Key Attractions

KTAM Income and Growth Fund

Allianz Global Investors

Feeder Fund

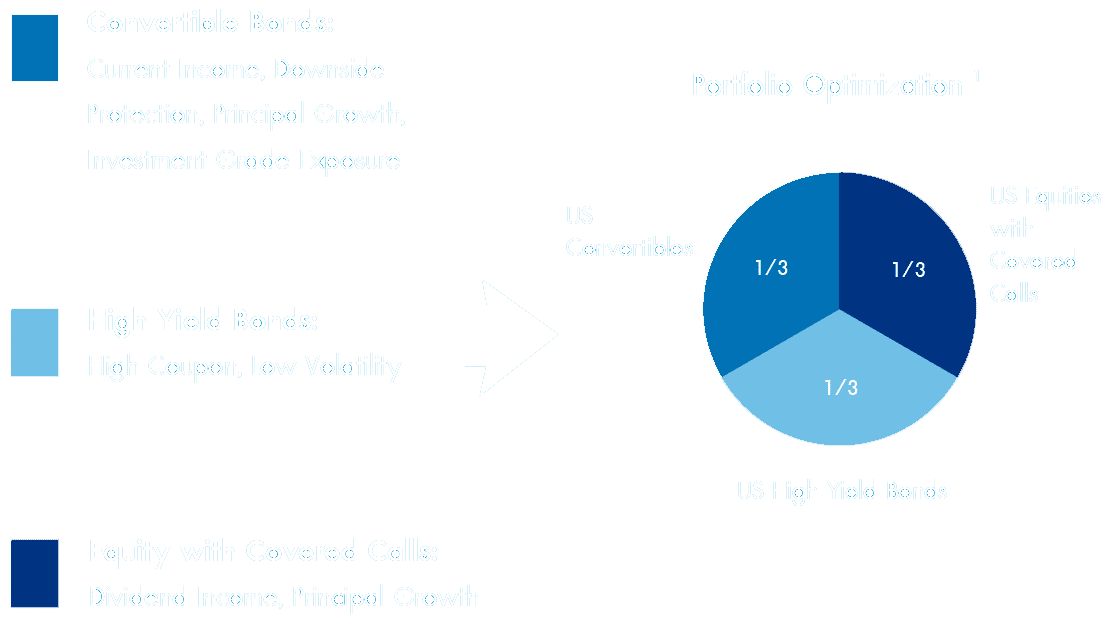

Portfolio Management: Focusing on total

return and diversification.

The target asset allocation is preliminary and subject to change. The actual asset allocation may vary materially and will depend on availability of assets and current market conditions.

