Key Attractions

KTAM European Equity

Invesco Continental European

Small Cap Equity Fund

Europe ex UK

Invesco 2021 Outlook

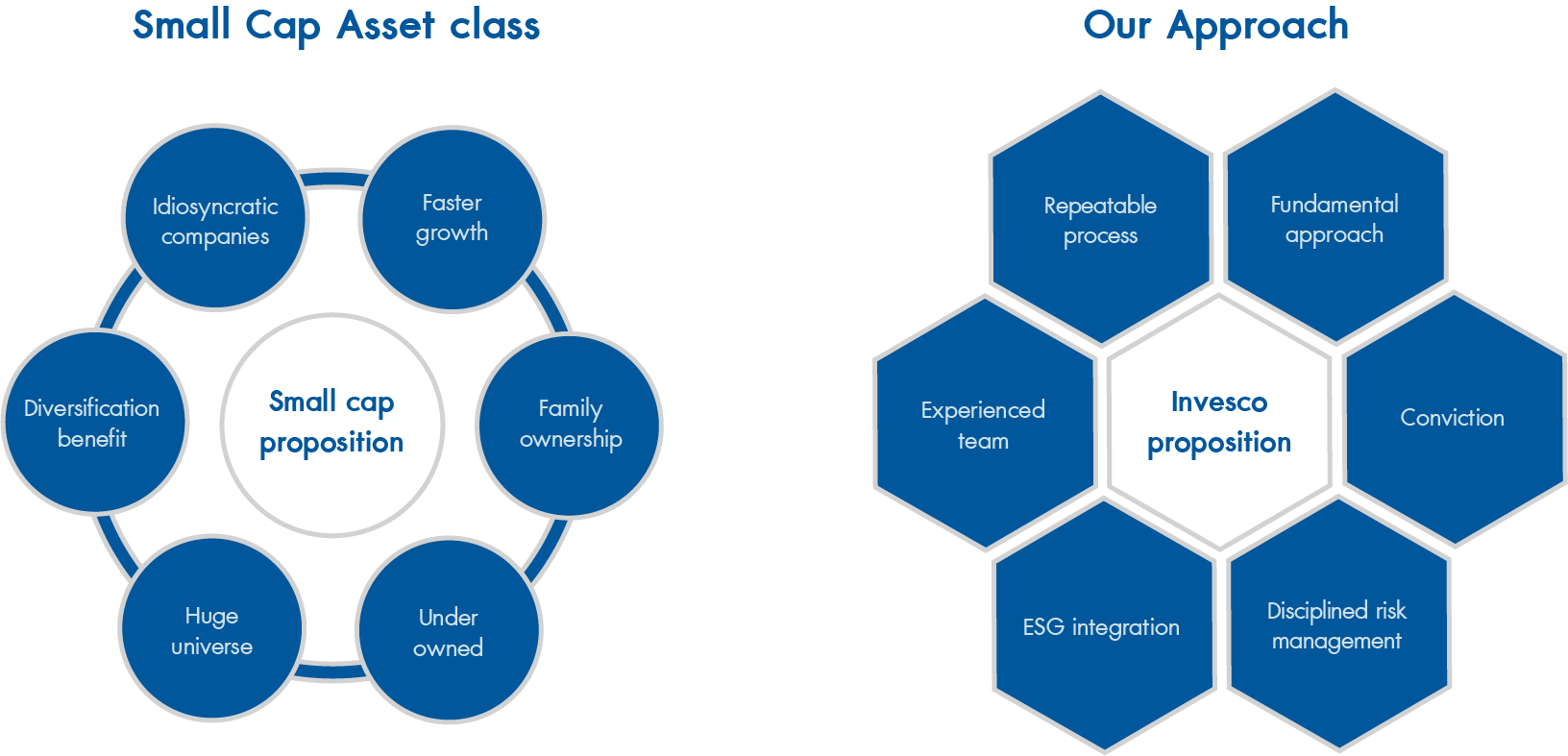

Fund Investment Strategy and Philosophy

Investment Philosophy, our investor DNA

We invest in European Smaller companies using a 3 pillar framework

Investment proposition

Combining the attributes of small and mid Caps with a

unique investment process

Our Mission is to build portfolios of European Small and Mid Caps that consistently

