Schroder International Selection

Fund Global Credit Income

KTAM Global Credit

Schroder ISF Global

Credit Income Master Fund

Open-end Fixed Fund

Blending the right mix for changing

investment climates

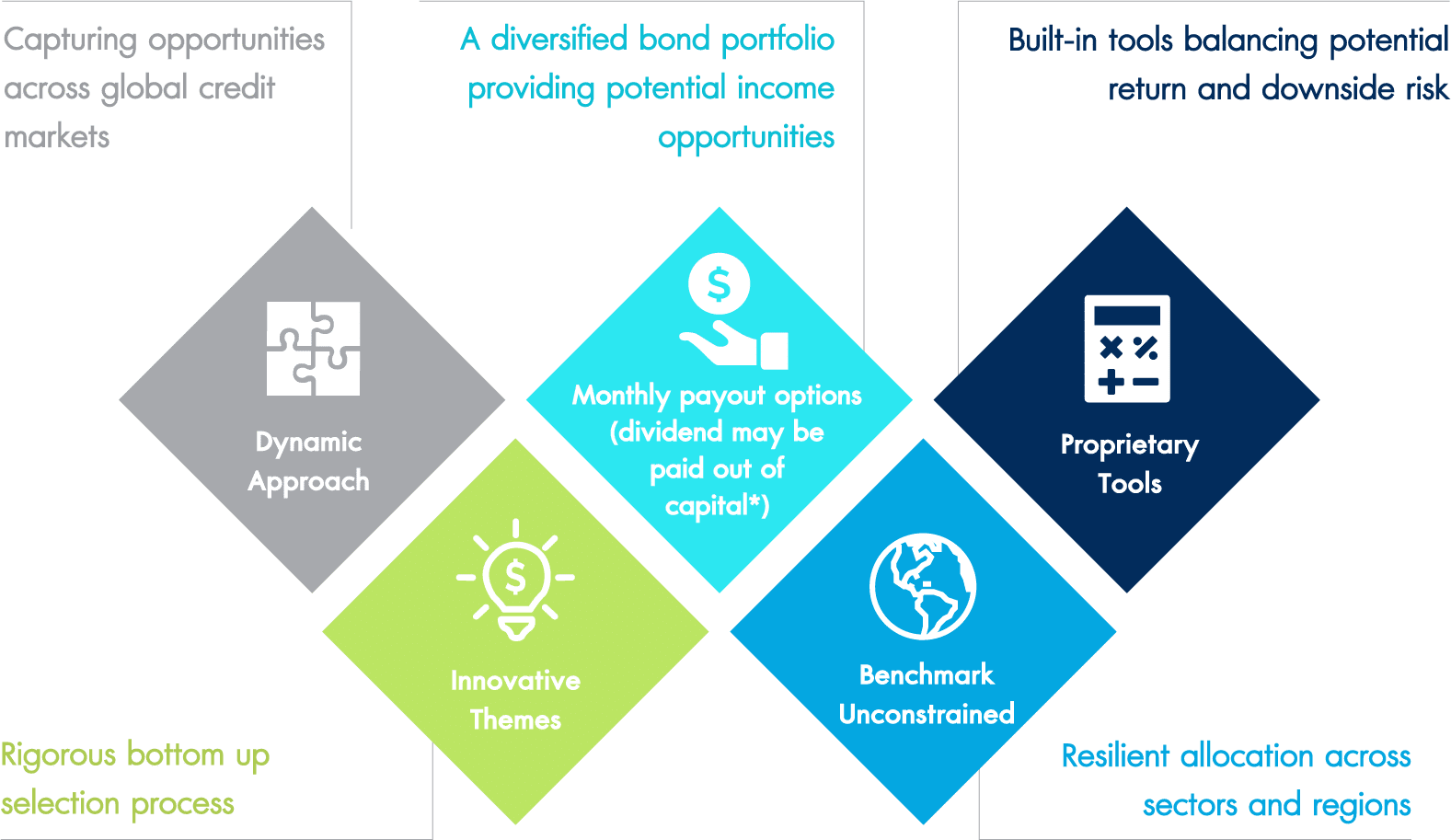

For investors who want consistent, attractive income with risk managed in the current environment of low yields and higher volatility. A dynamic, unconstrained approach to investing across the global credit spectrum is key to achieving these objectives.

