocks” is the Main Factor in

Generating Excess Return (Alpha)

Analyst Stock Ratings - Measured Cumulative Performance vs. MSCI China (Illustrative)

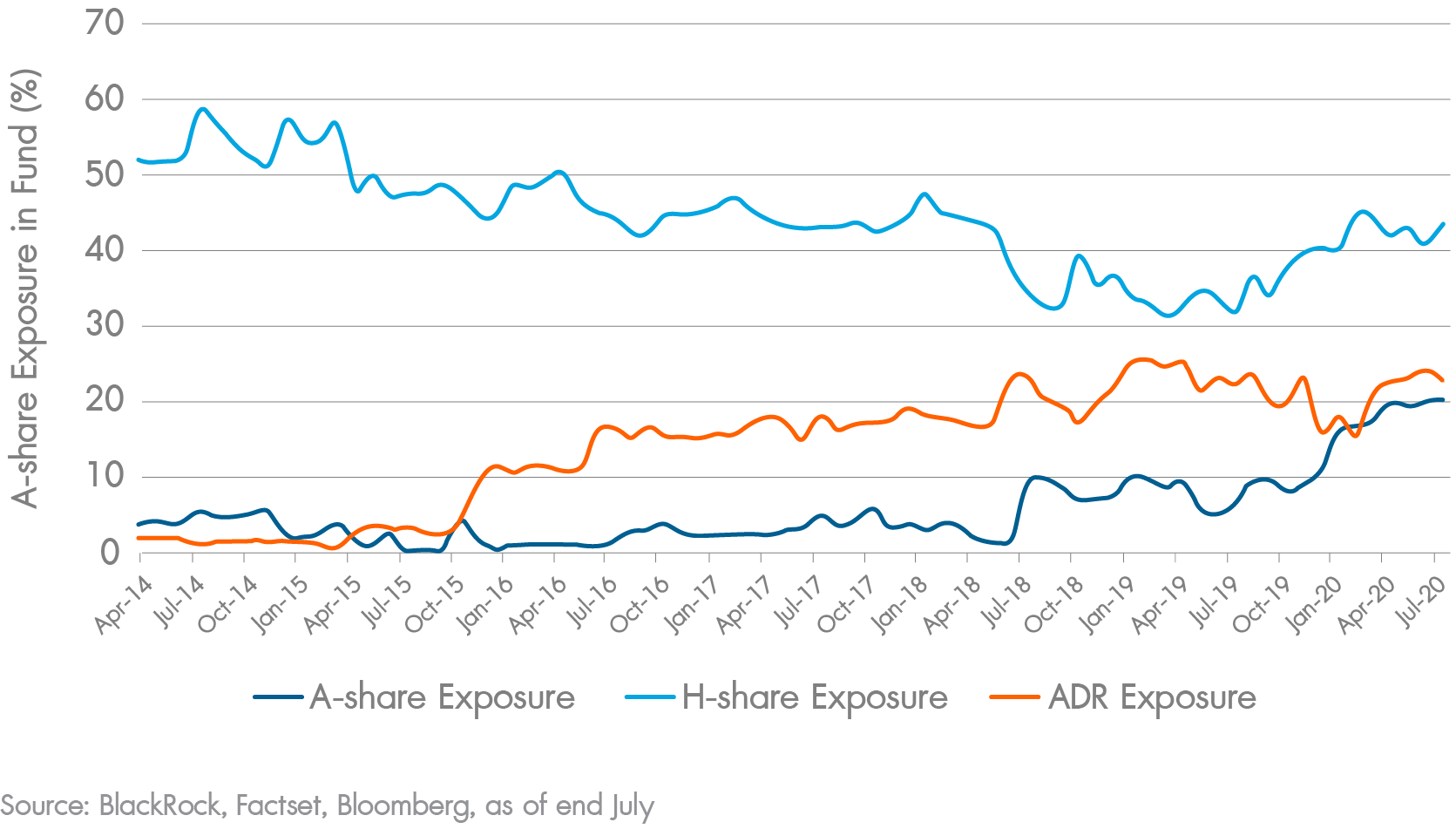

Flexible Investment in Chinese Stocks Registered

Inside and Outside China

“It is flexible and able to increase investment proportion to Chinese stock market, A-shares, to expand the investment scope and increase the potential of generating Alpha"

Fund Information

KTAM China

Equity Fund

(KT-CHINA)

BGF China Fund

Master Fund

Stocks of Chinese

Companies Registered

both Inside and

Outside China

|

Investment Policy |

|

|---|---|

|

KT-CHINA |

The fund’s policy is to have foreign net exposure averaging no less than 80% of NAV during the financial year by investing solely in the BGF China Fund (master fund) at the aforementioned portfolio weight or as prescribed by the SEC. |

|

Master Fund |

The master fund's objective is to generate the highest total return by investing at least 70% of the fund's total assets in equity securities of companies domiciled in or part of the beneficiary of economic growth in the People's Republic of China. |

|

Fund type |

Open-end Equity Fund, Feeder Fund |

|

Risk Level |

6 |

|

Master Fund |

BGF China fund |

|

ISIN (Master Fund) |

LU0359204475 |

|

Management Company |

BlackRock (Luxembourg) S.A. |

|

Currency |

USD |

|

Hedging Policy |

Subjected to the discretion of the fund manager given prevailing investment climate |

|

Minimum Subscription |

1,000 Baht |

For more information, click

Fund Investment Risk Factors

- Market Risk

- Credit Risk

- Foreign Exchange Rate Risk

- Counter Party Risk

- Country Risk

- Liquidity Risk

- Repatriation Risk

Warnings

- This Fund is concentrated in the People's Republic of China. Therefore, investors should also consider risk diversification of their overall investment portfolios.

- This Fund has a foreign exchange rate risk. It has a hedging policy at the discretion of the fund manager. In the event that the Fund does not have a policy to hedge its foreign exchange rate risk in full, investors may lose or receive a foreign exchange rate profit or a refund lower than their initial investment.

- Before investing, investors should understand product characteristics, return conditions, and risks.

Who’s Suitable to Invest

- The fund is suitable for investors willing to accept the risk of investing in a foreign equity fund and currency risk.

- The investor must also be able to fully accept NAV volatility, in exchange for the opportunity to generate good returns by investing in a foreign fund.