Key Attractions

KTAM World Technology

Allianz Global Investors

Feeder Fund

Artificial Intelligence – invest in the future

Shouldn’t you invest in Artificial Intelligence today?

Embracing the power of artificial intelligence

Market Insights

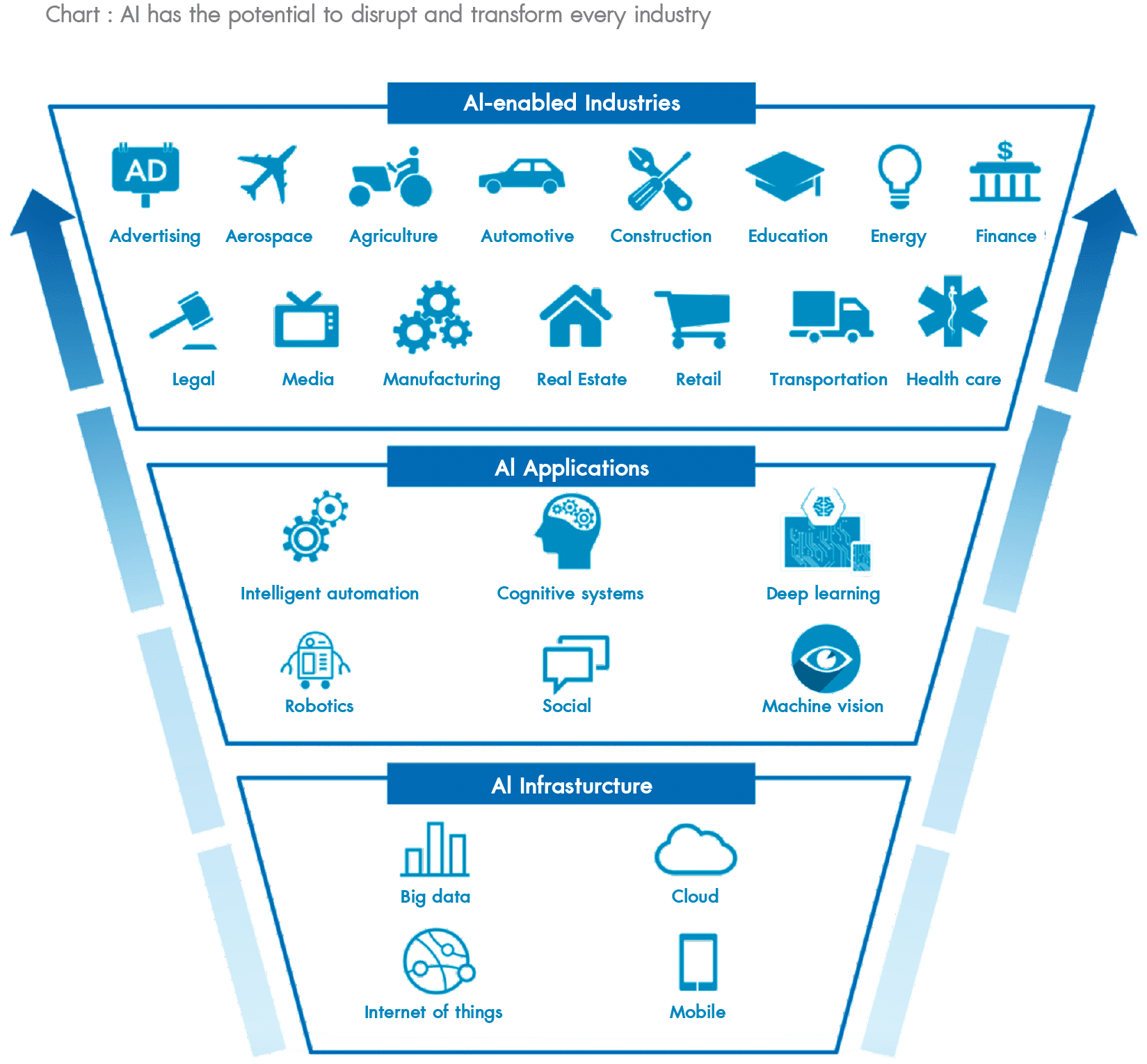

1. Artificial Intelligence could be the most disruptive technology

of the 21st century

- Artificial Intelligence (AI) is likely to be one of the largest driver of innovation across different industries.