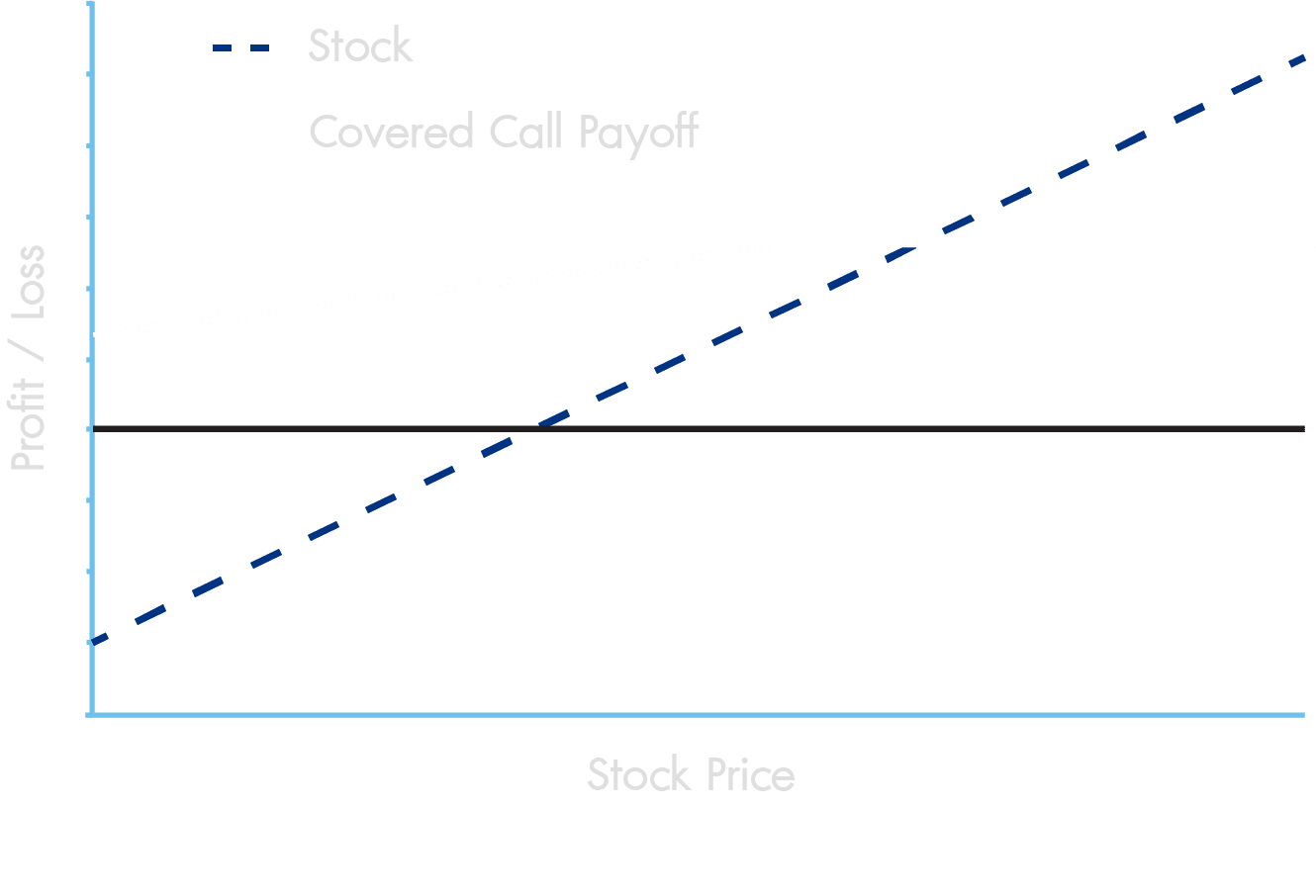

Covered Call Selling: Popular Income Generating and Risk Diversifying Strategy for Managers

Covered call selling generates upfront premium in exchange for committing

to sell stock at a strike price.

|

Best case: |

|

Keep stock and premium. |

|

Moderate case: |

|

Exit at strike plus premium. |

|

Bad case: |

|

Lose on stock holdings, premium |

A covered call option strategy may cause the Fund to forego any appreciation in the stock price above the option strike price. Also, the option strategy could cause the Fund to recognize larger amounts of net short term capital gains, which are taxable at the higher ordinary income tax rates.

Seven sources of income :