outperform their benchmarks on a 3-year rolling basis driven predominantly

by stock selection rather than factor risks

Reason To Invest

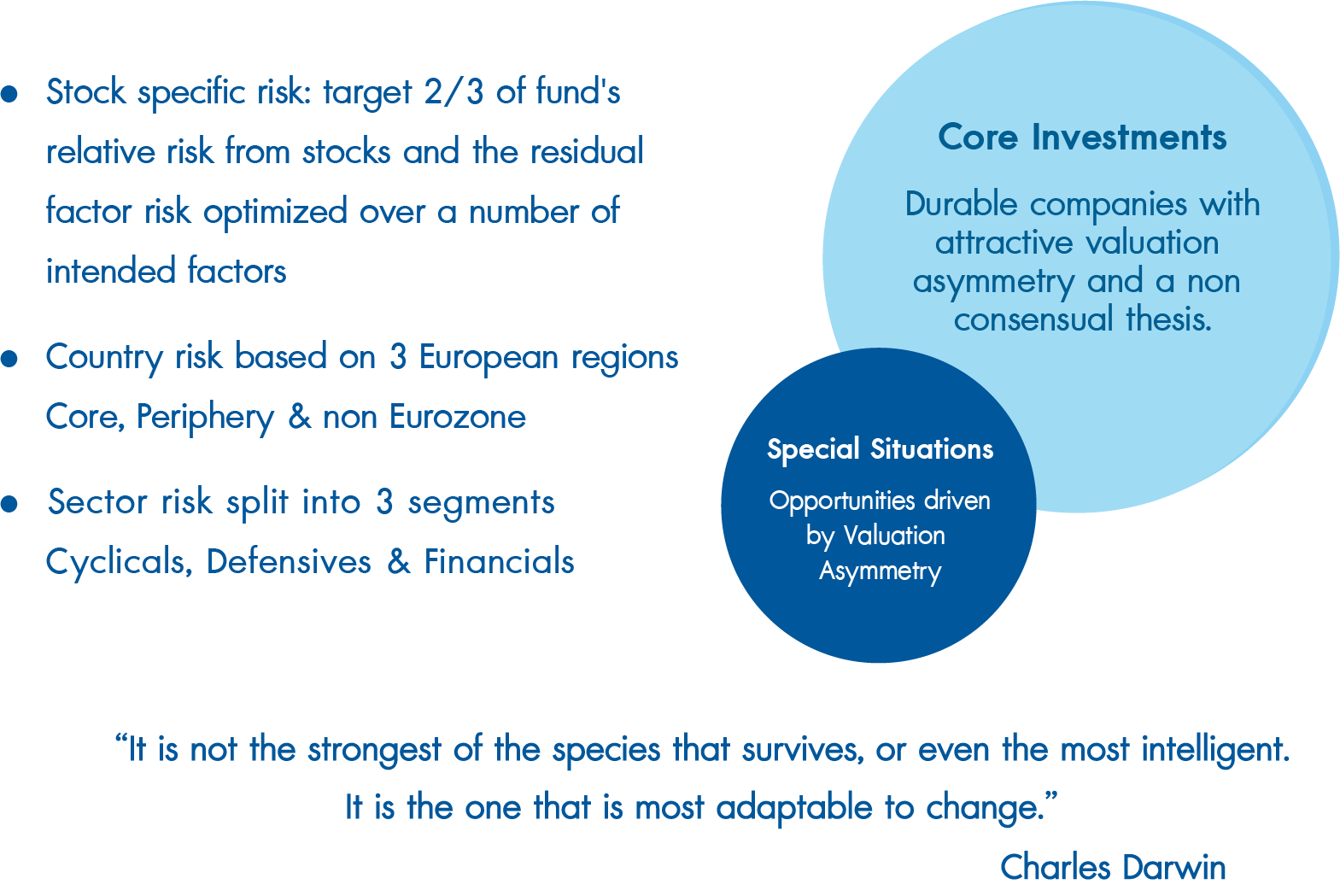

- The stocks we buy : Durable companies where we have a non-consensual thesis leading to valuation asymmetry on a 3 year view