- AI is set to drive the next significant wave of innovation and automation for decades. We are seeing advances in AI drive major transformation in areas such as transportation, finance, healthcare, manufacturing, and others.

- The potential benefits from AI have led some people to compare its advancement to the next industrial revolution. AI has the potential to disrupt business models, and change how we work and live.

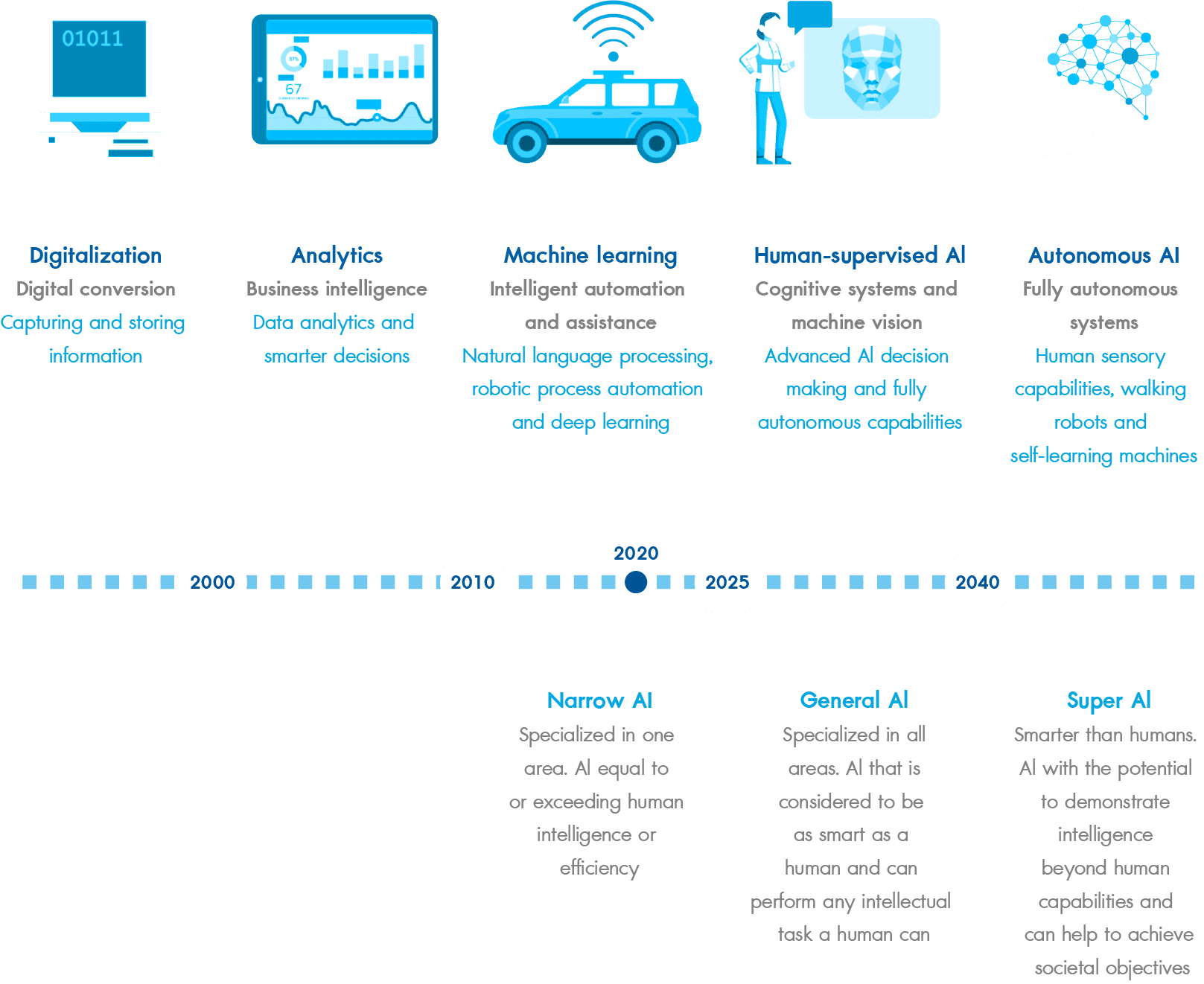

2. AI is our future, AI is now?

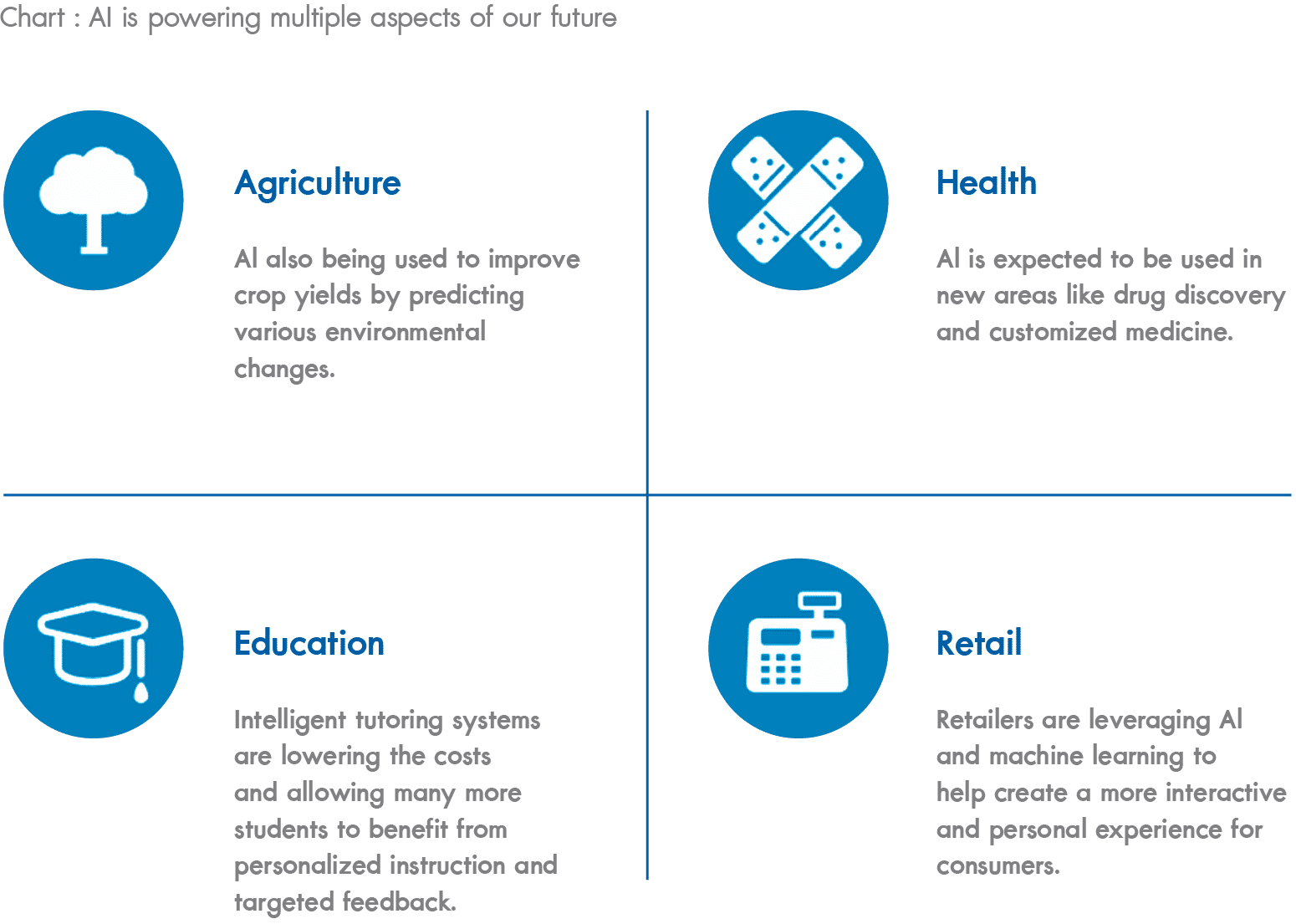