High-Yield Bond coupons

Convertible bond coupons

Equity dividends

Covered Call Option Premiums

Gains from the high-Yield sleeve

Gains from the convertible-Yield sleeve

Gains from the equity-Yield sleeve

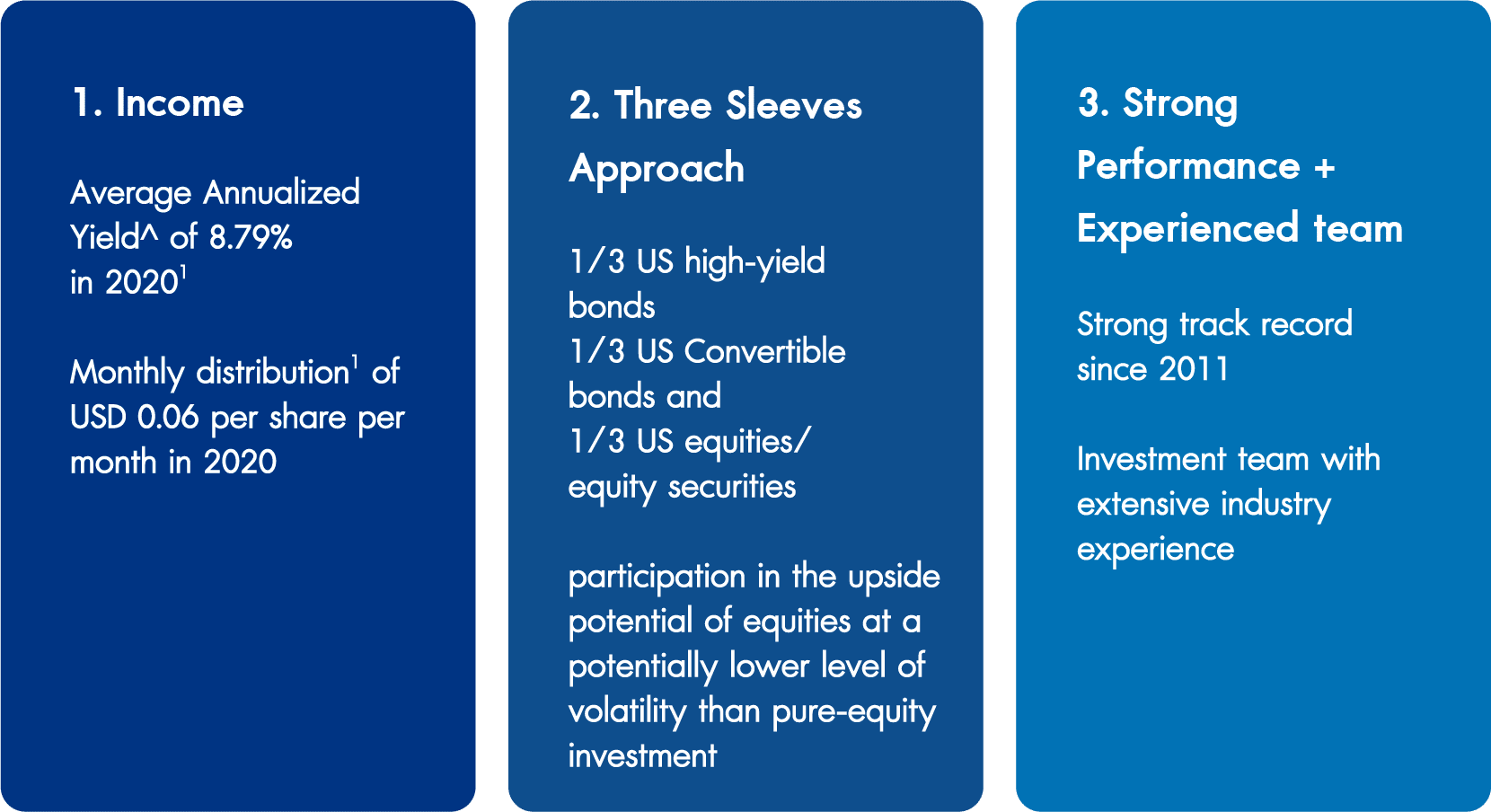

Reason To Invest

Market Insights

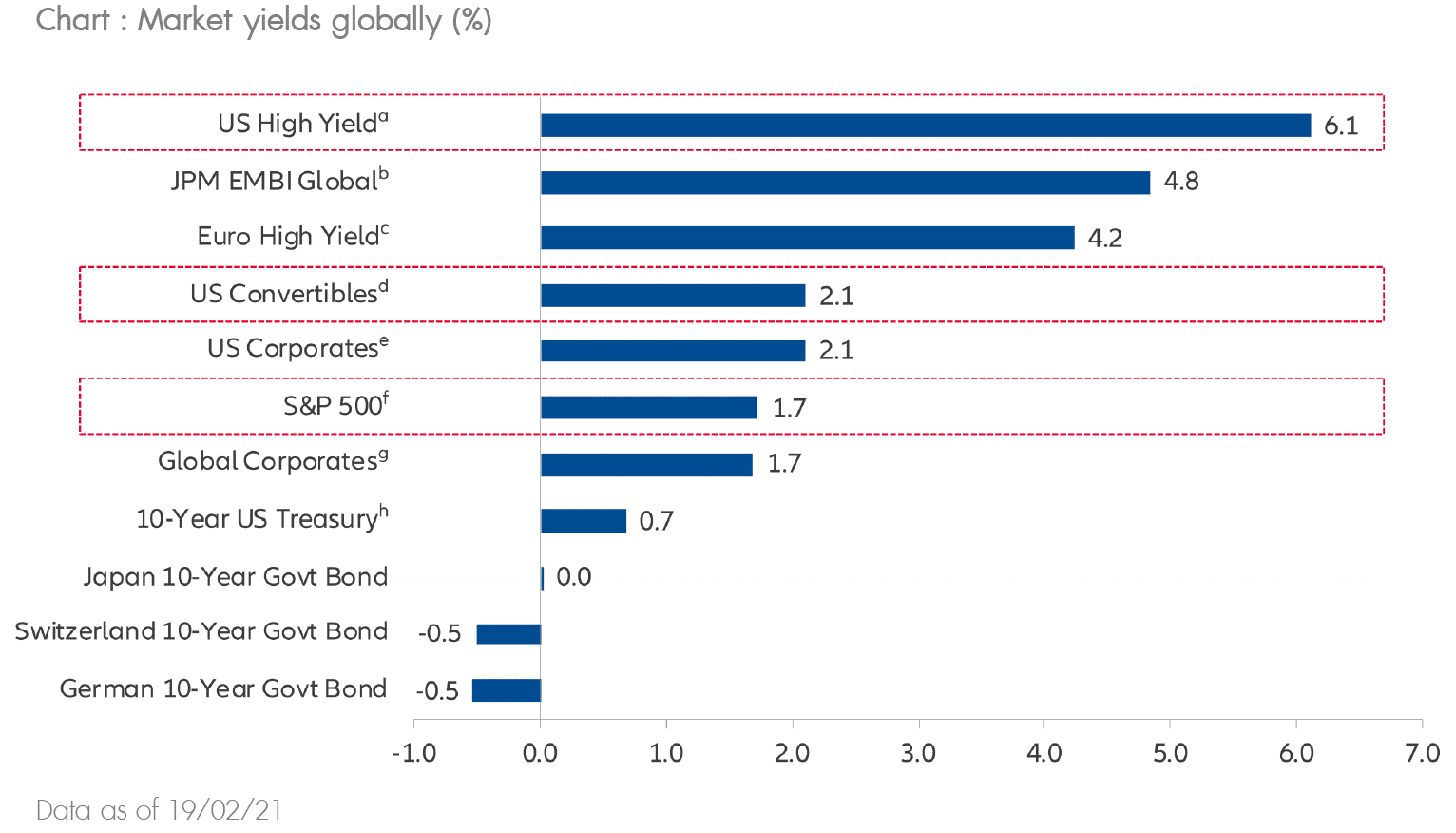

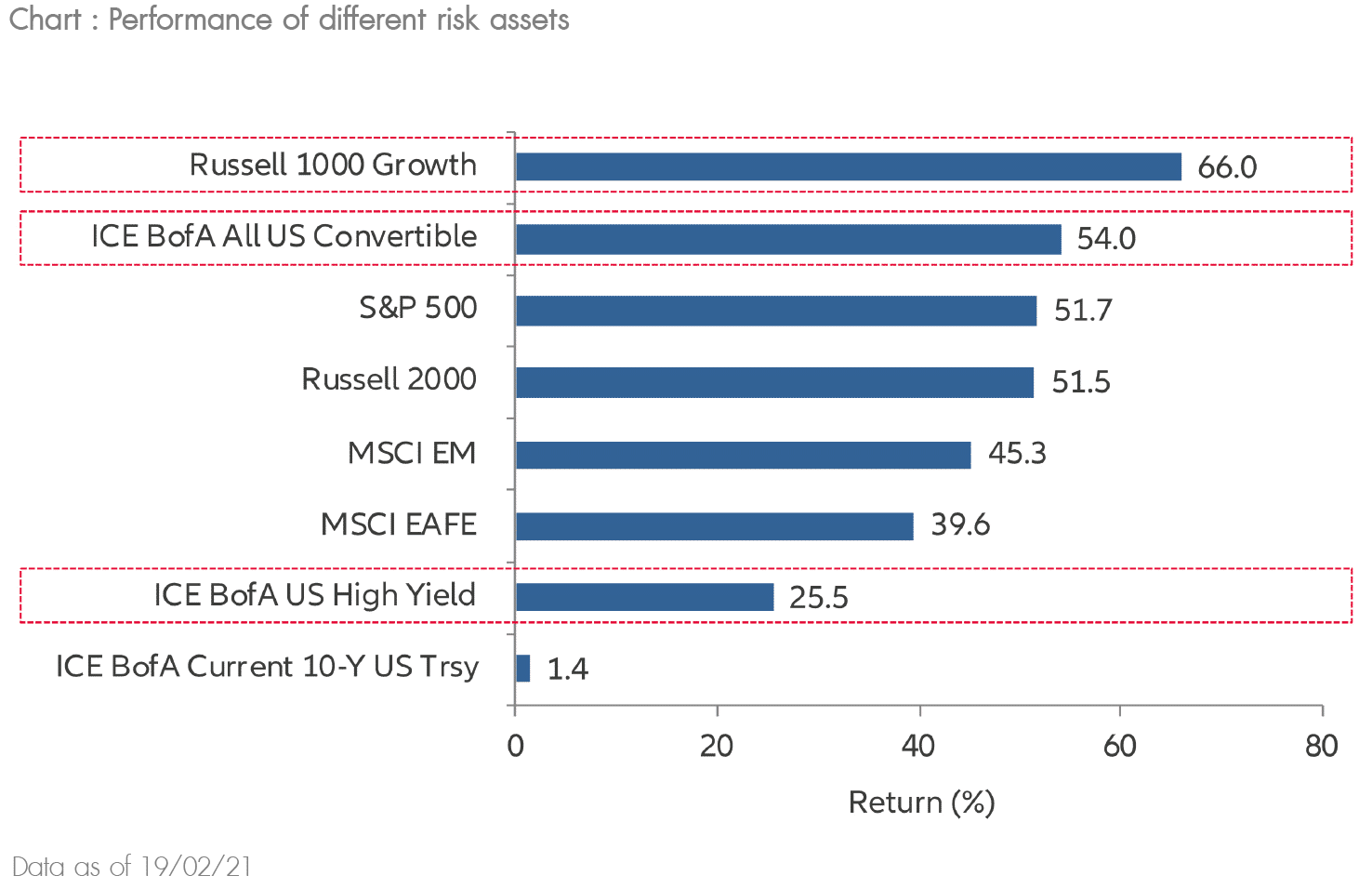

1. High Yield Bonds: One of the sources offering highest yield globally

- High yield bonds remain as one of the highest yielding fixed income alternatives. Compared to the depressed yields globally, US high yield remains an attractive asset class.

- US high yield bonds could potentially contribute from both a diversification and a relative performance perspective, offering a compelling yield opportunity compared to negative and depressed yields globally with lower interest-rate sensitivity.