- The portfolios we build : High conviction, focus on stock specific risk while avoiding unwanted factor exposure

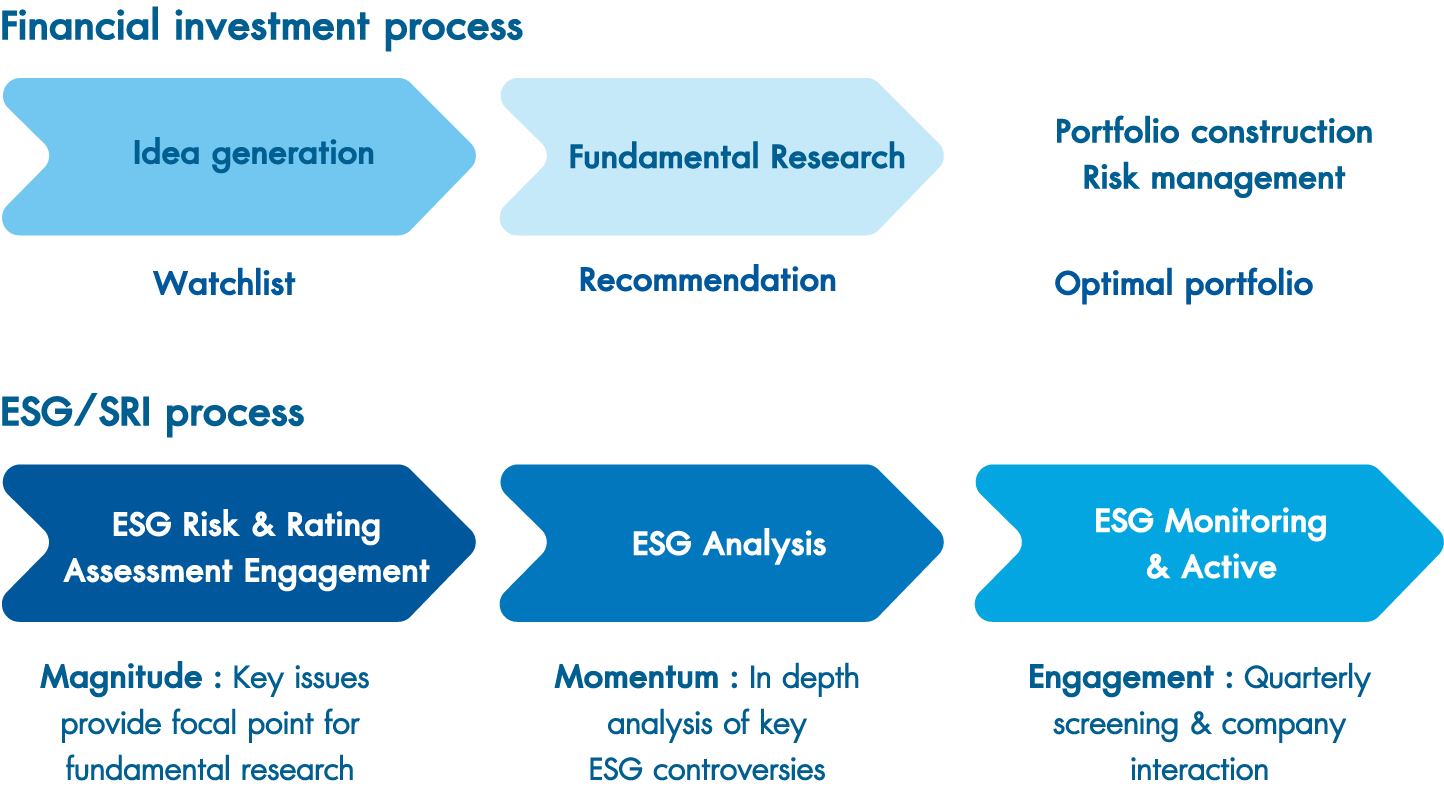

We aim to build portfolios of European Small and Mid Caps that consistently outperform their benchmarks on a 3-year rolling basis, driven predominantly by stock selection rather than factor risks.