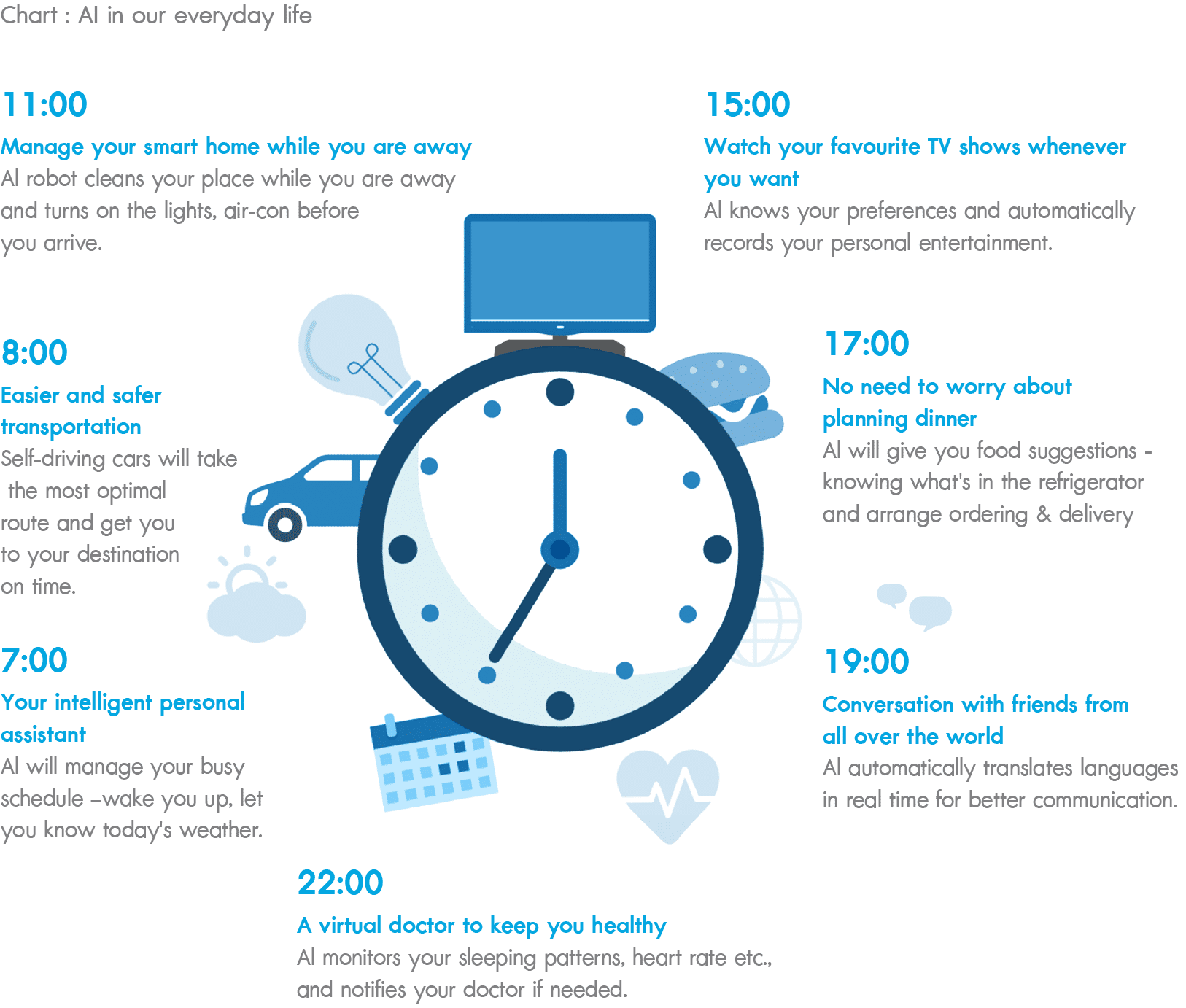

- AI is part of everyday life now. The technological underpinnings of AI are developing rapidly, with seemingly new breakthroughs every day. We are now training machines to see, hear, navigate, and interact with the environment around them.