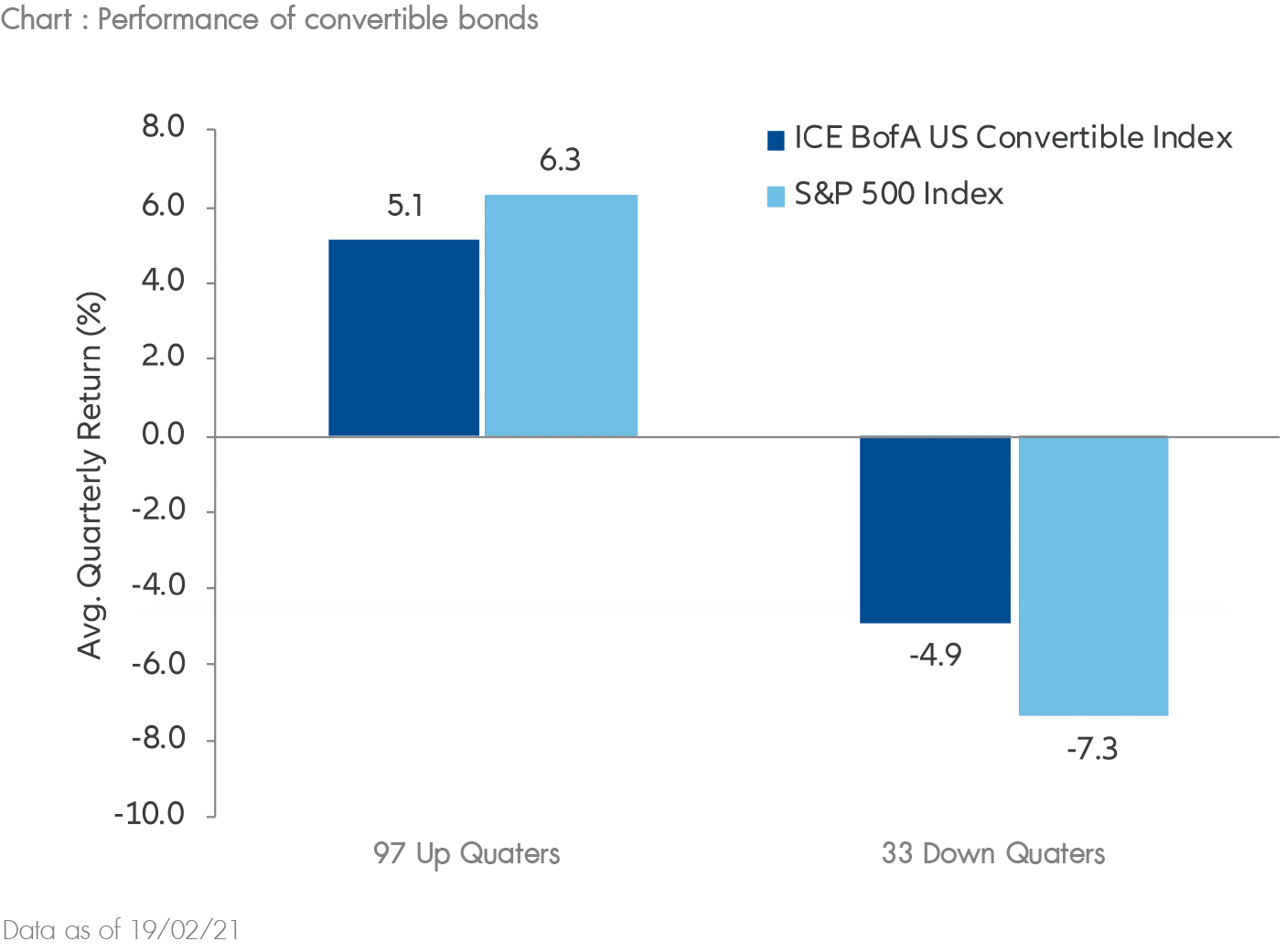

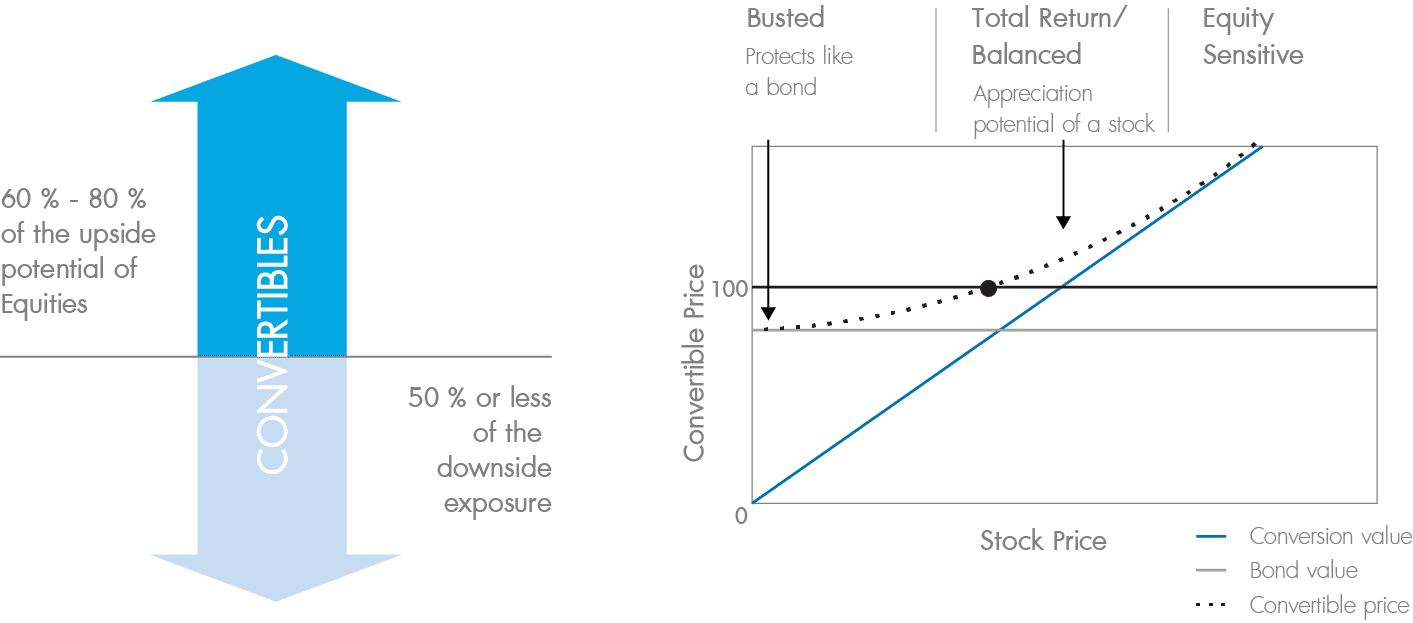

2. Convertible Bonds :

Potential for upside participation and cushioning volatility

- A convertible bond is a fixed-income debt security that yields interest payments, but can be converted into common stock at the holders’ option. Its debt and equity feature allows investors to participate in upside potential of the equity markets, while cushioning

against potential downside volatility.

- After the March sell-off, many convertible bonds have approached their bond floors, which means downside risk should be much more contained going forward. When the underlying equities recover, convertible bonds will be well-positioned to participate in the upside.

Total return convertibles aim to participate in the upside potential of the equity market, while limiting exposure to downside volatility.

Hypothetical example-not representative of any specific convertible. Convertibles involve the risk factors of both stocks and bonds. They fluctuate in value with the price changes of the underlying stock. If interest rates on the bonds rise, the value of the corresponding convertible will fall. Funds that invest in convertibles may have to convert the securities before they would otherwise, which may have an adverse effect on the Fund’s ability to achieve its investment objective. Source: Allianz Global Investors. Data as at 31/6/2016