- Genuine, long-term active fund management with a good long-term record of market-beating returns*

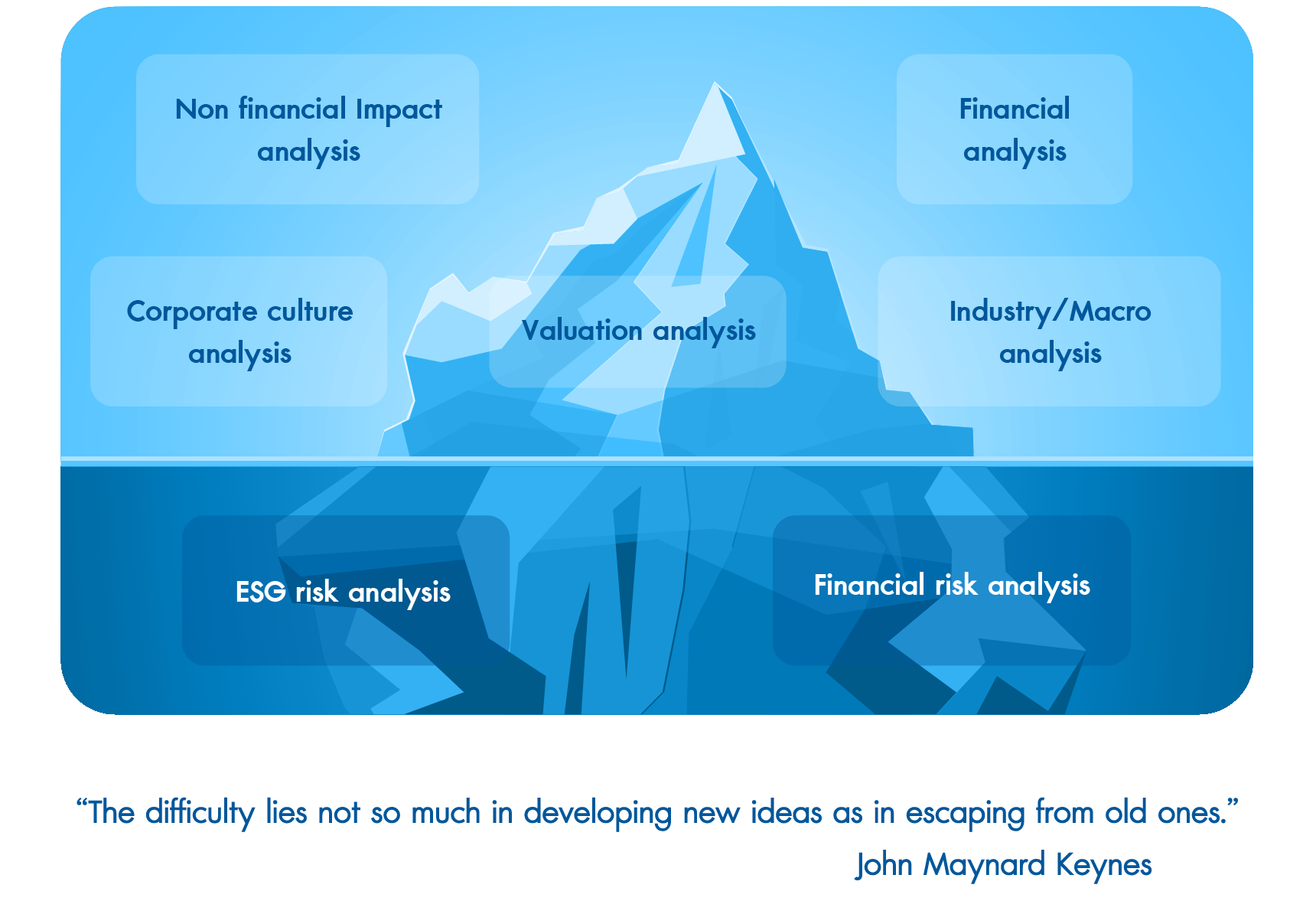

- Robust investment approach with a strong focus on fundamental valuation

- Caring about what we pay for stocks has tended to give the fund a marked value tilt in recent years, BUT…