- It is important to understand that much of what today’s AI is achieving is behind the scenes or merely the start of the journey. These technologies are fueling advances such as intelligent assistants, self-driving cars and medical diagnostics to name just a few.

3. Vast potential benefits for today’s world

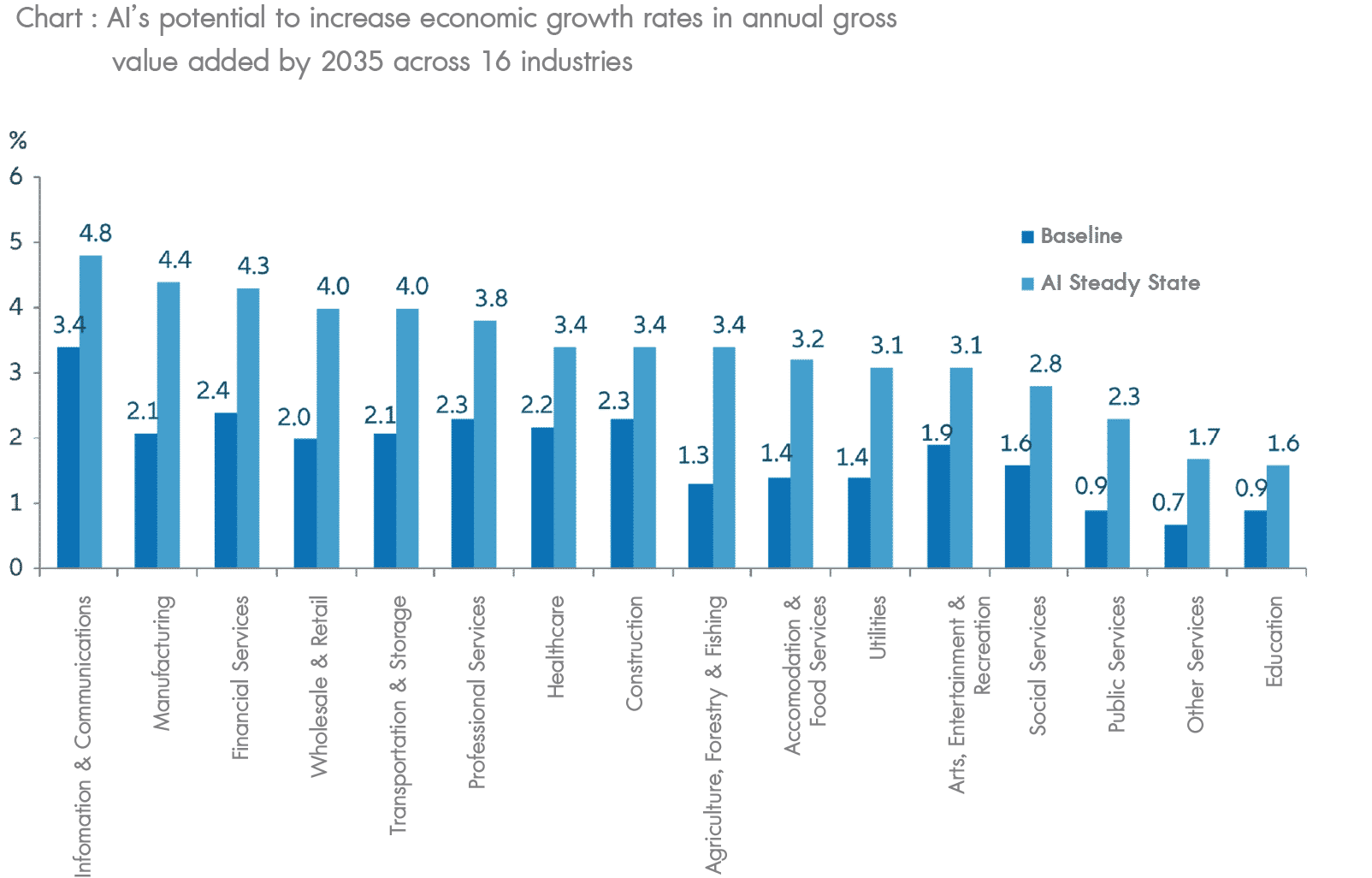

- AI is developing rapidly with many potential benefits for the economy, society and individuals. </span >