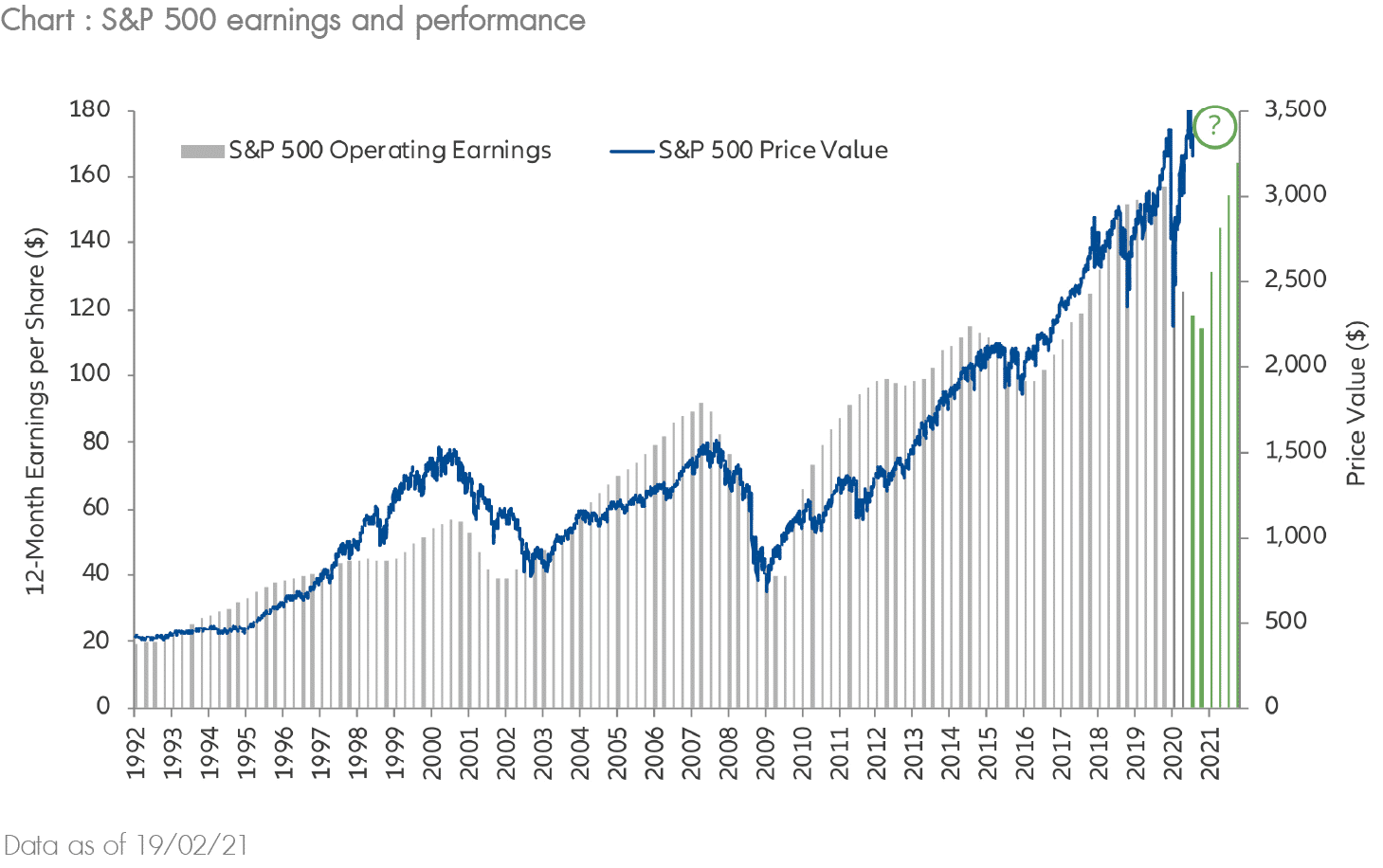

3. Equities : Earnings may have troughed

- After bottoming in 2020, we expect corporate profits to potentially reaccelerate in 2021.

- US companies are well positioned to directly benefit from the Federal Reserve's programs and US government fiscal support. Looking forward, positive