Why global credit income

Key attributes of the fund

Think Income

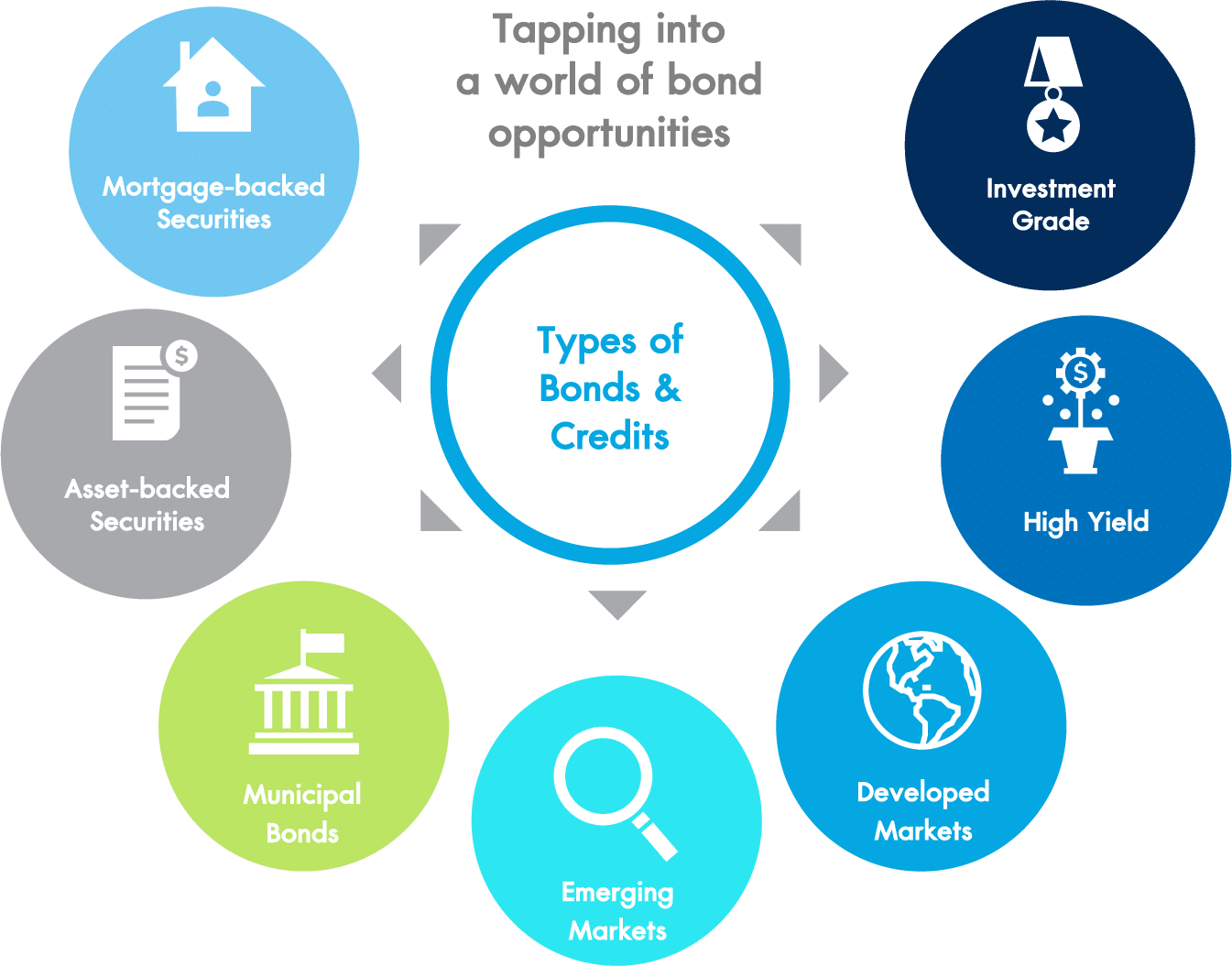

Flexibility in investing across a wide range of bonds and credits

Invest freely across the global bond spectrum.