- …be open-minded: valuation anomalies may come in any sector

- “Bottom up” stock picking hand in hand with “top down” analysis: to do well in Europe, you need to do both

- Smaller companies are less well covered by sell side analysts

- Smaller companies require more in-house research by fund managers

- The result is a less efficient market with more alpha opportunities

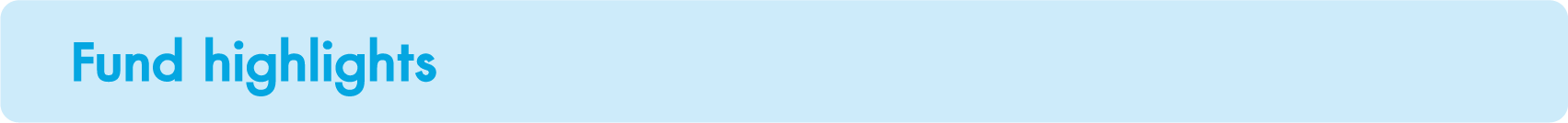

Leveraging Regional Knowledge to build consistent portfolios

Digitalisation : “We have to push for investment and reform –and we have to strengthen our economies by focusing on our common priorities, like the European Green Deal, digitalisationand resilience,” –Von der Leyen,14th May 2020

Green Infrastructure investment : “The European Green Deal as the EU's recovery strategy: A massive renovation wave of our buildings and infrastructure and a more circular economy, bringing local jobs”

Innovation : “Executive Vice-President, Margrethe Vestager, said: “The coronavirus crisis has demonstrated how crucial it is for citizens and businesses to be connected and to be able to interact with each other online.”

Sustainability and Taxonomy : Sustainability matters in Small and Mid Caps. European taxonomy policies are aimed to reduce the cost of equity for cleanest technology and encourage change

Investing in a greener and smarter future

- Semiconductors : The end of Moore’s law and strong growing end markets (besides PC and Smart phones now also 5G, Automotive, IOT) drives a reduction in cyclicality of the sector and a need for innovation in new materials and new packaging methods

- The digitalization of Corporate Europe : Smaller companies in Europe have been slow to transform theirbusinesses, Covid-19 hasbeen a wake-up call for many SME’s andSmaller corporates

- Health-Tech : Although the overall healthcare system performed well in Europe during Covid-19, European policy makers recognize the increasing importance of accurate data and efficient healthcare delivery systems

- “Europe First” in Tech? : Has Europe come to the conclusion that it cannot rely on US or Chinese tech providers for strategically important data and processes?

- Digitalisation, umbrella for multiple investable themes : Unlike in the US and China, European tech is largely a small cap affair

Green Infrastructure Investment

The EU Green deal is a true game changer

Climate change and environmental investment at never seen before scale :

"Climate change is an existential threat to Europe and the world”. To overcome these challenges, Europe needs a new growth strategy that transforms the Union into a modern, resource-efficient and competitive economy where there are no net emissions of greenhouse gases by 2050.

- Power - clean, affordable and secure energy: Renewables costs have fallen :

dramatically, having crossed over with thermal in many countries and are expected to fall further. Wind, solar, utility scale batteries and green hydrogen as solutions.