fundamental and economic change at the margin could provide support for US equities.

Fund Features

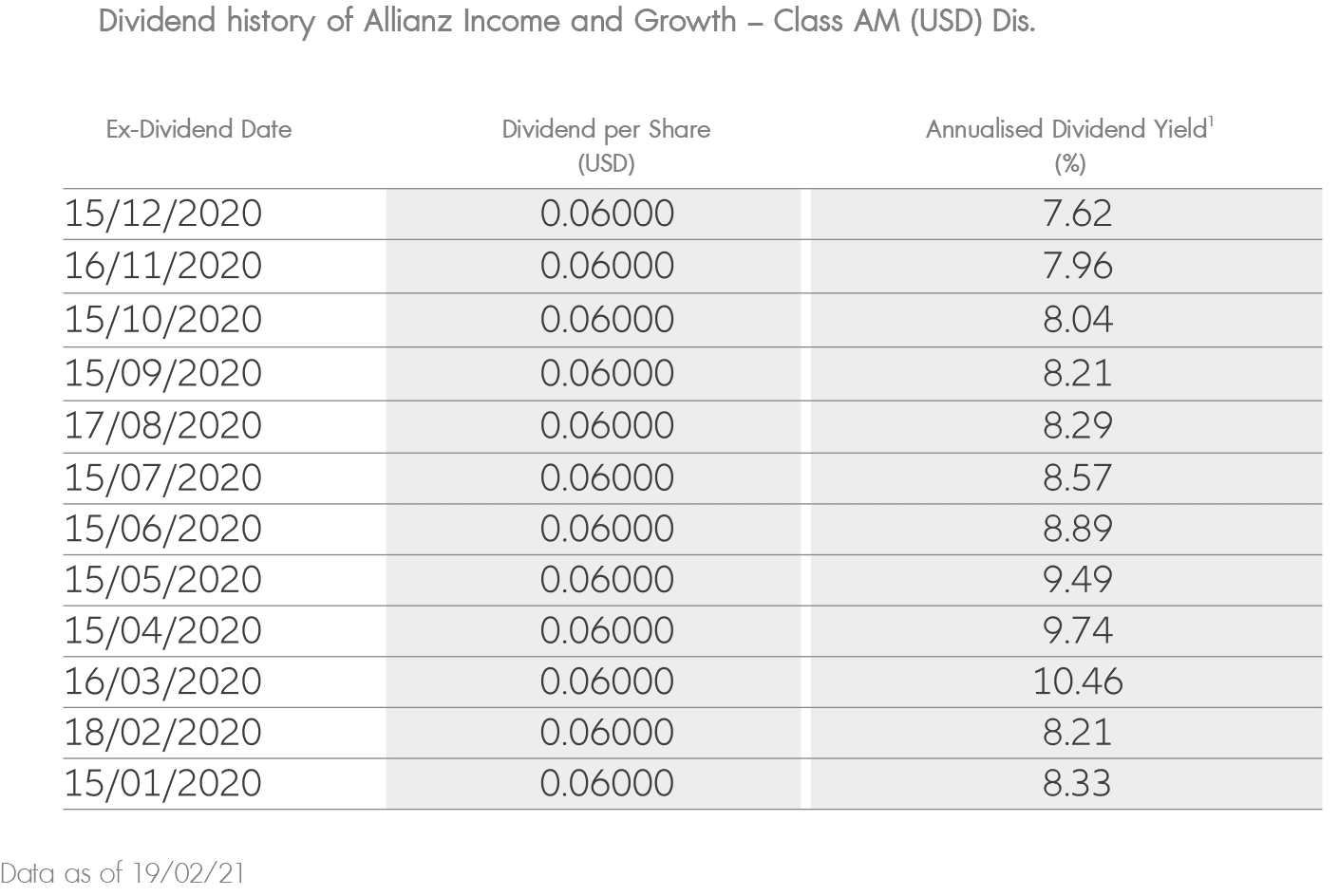

1. Potential income opportunities available

- The Fund’s AM share classes aim to pay monthly dividend (yields are not guaranteed, dividend may be paid out from capital).