The fund is managed with a benchmark unconstrained approach, we can invest across sectors and regions to capture attractive income opportunities and to help mitigating risk by diversification.

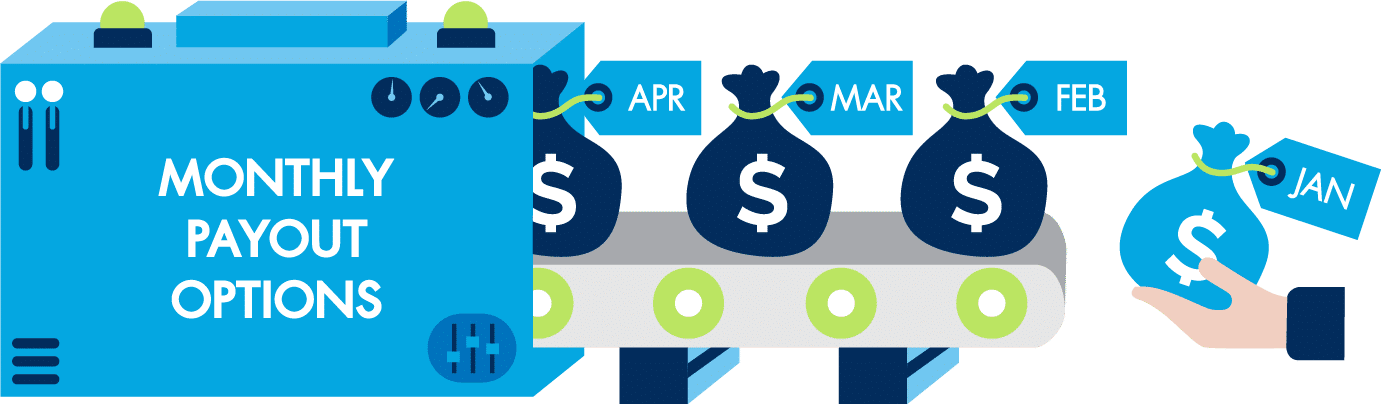

Providing monthly and fixed payout choices (dividend may be paid out of capital)

Remark* There are options for both quarterly and cumulative payments of return for KTAM Global Credit Income

Bonds are popular investments for income seekers. Interest rates will likely remain low in the near future, a portfolio composed of various types of bonds could enhance potential returns with a sensible balance of risks. The fund’s primary target is to maintain sustainable and attractive payment, and intends to make a fixed payout of 4.75% p.a. (Applicable to A Dis USD and HKD classes)

Remark* Data as of the end of 2020

Think Stability

Rigorous risk management to mitigate volatility

|

We recognize that income seekers can be more sensitive to capital loss. A well-diversified bond portfolio built under dynamic asset allocation allows the fund to reduce risk in market downturns. Detailed downside risk analysis as well as management on currency and interest rate risk are incorporated with an aim to help mitigating potential loss and volatility. |