- Transportation - accelerating the shift to sustainable & smart mobility: shift to low :

carbon fuel sources (e.g., electric vehicles, hydrogen fuel cells)

- Infrastructure – building and renovating in an energy and resource efficient way :

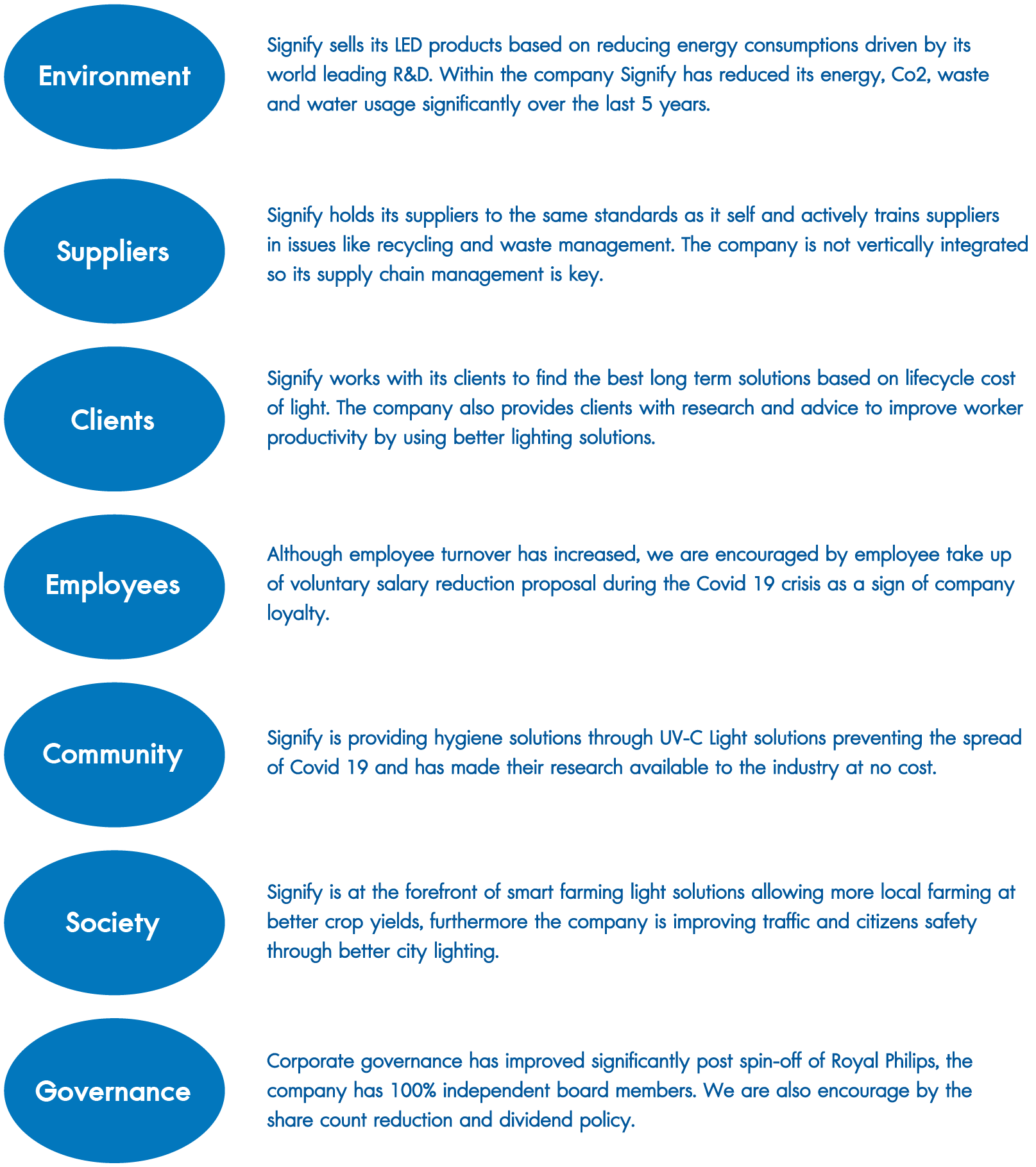

Switch to low-carbon heating/cooling systems (e.g., solar thermal, hydrogen) and improve lighting and appliance resource efficiency