Note : It helps investors to capture potential source of income.

- Since the inception of the Fund (Class AM (USD) Dis.) in October 2012 to end of January

2021, it has achieved a historical average annualized dividend yield of approximate 8%.

Note : i Monthly dividend may comprise of both income and/or realized gains and will vary depending on market conditions.

2. Exposure to income and growth potential

- The chart demonstrates an example of an investment of USD 10,000 in Allianz Income and Growth – Class AM (USD) Dis., which grew 107.41% since launch (16 October 2012) till 31 January 2021, with dividend re-invested.

3. Position for investment opportunities

- The Fund’s structure seeks to participate potential income and capital appreciation while helping to moderate downside risk.

- US economic growth in 2020 rode on the back of continued and unprecedented monetary policy and fiscal stimulus. Improving economic data and vaccine hopes may have helped offset geopolitical tensions and surging virus cases.

Allianz Global

Investors

Allianz Global Investors

Allianz Global Investors works for many clients around the world. From pension funds, large and small, to blue-chip multinationals, from charitable foundations to families, individuals and their advisers. We have created a business that enables us to meet the demands of our clients on a local basis and that empowers our investment managers to focus on achieving strong and consistent investment results.

25 Locations worldwide

€582 bn Aessets under management

760+ Investment professionals

630+ Relationship managers

Our investment thinking is rooted in our purpose: to help our clients achieve their investment goals.

Across all our investment strategies, there is a common belief that insightfulness and understanding will give us an advantage. We address the challenges our clients face with forward-thinking strategies and customized solutions.

Why invest in Allianz Income and Growth ("the Fund”)?

- The US risk assets extended gains in Q3, supported by better-than-feared corporate earnings, accommodative monetary policy and progress with a COVID-19 vaccine and treatment.

- Economic reports surprised to the upside. Q3 growth estimates were revised higher, unemployment numbers declined, most housing-related statistics exceeded expectations and consumer confidence topped projections.^ Against this backdrop, US election

uncertainty, the lack of a new fiscal package and rising European virus cases could trigger market volatility.

- The Fund adopts a "three-sleeves” approach, with the core holdings invested primarily in a portfolio consisting of 1/3 US high-yield bonds, 1/3 US convertible bonds and 1/3 US equities/equity securities. It aims to capture multiple sources of potential income

and includes participation in the upside potential of equities at a potentially lower level of volatility than pure-equity investment.

Structure of the KTAM

Income and Growth Fund

(Class A) (KT-IGF-A)

KTAM Income and Growth Fund

(Class A) (KT-IGF-A)

Allianz Global Investors

Feeder Fund

|

Fund Infomation |

|

|---|---|

KT-IGF |

The fund's main investment, average of at least 80% of NAV in each accounting year, shall solely consist of retail fund Allianz Income and Growth (Master Fund) |

Master fund |

The investment policy is geared towards generating long term capital appreciation and income by investing in 3 asset classes (listed in the US): common stocks and other equity-related securities, fixed income securities, and convertible securities. The allocation of the master fund’s investments across asset classes will vary substantially from time to time based on the Investment Managers’ assessment of economic conditions and market factors, including equity price levels, interest rate levels and their anticipated direction. |

|

Fund Type |

Open-end Mixed Fund, Feeder Fund |

|

Risk Level |

5 |

|

Master Fund |

Allianz Income and Growth |

|

ISIN (Master Fund) |

LU0820561818 |

|

Asset Management Company |

Allianz Global Investors Limited |

|

Currency |

USD |

For more information Click

- The Fund aims at long-term capital growth and income by investing in US and/or Canadian corporate debt securities and equities.

- The Fund is exposed to significant risks of investment/general market, company-specific, creditworthiness/credit rating/downgrading, default, currency, valuation, asset allocation, country and region, emerging market, interest rate, and the adverse impact on RMB share classes due to currency depreciation. The Fund's investments focus on US and Canada which may increase concentration risk.

- The Fund is also exposed to risks relating to securities lending transactions, repurchase agreements and reverse repurchase agreements.

- The Fund may invest in high-yield (non-investment grade and unrated) investments and convertible bonds which may subject to higher risks, such as volatility, loss of principal and interest, creditworthiness and downgrading, default, interest rate, general market and liquidity risks and therefore may adversely impact the net asset value of the Fund. Convertibles will be exposed to prepayment risk, equity movement and greater volatility than straight bond investments.

- The Fund may invest in financial derivative instruments ("FDI") which may expose to higher leverage, counterparty, liquidity, valuation, volatility, market and over the counter transaction risks. The Fund's net derivative exposure may be up to 50% of the Fund's net asset value.

- This investment may involve risks that could result in loss of part or entire amount of investors' investment.

- In making investment decisions, investors should not rely solely on this material.

Who is this fund suitable for?

It is suitable for investors who accept risk from investing in foreign mutual fund unit trusts and various securities as well as foreign exchange rate risk. Moreover, it is suitable for non-individual investors and/or high-net-worth individuals with potential for self-care that can accept a higher investment risk than funds offered for sale to general investors.