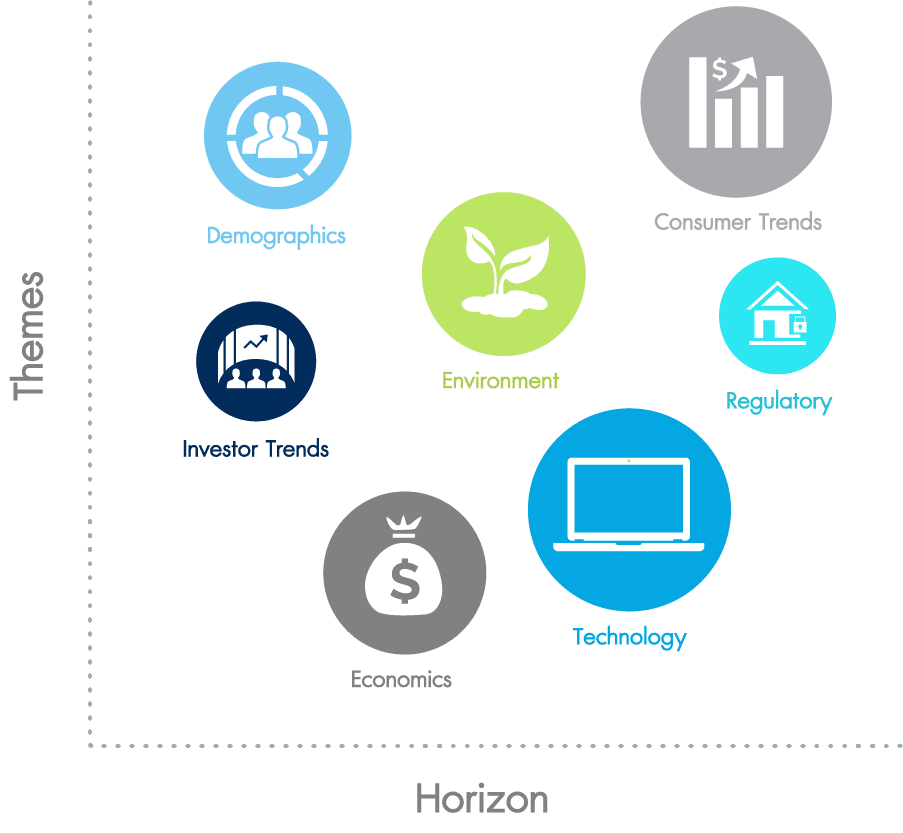

Think Innovation

Innovative themes-based approach

|

In our credit selection process, we apply forward-looking themes like technological disruption, changing demographics and consumer trends. This approach helps identifying companies that are adapting well to change. |