Data as of 31/08/20

The enablers have been put in place many years ago, now it is time for Europe's entrepreneurs to deliver the next wave of world leading companies

- More than just Tech and Green Tech : We see innovation in Europe driving growth in many areas like Healthcare, Industry, Infrastructure and areas like food

- IPO activity is increasing : We are seeing a sharp pick up in IPO activity driven by smaller fast-growing companies in a wide variety of sectors

- The enablers that were put in place many years ago are finally showing results : Europe's strong educational institutions, large industrial base and supportive government infrastructure which had been put to work post Financial Crisis are starting to deliver results

Invesco

Invesco was established in 1935 and today operates in more than 25 countries. The firm is currently listed on the New York Stock Exchange under the symbol IVZ. Having been in the region since 1962, Invesco is one of the most experienced investment firms in Asia Pacific. 13+ offices across 8 markets in Asia Pacific

Invesco, data as of 31 Dec, 2020

Invesco, data as of 31 Dec, 2020

Key highlights of our Asia Pacific business include :

- 50 years of experience investing in Asia Pacific, with 165 investment professionals.

- A pioneer investor in Chinese Equities, with around 25 years of experience in managing offshore Chinese Equities and over 10 years in managing onshore Chinese equities (under the QFII scheme).

- An early mover, started in Hong Kong in the 70’s and the first Sino-America fund management company in 2003 in China.

- One of the first few global asset managers that established a wholly-foreign owned enterprise in China to conduct investment management business.

- Two important joint ventures, partnering with China Huaneng Group, in China :

- Invesco Great Wall – formed to target domestic mutual funds market in China

- Huaneng Invesco WLR – targeting private equity market

- Significant presence in Japan since 1983.

- Expanding presence and capabilities in India with Invesco Asset Management (India) Private Limited^, one of the top 16# asset management companies in India, with an AUM of US$5.40 billion.

- Prominent presence in Australia, Singapore and South Korea.

Our goal is to deliver an investment experience

that helps people get more out of life.