- AI has the potential to increase growth rates in every industry due to increased productivity, higher quality, greater efficiencies and time savings. We think of AI as a horizontal technology and every industry can potentially be disrupted and reap benefits.</span >

Reason To Invest

Allianz Global

Investors

Allianz Global Investors

Allianz Global Investors works for many clients around the world. From pension funds, large and small, to blue-chip multinationals, from charitable foundations to families, individuals and their advisers. We have created a business that enables us to meet the demands of our clients on a local basis and that empowers our investment managers to focus on achieving strong and consistent investment results.

25 Locations worldwide

€582 bn Aessets under management

760+ Investment professionals

630+ Relationship managers

Our investment thinking is rooted in our purpose: to help our clients achieve their investment goals.

Across all our investment strategies, there is a common belief that insightfulness and understanding will give us an advantage. We address the challenges our clients face with forward-thinking strategies and customized solutions.

Why invest in Allianz Income and Growth ("the Fund”)?

- The US risk assets extended gains in Q3, supported by better-than-feared corporate earnings, accommodative monetary policy and progress with a COVID-19 vaccine and treatment.

- Economic reports surprised to the upside. Q3 growth estimates were revised higher, unemployment numbers declined, most housing-related statistics exceeded expectations and consumer confidence topped projections.^ Against this backdrop, US election

uncertainty, the lack of a new fiscal package and rising European virus cases could trigger market volatility.

- The Fund adopts a "three-sleeves” approach, with the core holdings invested primarily in a portfolio consisting of 1/3 US high-yield bonds, 1/3 US convertible bonds and 1/3 US equities/equity securities. It aims to capture multiple sources of potential income

and includes participation in the upside potential of equities at a potentially lower level of volatility than pure-equity investment.

Structure of the KTAM

World Technology Artificial

Intelligence Equity Fund

(Class A) (KT-WTAI-A)

KTAM World Technology

Artificial Intelligence Equity

Fund (Class A) (KT-WTAI-A)

Allianz Global Investors

Feeder Fund

|

Fund Infomation |

|

|---|---|

|

KT-WTAI |

The fund mainly invests in the Class AT (USD) units of the Allianz Global Artificial Intelligence Fund (master fund) distributed to retail investors. Average holdings during a financial year will be at least 80% of NAV. |

|

Master fund |

Achieve long-term capital growth by investing at least 70% of NAV in global equity markets of companies whose business will benefit from/or is currently related to the evolution of artificial intelligence. |