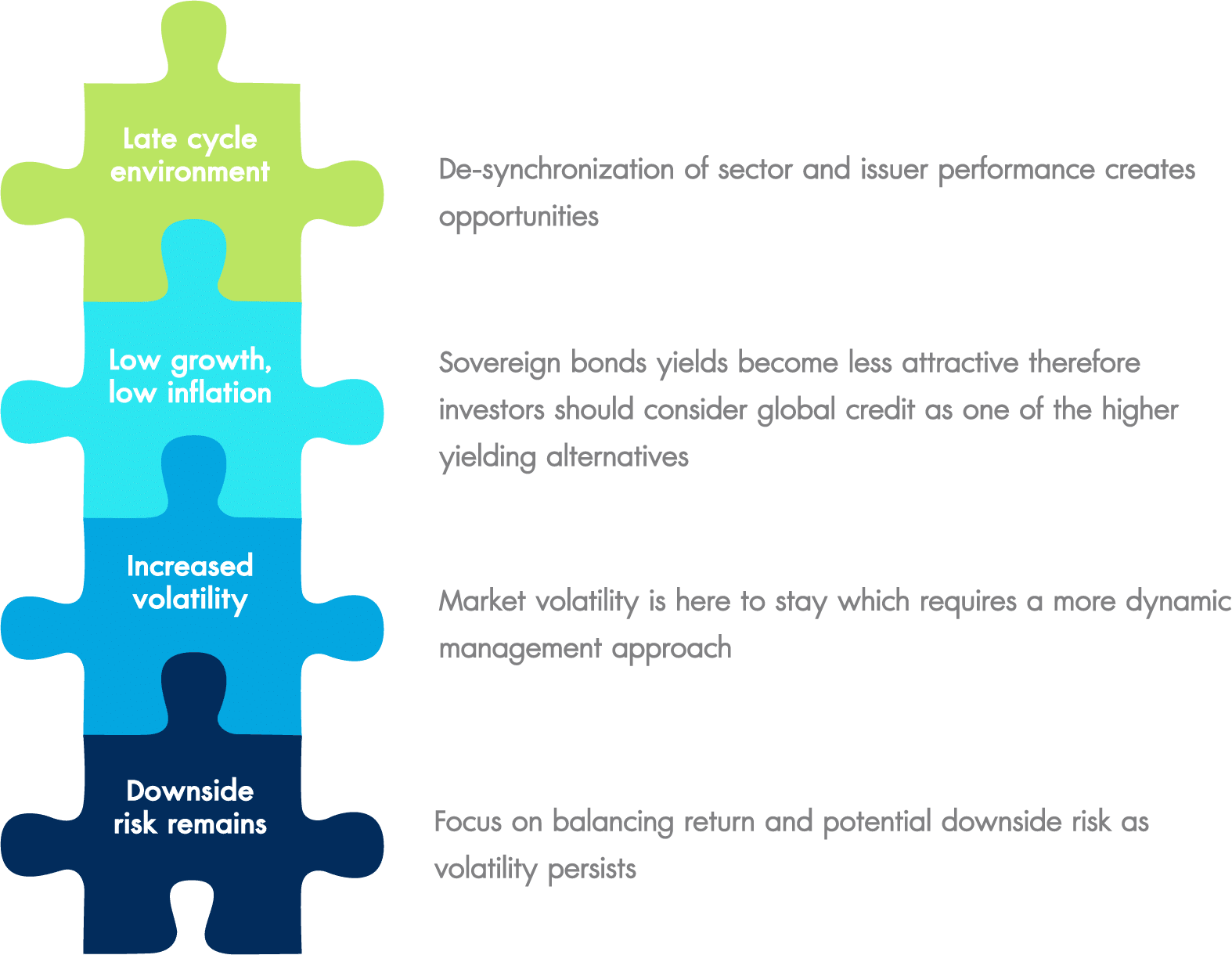

Global Credit Outlook

|

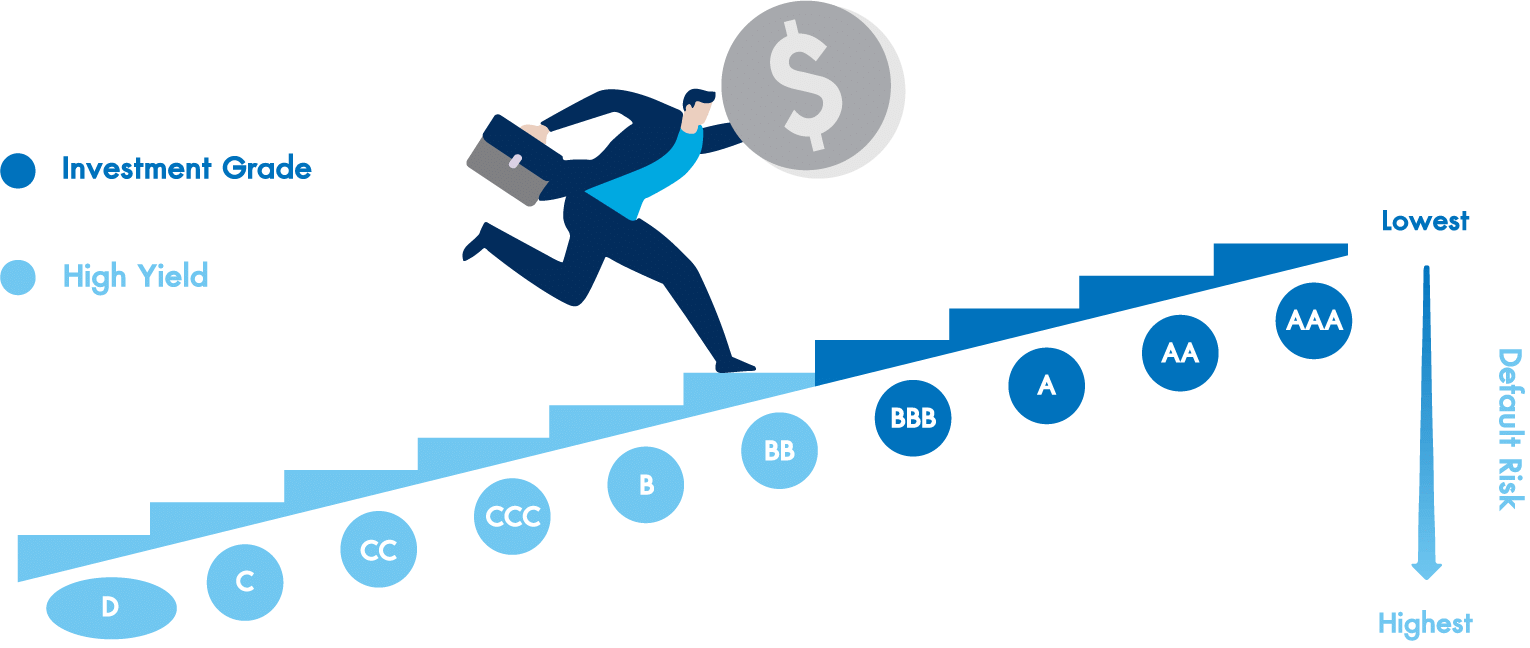

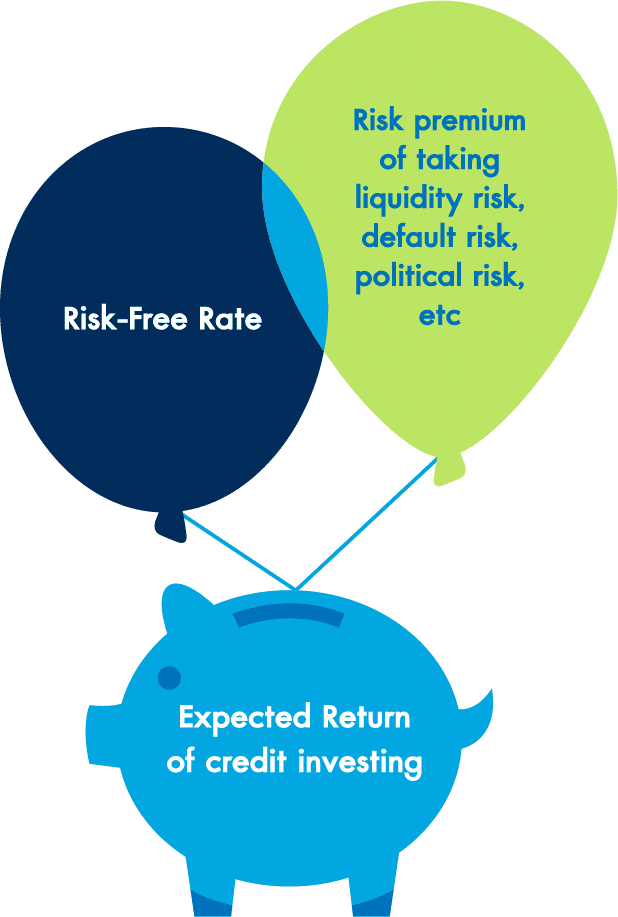

Low yields have pressured investors to pile into riskier debt to make up for the shortfall in prospective returns. However, grabbing this low hanging fruit may not be a sound investment strategy because it can expose investors to significant downside risks.