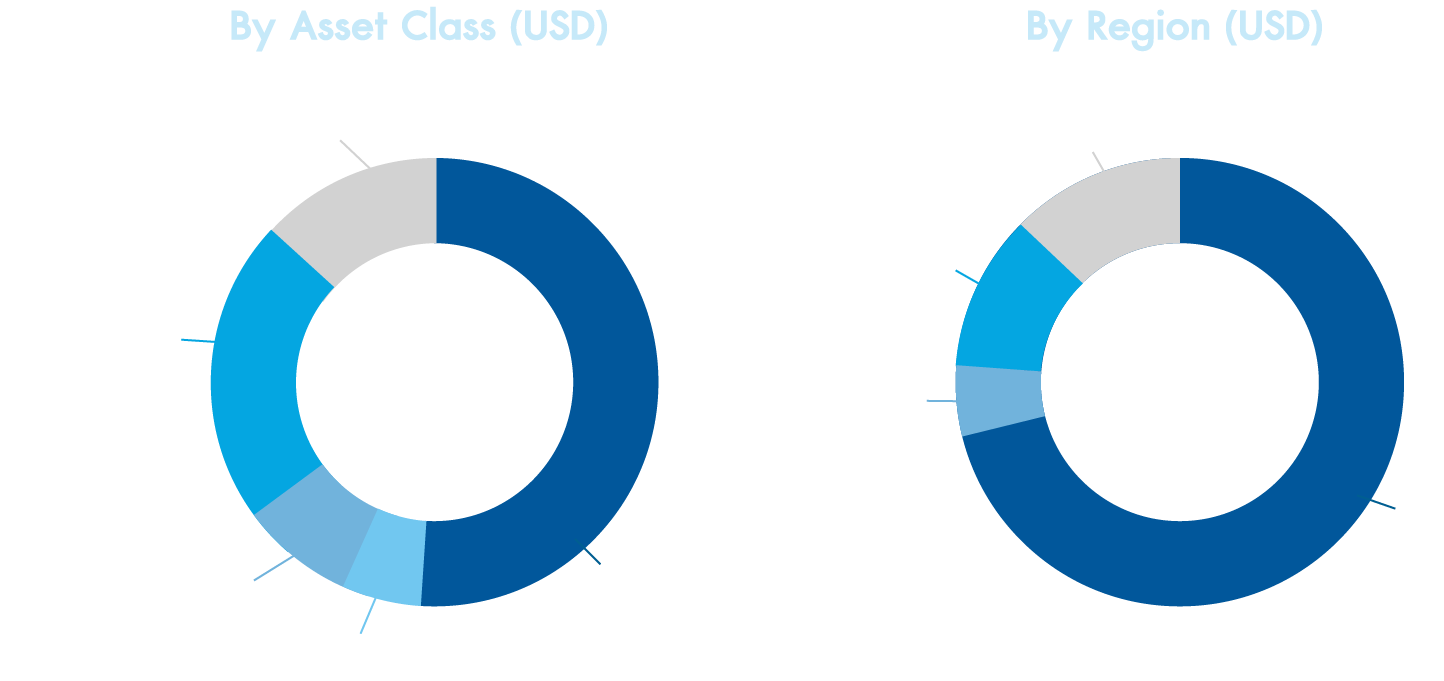

We manage US$ 1.3 trillion* of assets globally with an on-the-ground

presence in more than 25 markets.

Invesco, data as of 31 Dec, 2020

A unique blend of people, capabilities and scale

Invesco offers a multi-style, multi-product approach, allowing our clients to choose what they need and to diversify their investments. Investment strategies are tailored to the markets in which we operate, and our investment teams follow systematic, proven investment processes with a strong emphasis on risk control.

WORLDWIDE NETWORK

Access to a worldwide network of investment

professionals.

DIVERSIFICATION

Diversified offering of capabilities in virtually every asset

class and investment style.

COMMITMENT TO EXCELLENCE

An independent firm with an investment-centric,

client-focused culture

Why should you invest with us?

Having been in the region since 1962, Invesco is one of the most experienced investment firms in Asia Pacific. We have comprehensive geographical coverage with offices in Australia, China, Hong Kong, India, Japan, Singapore, South Korea, and Taiwan. In addition, Invesco has a presence in China via a joint-venture, Invesco Great Wall.

Structure of the KTAM European

Equity Fund (KT-EURO)

KTAM European Equity

Fund (KT-EURO)

Invesco Continental European

Small Cap Equity Fund

Europe ex UK

|

Fund Information |

|

|---|---|

|

KT-EURO |

Invests solely in the Invesco Continental European Small Cap Equity Fund (master fund),a retail fund, averaging at least 80% of NAV during the accounting year. |

|

Master Fund |

The master fund aims to achieve long-term capital growth by investing in small companies throughout Europe, but excluding the United Kingdom. The Investment Adviser will seek to meet this investment objective by investing primarily in listed equity and equity related securities of smaller companies in European markets (including warrants and convertible securities : however no more than 10% of the net asset value of the Fund may be invested in warrants). Europe includes countries in the European Union, Switzerland, Scandinavia, Bulgaria, Romania, Croatia, Turkey and the Commonwealth of Independent States. |

|

Fund Type |

Open-end Equity Fund, Feeder Fund |

|

Risk Level |

6 |

|

Master Fund |

Invesco Continental European Small Cap Equity Fund |

|

ISIN (Master Fund) |

LU1775962050 |

|

Management Company |

Invesco Management S.A. |

|

Currency (Master Fund) |

EUR |

For more information Click

Who is this fund suitable for?

- Investors who accept the risk from investing in securities in the type of unit trusts of foreign mutual funds, including foreign exchange rate risk.

- Investors who can accept the fluctuation of the share prices that the mutual fund invests in, which may increase or decrease lower than the investment value and cause loss.

- Those who can invest in the medium to long term and expect better long-term returns than investing in general debt securities.