|

Fund Type |

Equity Fund, Feeder Fund |

|

Risk Level |

6 |

|

Master Fund |

Allianz Global Artificial Intelligence Fund |

|

ISIN (Master Fund) |

LU1548497426 |

|

Asset Management |

Allianz Global Investors GmbH |

|

Currency (Master Fund) |

USD |

For more information Click

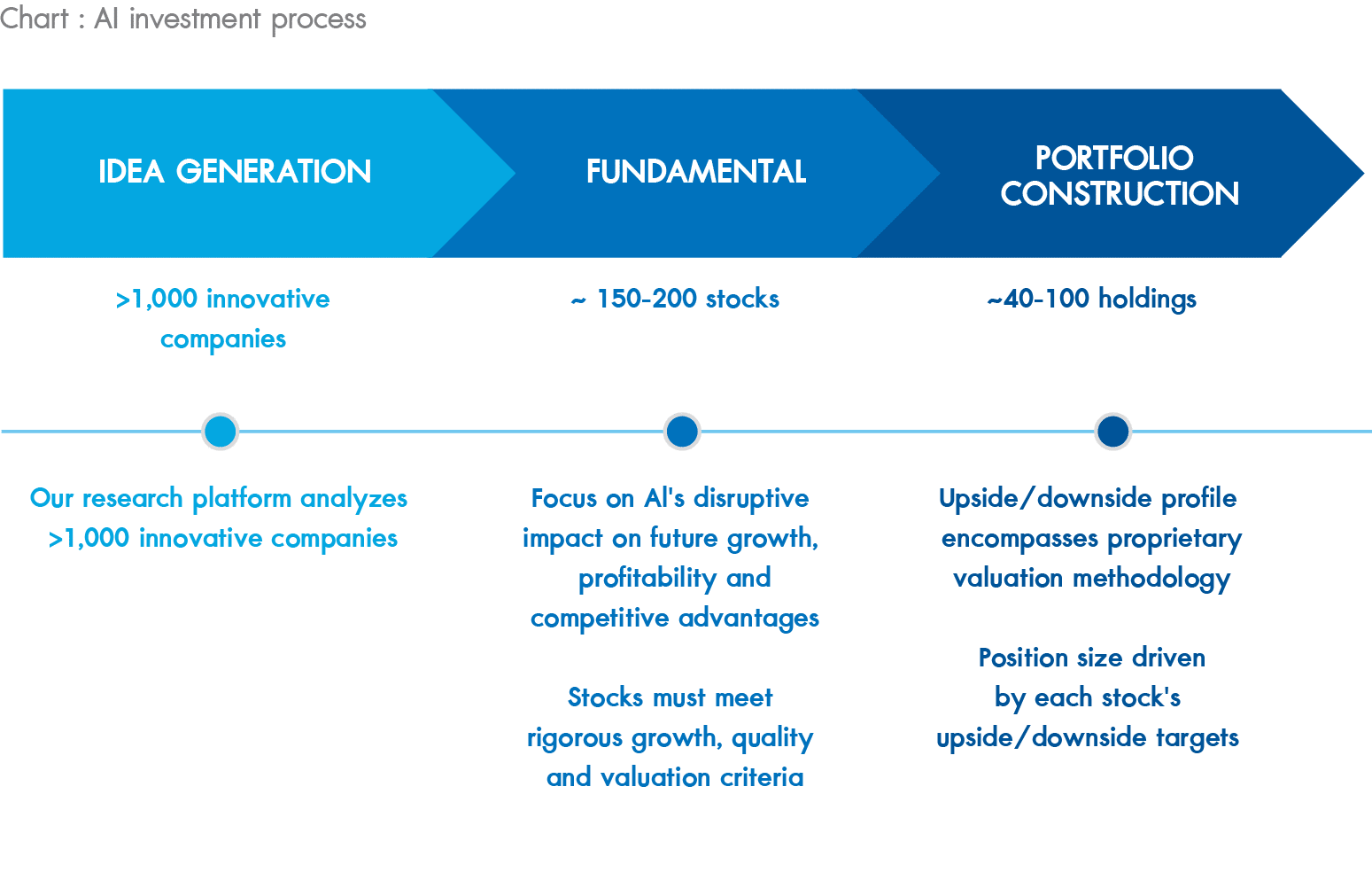

- The Fund aims at long-term capital growth by investing in the global equity markets of companies whose business will benefit from/or is currently related to the evolution of artificial intelligence.

- The Fund is exposed to significant risks of investment/general market, concentration, company specific, emerging market, currency (such as exchange controls, in particular RMB), and the adverse impact on RMB share classes due to currency depreciation.

- The Fund may invest in financial derivative instruments (“FDI") which may expose to higher leverage, counterparty, liquidity, valuation, volatility, market and over the counter transaction risks. The Fund's net derivative exposure may be up to 50% of the Fund's net asset value.

- This investment may involve risks that could result in loss of part or entire amount of investors' investment.

- In making investment decisions, investors should not rely solely on this material.

This fund is at risk of foreign currency with a hedging policy at the discretion of the fund manager. Investors must understand the characteristics of the product, return conditions, and risks before deciding to invest.

Who is this fund suitable for?

Investors who are willing to accept the risk of investing in a foreign fixed income fund,as well as foreign exchange risk exposure. The unitholder fully understands that thevalue of units may fluctuate but wants the opportunity to earn a satisfactory return by investing in a foreign master fund.