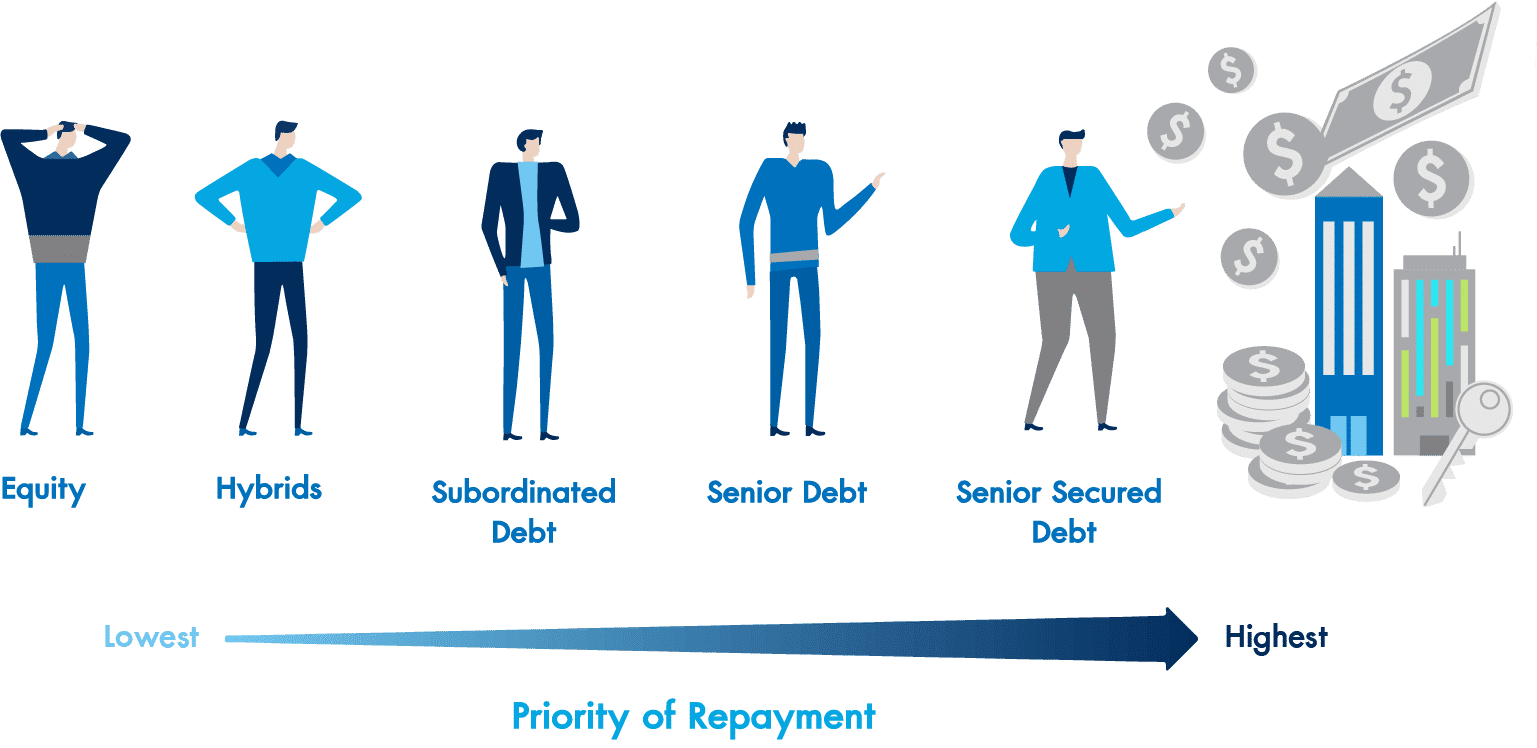

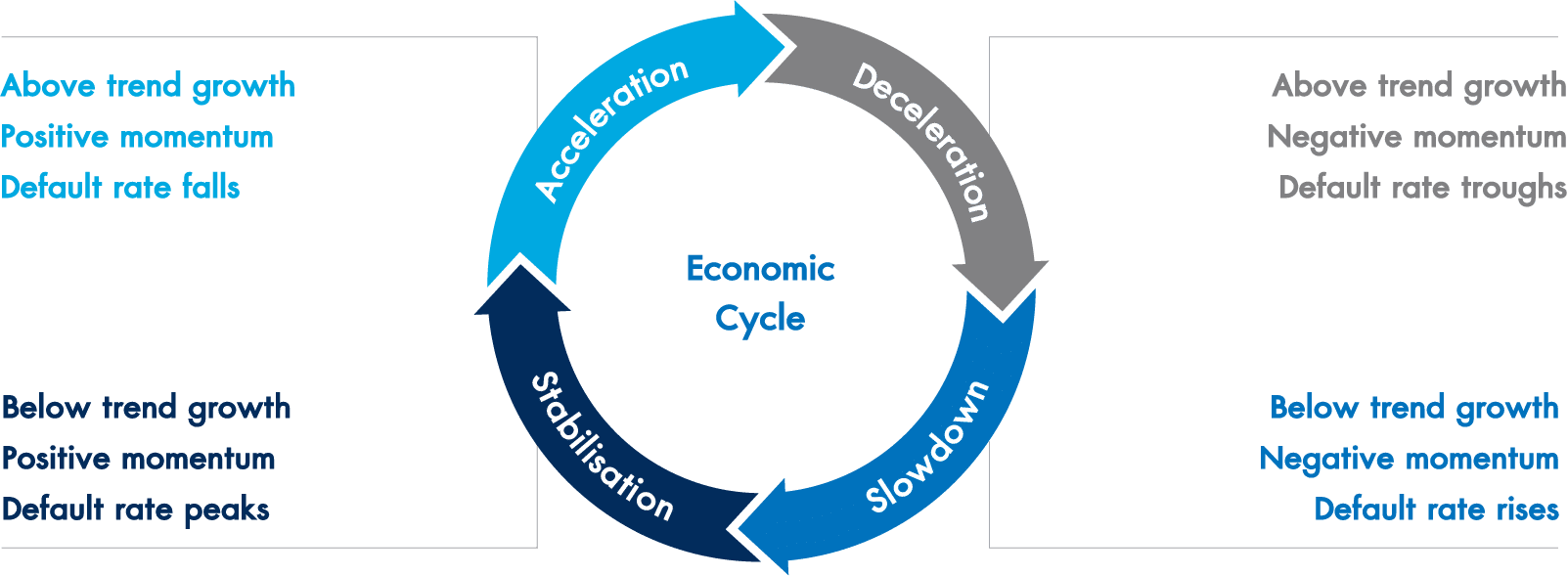

Throughout the economic cycle, returns across and within different segments of the credit universe can diverge significantly. Investors with the flexibility to shift their asset allocation and security selection over time can exploit this phenomenon, take full advantage of the diversity of credit markets, and to enhance portfolios returns while mitigating drawdowns. |

Infrastructure of KTAM Global

Credit Income Fund (Class A)

(KT-GCINCOME-A)

KTAM Global Credit

Income Fund

(KT-GCINCOME)

Schroder ISF Global

Credit Income Master Fund

Open-end Fixed Fund

|

Fund Information |

|

|---|---|

KT-GCINCOME |

Invests solely in the Schroder International Selection Fund Global CreditIncome Fund (master fund), averaging at least 80% of NAV during the financial year |

Master Fund |

The master fund aims to generate income and capital appreciation by investing at least two-thirds of its assets in fixed and floating rate investment grade and high yield securities issued by governments, government agencies, supra-nationals and companies worldwide, including emerging market countries |

|

Fund type |

Open-end Fixed Fund, Feeder Fund |

|

Risk Level |

5 |

|

Master Fund |

Schroder International Selection Fund - Global Credit Income |

|

ISIN (Master Fund) |

LU1514167219 |

|

Management |

Schroder Investment Management (Lux) |

|

Currency |

USD |

For more information Click

Who’s SCHRODERS

Schroders has a comprehensive range of investment capabilities to help you meet your financial needs. We manage funds and mandates for a broad range of clients including official institutions, sovereign wealth & pension funds, insurance companies, charities, high net worth individuals and retail investors.

Why Schroders for Global Credit?

The fund draws on Schroders’ global credit platform, in-depth credit research expertise and bespoke quantitative techniques in a highly diversified strategy. A fund designed for the market environment of tomorrow.

Who is this fund suitable for?

Investors who are willing to accept the risk of investing in a foreign fixed income fund,as well as foreign exchange risk exposure. The unitholder fully understands that thevalue of units may fluctuate but wants the opportunity to earn a satisfactory return by investing in a foreign master fund.